French oil major Total yesterday announced it had signed an agreement for a stake in an offshore Suriname oil block and will pay a signing bonus of US$100 million on closure of the deal.

The payment of this signing bonus for a pre-oil stake in an offshore block will raise eyebrows here. Guyana ended up with US$18 million in a post-oil signing bonus which was later styled as a legal fund to assist with fees for its border controversy case with Venezuela. Critics have long argued that inept negotiating by Guyanese officials resulted in the country losing out on what should have been a much higher signing bonus and a larger royalty rate.

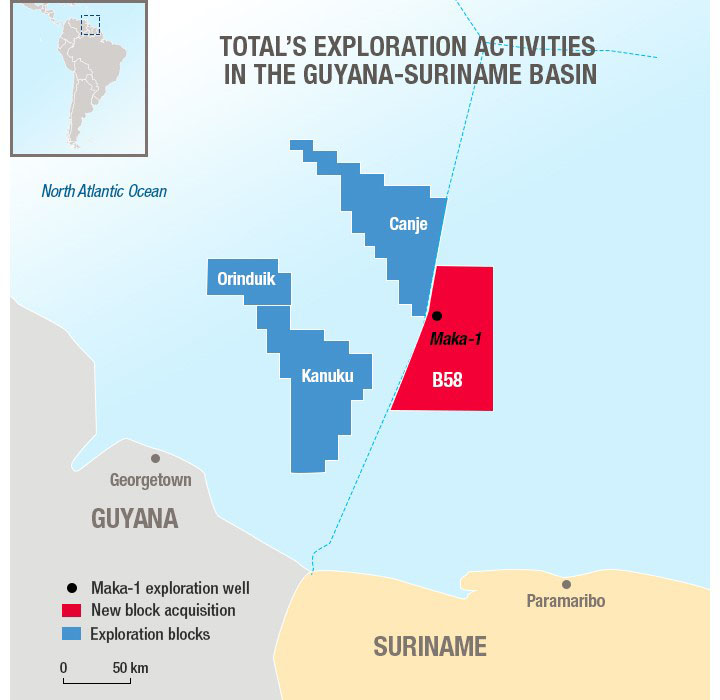

In a press release, Total yesterday said that it had struck a deal with Apache Corporation to acquire a 50% working interest and operatorship in the high prospect Block 58 offshore Suriname, further expanding Total’s footprint in the Guyana-Suriname basin.

Block 58, the release, said is located in proximity with the prolific discoveries in the adjacent Stabroek block in Guyana. The Maka-1 exploration well is currently being drilled on the block in a water depth of about 1,000 meters and early results confirm the prospects of the licence. Two additional exploration wells are planned to be drilled by Apache after the completion of Maka-1 before the transferring of operatorship to Total.

“Total is pleased with this significant entry in Suriname where Total will become Operator and bring its deepwater expertise. The new license expands our positions in the Guyana-Suriname Basin, a highly favorable petroleum province,” Arnaud Breuillac, President, Exp-loration and Production at Total was quoted as saying. “We look forward to working alongside with Apache, and Staatsolie, the national oil company.”

At closing, the release said, Total will pay a bonus of $100 million, plus its share of past costs. In the event developments are launched, Total will provide a reimbursable carry for a portion of Apache’s capital expenditure for the development phase and make some additional payments linked to the development and production. Cost of carry and payments would then constitute an acquisition cost of around US$2 per barrel.