Complex and opaque corporate structures are at the front and centre of major financial crimes. There’s overwhelming evidence that the corrupt and criminals benefit from corporate secrecy, and that legal structures such as anonymous shell companies enable them to hide, move or launder ill-gotten assets. This means that often the hardest part for the investigators is to track down the so-called beneficial owners – those who really own, control and profit from suspicious companies.

Transparency International

Capitalism is a machine made to squeeze every last cent out of this planet until there is nothing left. We can either fool ourselves about that until it kills us, or we can change it.

Hamilton Nolan – New York-based writer

Pakistan Prime Minister Imran Khan’s official residence as well as his main private residence have been put up for rent to fund welfare schemes for the country’s citizens. Earlier this year, the Government auctioned 61 luxury cars to raise revenue for the State. Governors would also no longer reside in government houses in order to not only break with colonial history but also cut public expenditure. One recalls the world-renowned cricketer of yesteryear founding a cancer hospital in honour of his mother who died of cancer in 1985. These selfless actions by the Prime Minister are a source of admiration, considering how several rulers, past and present, have enriched themselves, their families, their friends and their business associates at the expense of the poor, and disadvantaged and vulnerable groups. The latest example is the Vice-president of Equatorial Guinea who amassed enormous amounts of wealth, while more than 76 percent of the citizens live in poverty.

On 29 June 2021, the G20 meeting in Italy ended without any commitments on phasing out coal power and on steps to be taken to try keep hold global warming to within 1.5 degrees Celsius of the per-industrial average. Indeed, a report by scientists found that China, Russia, Brazil and Australia are all pursuing policies that could lead to a five-degree warming, while a recent study revealed that G20 members in the past five years have paid US$3.3 trillion in subsidies for fossil fuel production and consumption. These disclosures were made by New York-based writer Hamilton Nolan and reported in the Guardian of 4 August 2021. Nolan expressed the following view:

As overwhelming and omnipresent as the climate crisis is, it is not the core issue. The core issue is capitalism. Capitalism’s unfettered pursuit of economic growth is what caused climate change, and capitalism’s inability to reckon with externalities – the economic term for a cost that falls onto third parties – is what is preventing us from solving climate change. Indeed, climate change itself is the ultimate negative externality: fossil-fuel companies and assorted polluting corporations and their investors get all the benefits, and the rest of the world pays the price. Now the entire globe finds itself trapped in the gruesome logic of capitalism, where it is perfectly rational for the rich to continue doing something that is destroying the earth, as long as the profits they reap will allow them to insulate themselves from the consequences.

Last Monday, the Intergovernmental Panel on Climate Change (IPCC) released its most recent climate change report. The report clearly indicates that: human intervention is indeed the main cause of global warming and climate change; and intensified and sustained actions aimed at reducing greenhouse gases in the next 20 to 30 years could improve air quality and stabilize global temperatures. United Nations Secretary-General António Gutterez considered the report ‘a red code for humanity’:

The alarm bells are deafening, and the evidence is irrefutable: greenhouse gas emissions from fossil fuel burning and deforestation are choking our planet and putting billions of people at immediate risk. Global heating is affecting every region on Earth, with many of the changes becoming irreversible.

This report must sound a death knell for coal and fossil fuels, before they destroy our planet. There must be no new coal plants built after 2021…Countries should also end all new fossil fuel exploration and production, and shift fossil fuel subsidies into renewable energy.

At the 22nd Conference of Parties of the United Nations Framework Convention on Climate Change, former President David Granger gave the commitment to ‘position our country to move more quickly and more closely towards full renewable energy use by 2025’. In the light of recent developments in Guyana’s oil and gas industry, one wonders what will be the new Administration’s position when its representatives meet at the next Conference of Parties (COP 26) meeting in Glasgow, Scotland in November.

In our last article, we began an examination of the Guyana 2018 EITI Report which was published last April. So far, we have dealt with revenues received by government agencies; production data; and data collection and reconciliation. The report highlighted several shortcomings in these areas and concluded that the Independent Administrator was unable to determine that all significant contributions made by the extractive entities to the revenues of Guyana in 2018 were included in the report. Today, we continue our coverage of the report by highlighting other key areas.

