This week’s column wraps up the ongoing discussion from an economic perspective of the last remaining of the five items, which that I had earlier identified from Guyana’s fiscal regime for its 2016 production sharing agreement, PSA. That item is the notion of the life cycle of a petroleum project.

What is a petroleum project? In petroleum economics a project constitutes: “the link between the petroleum accumulation and the decision-making process, including budget allocation” (World Petroleum Council, Petroleum Resources Management, 2007). Such projects may represent either 1) a single reservoir or field; 2) an incremental development in an already producing field or reservoir; or 3) the integrated development of a group of fields or reservoirs. This referenced group can be held in common ownership.

In addition, an individual project would seek to reach a level where a decision to proceed with spending money on it, or not, is made. Of course, the associated range of estimated recoverable resources would be established for the project (page 42)

The life cycle

What is the life cycle of a petroleum project based on this description? To begin with, as indicated in earlier columns, the project’s life cycle is integral to the accurate calculation of government take Indeed, Government revenue varies over the life cycle of the project, along with production costs, prices, cash flow, and profitability. An understanding of the life cycle concept is therefore central to any rational appraisal of the performance of a petroleum project.

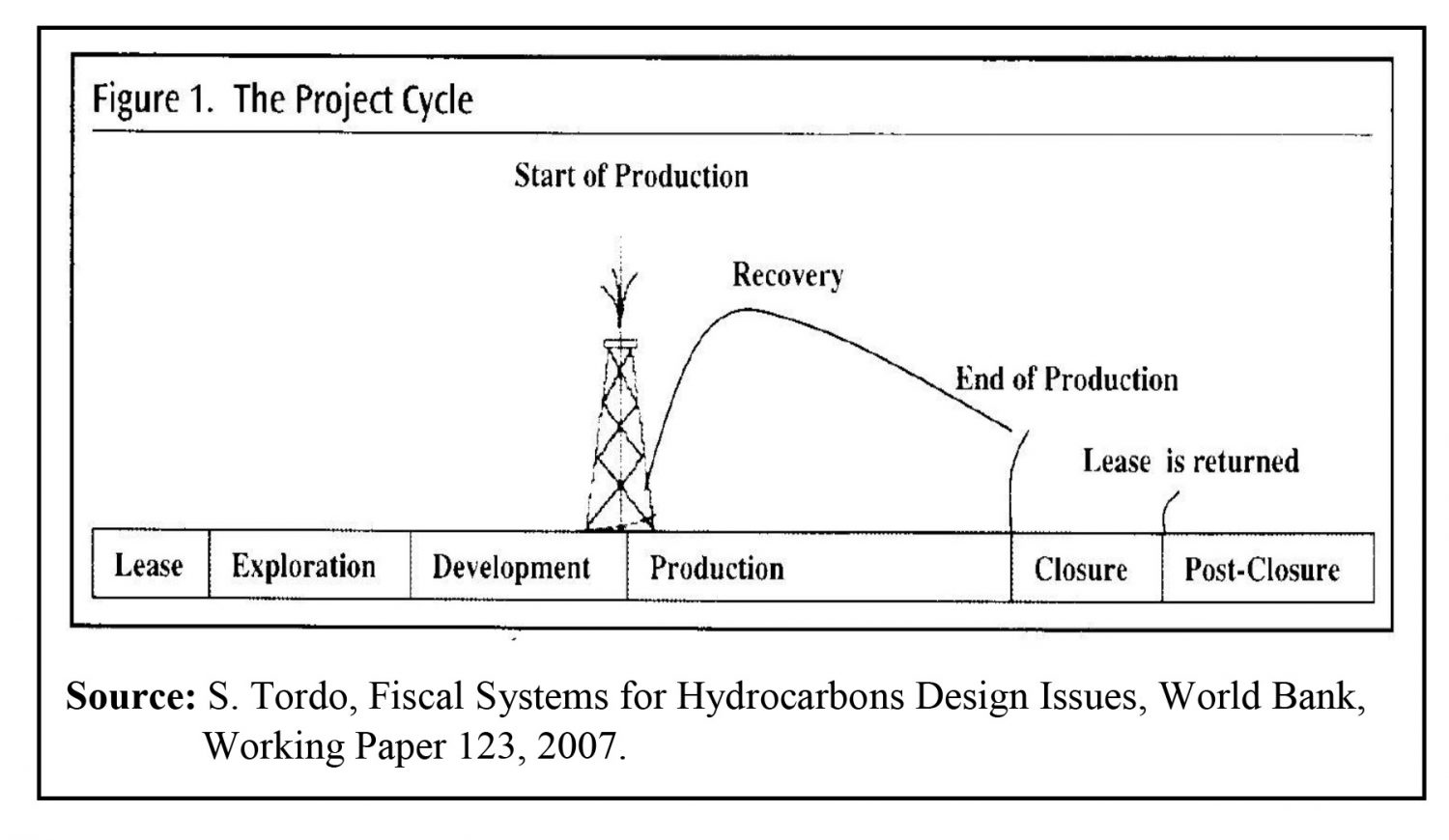

Most energy economics texts portray the life cycle of a typical oil and gas project as having six distinct stages. These are identified below in Figure 1. It has been observed though, that, over these six stages, the risk-reward profile of the project changes. And, further, such risks typically comprise three core elements; namely, geological, financial and political. As a rule, geological risks tend to diminish as petroleum finds and discoveries are made, but in the cases of the latter two risks (financial and political) these can in practice multiply!

This changing risk-reward profile often produces changes in the balance of negotiating power between the Owner, (for example, Government of Guyana, GoG) and the Contractor (Exxon and partners). Thus to take an example, when intended production starts in Guyana (circa 2020), the Contractor’s capital investment will by then have become a sunk cost. And, this consideration along with the facilities the Contractor would have established for offshore activities would in turn result in the Contractor being potentially more vulnerable, in a negotiating sense!

Six stages

The typical textbook description of a project cycle for a petroleum project is captured in what follows: the first stage is when the Contractor obtains the lease/licence/permit to explore and develop a field or bloc area. The second stage follows after acquiring the rights. That is, undertaking geological and geophysical surveys and conducting exploratory drilling. Given the offshore location of the Exxon and partners block area in Guyana, appropriate facilities for this task will have to be assembled by the Contractor. These would include both its own facilities and its sub-contracted capabilities.

