The 331 suspicious transaction reports received last year by the Financial Intelligence Unit (FIU) related to sums totalling over $8.5 billion, according to Director Matthew Langevine.

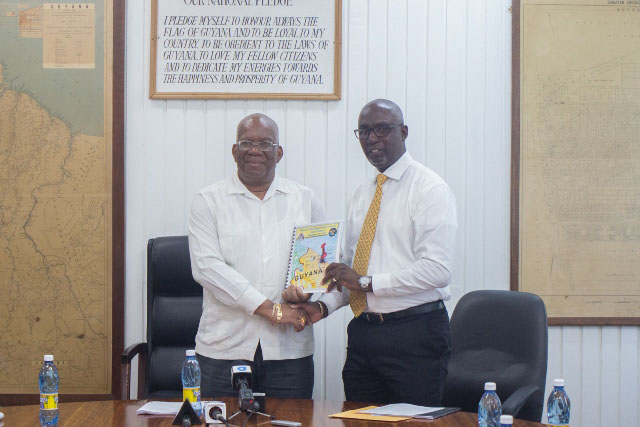

This is among the findings included in the unit’s annual report, which was handed over to Finance Minister Winston Jordan on Monday.

The report is expected to be made public on the ministry’s website shortly.

Moments before the handing over, Langevine said that the Suspicious Transactions Reports (STRs) were shared with the unit to see if there was need for any investigation. Some of these suspicious transactions concerned tax evasion, drug trafficking, corruption in public office, suspected terrorist financing and insider trading. From the STRs, he said the majority of 40 intelligence reports and 10 updated reports were shared with the Special Organised Crime Unit (SOCU). Langevine said the reports were also shared with State Assets Recovery Agency (SARA) and the Guyana Revenue Authority (GRA).

Responding to questions, Langevine clarified that the FIU’s role does not require it to follow up with SOCU. He said the unit is required to share intelligence and support with any additional information. “We remain committed to ensuring the FIU is not just sitting there and taking up space but we are trying hard every day to execute our mandate,” he assured.

In April, Langevine had said that up to that point 120 STRs had been made to the unit for 2019, with a high per cent also coming from the money transfer entities. “[It is] a sector which we see a high level of suspicious transaction activities where monies are sent cross borders that raise a number of concerns,” Langevine said. “We want to encourage the public at large, not to get caught up in those kinds of activities however beneficial it may seem to you in the onset because it can have far-reaching implications for persons,” he explained then.

Langevine on Monday informed that the FIU during 2018 strived to execute its mandate of working with all local and international stakeholders to protect the integrity of the financial system from money launderers and those trying to use the system to finance terrorism and proliferation.

“The FIU had a very successful year in 2018, with particular progress being made in the area of onboarding of new reporting entities from a wide range of financial and designated non-financial sectors and that will include the gaming sector, among others …as well as the professions,” he said, while adding that the FIU has had engagements with attorneys and accountants in particular in an effort to bring them onboard. These two professions remain non-reporting to the FIU, he informed.

According to Langevine, the unit placed a heavy focus on training and outreaches to ensure that the public and reporting entities are aware of their respective roles and obligations under the Anti-Money Laundering and the Countering the Financing of Terrorism Act and the role they play in ensuring that the country’s financial systems are protected.

Additionally, the unit signed Memoranda of Understanding with the FIUs of Barbados and Jamaica, which were used in a couple of money laundering investigations already. He said that the unit currently has agreements with approximately 10 FIUs in the region and these are more important as “we continue to strive towards having Guyana accepted as a member of the Egmont Group of International FIUs.”

Progress was also made in area of staff development as there are now four certified money laundering specialists and four financial analysts within the unit’s employ, Langevine added.

The report, he said, includes the audited financial statements of the unit for 2018, which were completed and satisfactorily signed off by the Office of the Auditor General.

In keeping with the law, the unit should have submitted the report to the Minister of Finance by June 30th 2019 but due to the minister’s demanding schedule he was unable to receive the report on time. A copy of the report is to be handed over to the National Assembly within 30 days.

Meanwhile, Minister Jordan noted that this is the first report he would have received since taking office and he said that he would take it to Cabinet in the hopes of it being laid in the National Assembly before the August recess.