Reconciliation of cash flows

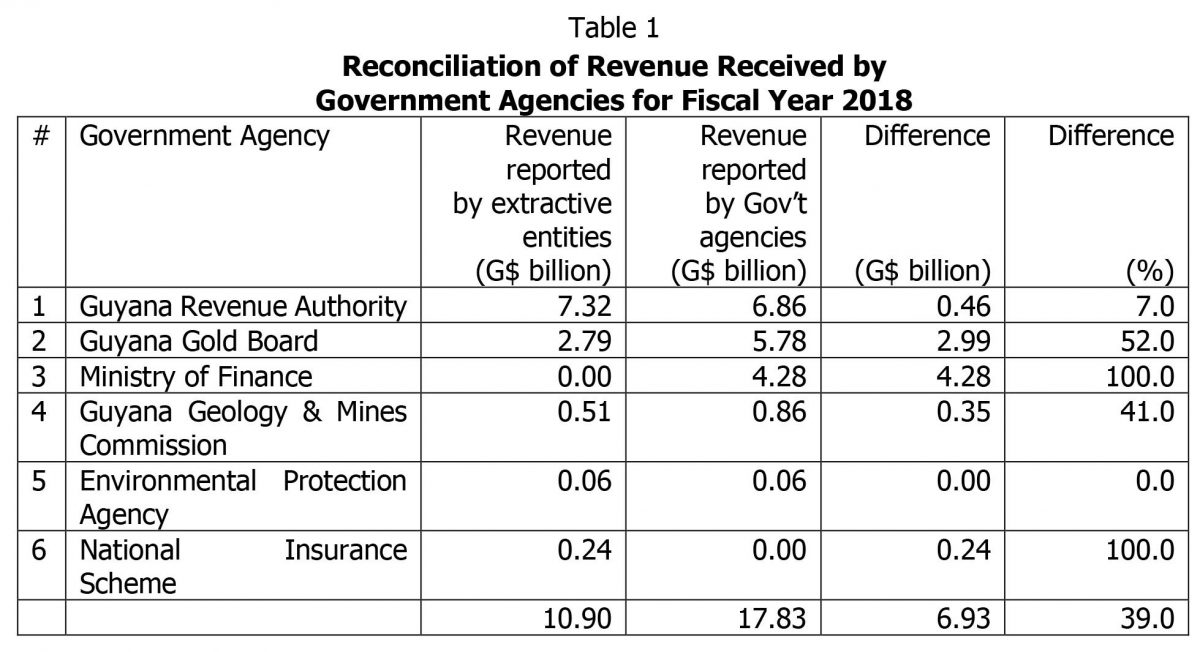

After adjustments and reconciliation, based on transactions that represent 65 percent of the total extractive revenue of G$27.63 billion declared by Government entities, a net difference of G$6.93 billion remained unreconciled. This represents 39 percent of the Government’s declared revenues for 2018, compared with G$3.805 billion or 27 percent in 2017, as shown at Table 1.

As can be noted, three of the six government agencies reported higher revenue received from the extractive entities, compared with that reported by the extractive entities. On the other hand the GRA and the NIS reported lower revenue.

Compliance with the EITI Standard

The report highlighted several areas of non-compliance with the requirements of the EITI Standard, as highlighted below:

Systematic disclosure of EITI data

The EITI data disclosed in the report were collected from different sources. However, data on revenue collected and budget allocations were not systematically published within a centralised platform. The report reiterated its previously stated recommendations that:

The Multi-Stakeholder Group (MSG): (i) make systematically disclosed data machine readable and inter-operable, and code or tag EITI disclosures and other data files so that the information can be compared with other publicly available data; and (ii) put in place a roadmap on the implementation of an open data that centralises all EITI data;

Government agencies and extractive entities publish EITI data under an open license and to make users aware that information can be re-used without prior consent;

The GYEITI website should include the relevant links to the different information when these are available by the different Government Agencies; and

Government agencies should set-up an open EITI database in the government systems by: (i) implementing and upgrading a cadastral system with adequate details such as data about valid licences, coordinates, licensees and the beneficial owners of the companies; and (ii) enhancing the current management information systems of the government agencies involved in the GYEITI process in order to allow for, among others, systematic publication of EITI data.

Use of unique identification numbers for government agencies

Government agencies did not include the Taxpayer Identification Number (TIN) to identify all the payments of the same taxpayer, and the names of some taxpayers were spelt differently from one payment record to another. This could lead to compilation of revenues collected by one government agency from one taxpayer to be inaccurate. Accordingly, government agencies should keep records of TINs rather than using names or different reference numbers for identifying taxpayers. This would lead to an efficient tracking of receipts and ensure the harmonisation of databases of different authorities. The MSG should make every effort to include this recommendation as part of its work plan.

Public disclosure of a register of licences

A centralised cadastre system did not exist for licenses and permits which were active during 2018. Instead, separate lists of licences and permits were maintained manually by the GGMC, resulting in several weaknesses. Such a system provides a summary of all the concessions/licensed coordinates in a single national data system that allows the GGMC to ensure an efficient oversight of the extractive sector and to facilitate the GRA’s matching of its records of taxpayers operating in the sector.

A similar observation was made in the previous GYEITI report, highlighting the importance of a comprehensive licences registry system. In this regard, the report reiterated its previously stated recommendation that GGMC undertake an inventory of all active licenses to complete all relevant details for each license and to facilitate the compilation of such a register. The register of licenses and permits should include TIN of current license holders or any other identification number rather than using companies’ or individuals’ names. The development of the online cadastral portal should be expedited in order to make the publicly available cadastre easily accessible online.

Public disclosure of mineral agreements

Countries implementing EITI are required to disclose all contracts and licenses that have been granted, entered into or amended from 1 January 2021. They are also encouraged to publicly disclose all contracts and licenses that provide the terms attached to the exploitation of oil, gas and minerals. However, mineral agreements were not accessible online.

The report reiterated its previously stated recommendations that the GYEITI Secretariat maintain an archive of copies of all active mineral agreements which can subsequently be included on the GYEITI website. Prior to this, the MSG should set out a short-term work plan for the electronic publication of all mineral agreements in the mining sector. This work plan may include: (i) defining how the electronic publication of mineral agreements can be undertaken and consider using GYEITI’s official website; (ii) the steps required for all mineral agreements to be published electronically and how to make these accessible to the public; (iii) a realistic short-term timeline as to when such data could be available; and (iv) performing a review of the institutional or practical barriers that may prevent such electronic publication.

To be continued –