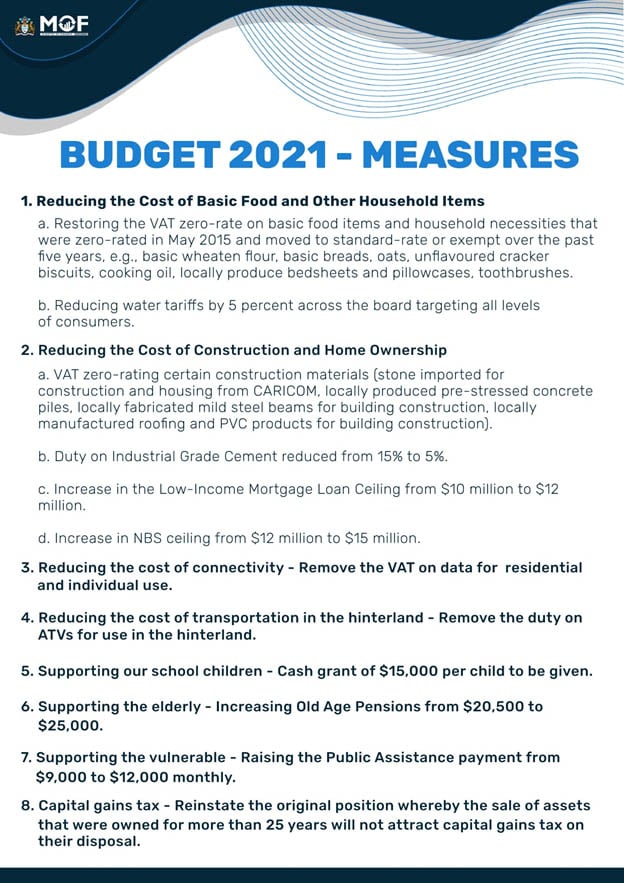

With his presentation of the government’s proposed $383.1 billion national budget, Finance Minister Dr Ashni Singh yesterday announced several measures aimed at bringing relief to the many households and businesses that have been experienced financial distress over the past year and beyond.

Singh told the National Assembly that a cash grant of $15,000 per child would be given to the parents of children in the nursery, primary, and secondary levels in the public school system, while there will also be an increase in old age pension from $20,500 to $25,000 with effect January 1, 2021, and an increase in the Public Assistance payment from $9,000 to $12,000.

He also said households are to receive a 5% reduction in water tariffs and a restoration of the Value Added Tax (VAT) zero-rate on basic food items and household necessities.

“We will restore to the zero-rated status all of the food items and other basic household necessities that were previously zero-rated at the time we demitted office in 2015. These items include: basic wheaten flour, basic breads, oats, unflavoured cracker biscuits, cooking oil, locally produced bedsheets and pillowcases, toothbrushes,” he explained.

Singh also announced a series of measures designed to stimulate growth in the construction sector and assist potential homeowners.

Noting that the PPP/C government has committed to providing 10,000 house lots annually, he said that certain construction materials will be zero rated. These included stone imported for construction and housing from CARICOM states, locally produced pre-stressed concrete piles, locally fabricated mild steel beams for building construction, locally manufactured roofing and PVC products for building construction.

Singh added that the government will also continue to monitor the cost of basic construction materials, such as cement and steel, and examine the possibility of applying relevant taxes in such a manner as to serve as an adjustor to cushion the impact of steep price escalation.

He said, too, that there will be a reduction of the duty on Industrial Grade Cement from 15% to 5%, increase in the Low-Income Mortgage Loan Ceiling from $10 million to $12 million and in due course an examination of the appropriateness of extending the programme to include other financial institutions such as insurance companies.

At the New Building Society, the ceiling on loans that can be granted will move from $12 million to $15 million, he further said.

The telecommunications sector, he added, will benefit from the removal of the VAT on data for residential and individual use, while the sale of assets that were owned for more than 25 years will not attract capital gains tax on their disposal.

For those living in the hinterland, Singh said government will remove the duty on All Terrain Vehicles for use in the hinterland.