The third stage is appraisal. If hydrocarbons are “discovered”, these will have to be appraised and this will most certainly require further drilling. The aim at this stage is to seek to establish the volume and quality of recoverable hydrocarbons. Typically, development planning and feasibility studies are conducted at this third stage, and indeed a preliminary development plan is prepared and costed.

The fourth phase is the development one. This stage occurs if, and only if, the appraised wells are favourable and the Contractor decides to proceed with their further development. At this stage: “development planning commences using site-specific geo-technical and environmental impact assessment” (World Bank, page 3). In practice, this phase requires that the necessary production and transportation facilities are established at the operations site.

At the fifth stage production commences and hydrocarbons recovery begins. By this stage, the wells are completed, the facilities commissioned, and the workforce is assembled at its required positions along the production chain.

The sixth and final stage marks the end of the economic life or commercial viability of the petroleum field or block. At that point production cost is equal to production revenue. The economic limit is reached in the sense that there is no incentive to continue. At this point, the decision to abandon the field or block is the only economically, rational one.

These data are summarized in Figure 1 below.

Other consideration

A few other considerations are relevant at this point of the discussion. First, although I described the petroleum project cycle above as having six distinct phases, several texts report only on five stages. The reason for this is that the first stage that I have indicated (leasing) is ignored, as being pre-project. However I prefer to include it, as this is the legitimate legal and contractual inception phase of every petroleum project’s life cycle.

Second, because the life cycle, as presented above, rests on the production chain, this implicitly indicates variations along this chain, such as costs, prices, and so on. Two of these however stand out. One is the government revenue life cycle. As would be expected, in the typical case most of government revenue would be obtained during the production phase. And, consequently very little in the pre-production phase or indeed after when a decision is made to halt production and decommission the petroleum project.

The other life cycle of note is the “non- revenue” economic life cycle of the project. This is noticeable in the macroeconomic effects of the project. This is observed in such areas as the balance of payments, exports, imports, local content requirements, and last, but by no means least, social investment

Third, the empirical literature has identified the effective implementation of project management as central to the successful execution of petroleum projects. Research indicates that this can avoid 1) waste of financial and other resources 2) bad management of the project’s assets and 3) errors in equipment selection and design. Similarly, it improves operational efficiency by reducing operating costs and saving resources.