“We are hoping that [at] latest, next year third quarter, that we will be able to auction the new blocks. That requires us now to aggressively enforce the relinquishing provisions in all of the contracts so that, added to the existing pool of areas available… which can then form part of the auction that will take place,” Jagdeo told a press conference on Monday, held at the Arthur Chung Conference Centre.

To facilitate the public sales, he explained that government is aiming to put in the necessary architecture within the next year which includes management of the industry, policies for the auction and amendments to the laws if necessary.

Contacted by the Stabroek News for clarity on the issue, Minister of Natural Resources Vickram Bharrat said that he is checking with his technical team to confirm if the said relinquishments referred to would include blocks where there has been no exploration.

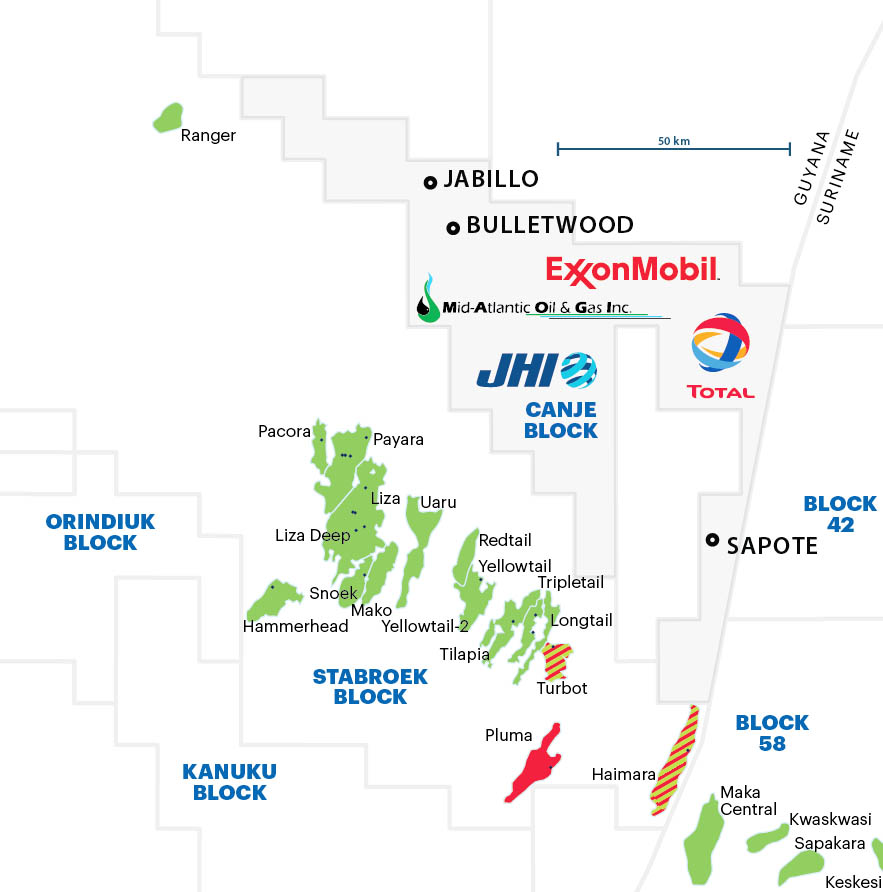

It is unclear how much of the offshore area is due back to this country through relinquishments. An agreement was entered into with ExxonMobil for its continued works in the Stabroek Block on scheduled relinquished areas and the then government had in 2019 announced that the company had relinquished 20% of the Canje Block area.

On the remaining blocks, Guyana Geology and Mines Commission (GGMC) Commissioner Newell Dennison had in 2018 told this newspaper that from the rough determinations, approximately 9,500 sq. km are available within the coastal environment, 24,000 sq. km within the environment of the continental shelf, 10,000 sq. km within the deep water environment and 9,000 sq. km within the ultra-deep water environment.

The country has two demarcated basins that have hydrocarbon potential–the Stabroek Basin, which is partly on shore and offshore Guyana, and the Takutu Basin, which is in the Rupununi area.

However, most interest has been on the offshore area and particularly in the deep sea following the major discoveries there by ExxonMobil in 2015.

According to a GGMC map that was updated in February last year, there are not many areas left that have not been contracted out to companies. The companies that have blocks in the deep water area, offshore Guyana, are: Repsol and Tullow Oil (the Kanuku Block); Tullow (the Orinduik Block); Anadarko (the Roraima Block); Ratio Oil (the Kaieteur Block); Esso, CNOOC Nexen and Hess (the Stabroek Block); Esso, Mid Atlantic and JHI (the Canje Block; CGX (the Demerara and Corentyne blocks); ON Energy; and Nabi.

In 2000, Suriname used force to evict a CGX rig from Guyana’s territorial waters. However, Guyana did not respond with force but sought the route of international law and was vindicated.

In 2013, Anadarko had been engaged in extensive work prior to drilling in Guyana’s western waters when a research vessel doing studies on its behalf was seized by the Venezuelan navy. That move saw all works halted by the company but it returned in 2015, following ExxonMobil’s big oil find in the Stabroek Block, and restated its interest in drilling for oil offshore.

Meanwhile, Jagdeo informed that government had not yet determined if it will conduct seismic data gathering before the auction or will sell the areas on an ‘as is where is’ basis, . Nonetheless, he said that government will make a decision on assessing which is the most feasible option for this country.

“[We will have to] make a decision like some countries are doing, whether they want to invest like Suriname is doing, to shoot 3D seismic [and go] to auction the blocks with seismic data for a higher price or to avoid that and just auction the area as a where is, so that policy has to be developed,” Jagdeo indicated.

He also opined that if government decides to use the approach of going to the auction with data, it will have to determine if it will fund the studies in the remaining blocks.

Further, he stated that in the policy decision making, government will also have to determine whether to preclude existing blocks from the auction or not. “There are several issues… that is why I said by the third quarter of next year. It gives us almost a year to do all of that and then we can go to the auction…” he stated.

In 2018, when the David Granger APNU+AFC government had said it would seek the advice of an international firm to guide a decision on the sale of remaining blocks, Jagdeo, then Opposition Leader, had scoffed at the decision, saying it is most prudent to either auction them or leave them for future generations.

“You don’t need to bring in anyone to tell you what your advisor already did. Auction the blocks that is the best way the government gets value,” Jagdeo told a press conference on Thursday.

“Either you auction it or not giving it out. You wait the next ten years, go to the Parliament, because there is something called intergenerational equity, and [say] we will leave these blocks for another generation,” he added.

But with a global posture of moving towards renewables, Jagdeo has said that Guyana should maximize oil production while fossil fuels still have a demand and use the revenues to prepare the country towards full use of renewables.

Earlier this year, President Irfaan Ali during an engagement with the press, while speaking on the topic had said his administration will auction all other remaining oil blocks. An area being examined was to see if this country should keep some of those blocks and develop them itself.

“We have made it very clear, the process in awarding new oil blocks will be very much different. It will be an open process and when we get to that stage it will be a public open bidding process. We will be looking for the best offer, in an open public way,” Ali informed.

“Unless of course, and we are still looking at… discussions are still ongoing. It calls for a lot of technical analysis on whether Guyana itself can retain some of those blocks for our own development and to manage by ourselves. That [discussion] is very preliminary,” he added.