Government yesterday released the Production Sharing Agreement (PSA) signed by the former Donald Ramotarled PPP/C administration with Canadian miner CGX Resources Inc, the terms of which appear to be almost identical to those of the much maligned 2016 agreement signed by the current administration with ExxonMobil’s local subsidiary and its partners.

[scribd id=371782063 key=key-5FvTkwgqqG6nhxtILKw1 mode=scroll]

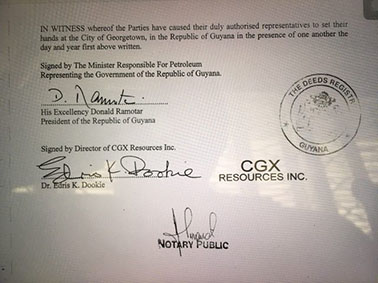

The 69-page document, which is comprised of 33 Articles, was signed by then president Ramotar on February 12th, 2013, and it appears to be an updated version that was clinched with CGX for its drilling operations, which began in 2000 but were interrupted by Surinamese gunboats. CGX has sunk several offshore wells but has not found oil in commercial quantities.

The 2016 ExxonMobil agreement appears to have been modelled after the 2013 CGX agreement. While there are key differences in profit sharing and royalty provisions, Articles addressing the stability of the agreement, relinquishment of areas and the extension of the agreement are nearly identical to the ExxonMobil PSA, which the opposition PPP/C has railed against. Up to last Thursday, Opposition Leader and PPP General Secretary Bharrat Jagdeo called the ExxonMobil PSA a “horrible and incompetently negotiated” agreement.

According to the 2013 agreement with CGX, government is guaranteed a 53% share of profit oil and profit gas, with 47% being retained by CGX. It also provides for a 1% subsumed royalty to be paid by the government. The ExxonMobil agreement, on the other hand, caters for a 2% royalty for Guyana, after which the two partners share profit from oil 50/50.

Additionally, the CGX agreement does not cater for a signing bonus as is catered for in Article 33 of the ExxonMobil agreement nor is there a provision for a “bridging deed.”

Unlike the CGX agreement which came into effect on its signing date, Exxon’s agreement states at Article 30.1 that it shall enter into force and effect on the date in which the petroleum prospecting license in respect of the contract area is in full force and effect (“the effective date”). It adds that the 1999 petroleum agreement shall continue to be legally binding on the parties until it terminates or is terminated in accordance with its terms and the bridging deed.

Stability clause

Meanwhile, Article 32, which specifies that “government shall not increase the economic burdens of the contractor,” is for the most part identical in the two agreements.

This stability clause of the Exxon PSA has come in for severe criticism from various commentators, including legal and financial consultant Christopher Ram. In his column, published in the December 29th, 2017 edition of the Stabroek News, Ram declared that this article “locks the country” into the agreement in “perpetuity.”

Government, he argued, is “effectively prevented from exercising one of the most fundamental and sovereign duties of any state in relation not only to the oil companies but also to their successors and assignees.”

Within its four paragraphs it specifies that if Guyana after signing the agreement were to change its laws, whether through the amendment of existing laws (including the hydrocarbon laws, the customs code, or tax code) or the enactment or new laws, any of which has a material effect on the oil companies, the government is required to take prompt and effective action to restore the benefits so lost.

The Article requires that the obligation of the government includes the obligation to resolve promptly, by whatever means may be necessary, any conflict or anomaly between the Agreement and any new or amended legislation, including by way of exemption, legislation, decree and/or other authoritative acts.

Article 32.4 further provides that any delay by the government to respond to any notification from the contractor that they may have suffered any adverse effects can result in the contractor taking the matter to arbitration.

In such a case, the arbitral tribunal is authorised to modify the agreement to reestablish the economic benefits under the Agreement to the Contractor. Where such restoration is not possible, the tribunal has the power to award damages to the Contractor that fully compensates for the loss of economic benefits under the Agreement, both for past as well as future losses.

Also identical is Article 27, which in both agreements direct that the contract “shall be governed by, interpreted and construed in accordance with the laws of the Co-operative Republic of Guyana, and, consistent with such rules of international law as maybe applicable or appropriate, including the generally accepted customs and usages of the international petroleum industry.”

Ram has argued that “this is a serious jurisdictional issue [which] means that if the Agreement was to be taken to Arbitration Guyana’s law would no longer be the dominant influence. Instead, the arbitrators would have to take account of international law and rules, customs, practice and usages of the international petroleum industry.”

Extensions and tax breaks

Both agreements also provide for extensions totaling 10 years and relinquishment of areas at each extension. However, while the ExxonMobil agreement calls for a relinquishment of 20% of the original contract area, CGX is required upon each renewal to relinquish 25% of its contract area.

The areas do not include any discovery or production area for both companies but ExxonMobil has also been able to exclude “any area under an Appraisal program should the area be larger than the discovery area.”

The Force Majeure provisions of both agreement also include “government action and inaction” within their definition of events beyond the “reasonable control of the party claiming to be affected” whose effects suspend its obligations.

Since the PSA was released late last year, government has faced criticism, particularly over the US$18 million signature bonus it received and the 2% royalty and members of civil society have called for a review of the contract.

Aside from the signature bonus, government also boasted that it was able to introduce a 2% percent royalty on gross production under the modified contract, an increase in annual rental fees, from US$240,000 to US$1 million, an increase in training funding from US$45,000 to US$300,000 per annum and a new allocation of US$300,000 for social and environmental programmes.

For ExxonMobil, a ten-year agreement, which was scheduled to be up in 2018, was extended and the tax regime remains the same as in 1999 where it would not pay VAT, excise tax or duties on its operations.

The company can also export all petroleum to which it is entitled free of any duty, tax or other financial impost and can receive and retain abroad all proceeds from the sale of such petroleum among many other benefits.

These same benefits were secured by CGX three years earlier, with government gaining US$100,000 in annual rental fees as well as US$100,000 in training funding. There is no provision in the CGX agreement for social and environmental programmes.