With an average of 124,000 barrels of oil now being pumped daily offshore Guyana nearly two years since oil production started, there is still no agreement on oil spill insurance and government appears to have backpedal-ed from pressing for unlimited liability coverage to now setting for only about US$2 billion.

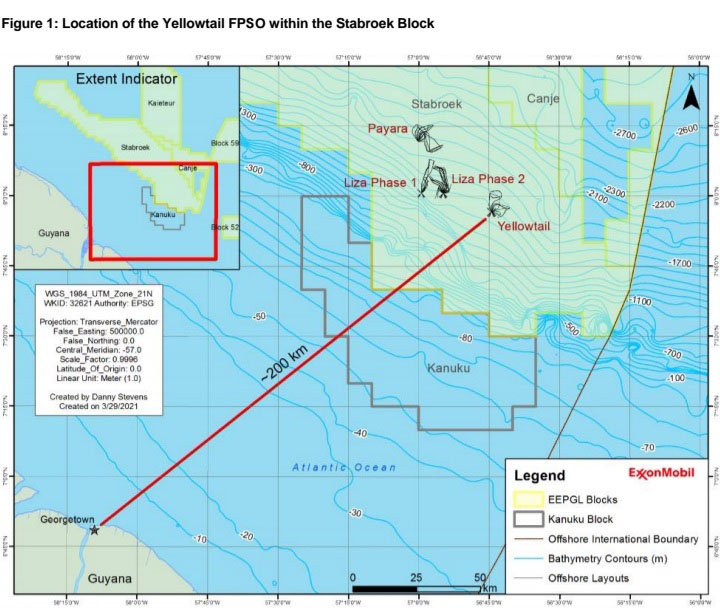

However, Vice President Bharrat Jagdeo on Monday told a press conference that the US$2 billion coverage being mulled was for the Exxon-led Yellowtail project, the fourth major development project, following Liza 1, Liza 2 and Payara.

“As you know, we are constantly seeking to improve the permits and so we have already, looking for the Yellowtail, we are looking for a generic position where the parent company, ExxonMobil will now guarantee,” Jagdeo said.

“We are looking at maybe up to US$2 billion of any damage caused here in Guyana, because from the beginning there was no parent [company] guarantee. It was implicit, they said, but we are looking at it and this will have to go. It is now getting them to acknowledge that there is that link between the two [parent company and EEPGL]…that is crucial for us as we move forward,” he added.

The announced US$2 billion is what oil major ExxonMobil had first proposed to the Envi-ronmental Protection Agency (EPA) and which was rejected by then EPA head Dr Vincent Adams as he pressed for that sum along with unlimited liability coverage from the parent companies, citing one spill that had cost over US$60 billion and counting.

Minister of Natural Resources Vickram Bharrat was asked the reason for the decision and said that he would respond but up to press time he had not done so.

In February of this year, Adams told Stabroek News that during his tenure as Executive Director of the EPA, two changes were made to the permit for the Exxon-led Liza-2 development. He said that the Environmental Permit for Liza-2 had initially stated that Exxon’s affiliate, EEPGL, would self-insure but given that it is a limited liability corporation, he demanded that it transfer the liability to its parent company.

He stated that it threatened to bring its President into the discussions but that he called its bluff and told the company it couldn’t pump a barrel of oil until it transferred the liability to their parent company. He noted that it was written in the permit but the EPA gave EEPGL time so that ExxonMobil and its co-venturers, Hess and CNOOC, could figure out how they will cover the liability.

“Even though it was written into the permit that the parent corporation is going to cover the liability, they went out for insurance for US$2.5 billion and we said that it’s not going to do and the parent companies have to have coverage for everything over and above, so it’s an unlimited liability coverage. Well, guess what? It’s been over a year now and they have not signed the document from the parent companies saying that they are going to go ahead. We had several meetings with them, with our lawyers present and so questions need to be asked from the government about what is going on with the signing of that guarantee for unlimited coverage that the company [EEPGL] had agreed to in the past,” Adams had said before adding that even though it is part of the environmental permit, EEPGL has not signed the document that guarantees this.

“They have agreed to it but did not put it on paper,” Adams, who was fired last year by the government, said.

‘Black and white’

When he had requested unlimited liability coverage from the parent company, he had explain-ed that it was only keeping with international standards.

“The one thing I have been asking is: ‘What is the international standard? And if that standard would be used here?’ We are not asking [anything] out of the ordinary. All we want to have is what they are required to do for the developed countries and we should not expect or will accept anything less. In the application for the permit, there wasn’t evidence presented to satisfy the requirements for insurance and the key was in the clause for liabilities where it said EEPGL will cover. EEPGL is a limited liability company, they do not have the assets to cover. They are a subsidiary of ExxonMobil as everyone knows. Verbally, I was given the assurance that ExxonMobil pick up and they have insurance and all of that. But you have to understand that in business getting documentation is key. Yes, putting it in black and white. I wanted specificity as to how it would be covered by insurance. You say, ‘Oh, it will,’ then fair enough, show me in writing exactly how and state by insurance. I wanted documented assurance by seeing insurance,” he had stressed.

He had explained that no insurance company would give a US$65 billion policy and that one had to be practical in the decision making process.

The Stabroek News had contacted ExxonMobil and the company stated that the Stabroek Block co-venturers have secured comprehensive insurance for their petroleum activities and added that under the existing legal framework and agreements with the government, there are extensive assurances of their commitments, including environmental protection measures to respond to operational incidents.

“ExxonMobil Guyana is committed to environmental performance excellence. Our goal is to prevent incidents that would have a negative impact to the environment. Prevention of such issues is our number one priority. However, we also prepare and practice emergency response in case of unlikely events such as an oil spill. We employ robust preventative and mitigating mechanisms including advanced technology; vigilant maintenance; robust health and safety measures; ongoing risk management and effective emergency preparedness,” ExxonMobil said in response to questions posed.

There was no response as to why the document that Adams referred to remains unsigned.

Article 12.1 of the Environmental Permit states that the “Permit Holder shall have insurance of liability for pollution damage and in such amount as is customary in the international petroleum industry in accordance with good oil field practices for petroleum Operations in progress Offshore Guyana in respect of:

1) Loss or damage to all assets used in projects

2) Pollution caused in the course of the project for which EEPGL will be jointly and severely, held responsible

3) Loss or damage to property or bodily injury suffered by any third party in the course of the Project for which EEPGL is liable to, according to terms of the policy.

4) EEPGL’s liability to its employees engaged in the projects.

5) Any other requirement(s) made by the EPA under condition 12.4.”

In addition, the permit also states that condition 12.1 shall not be interpreted to mean that the permit holder, its parent company, servants and/or agents will not be liable to any other existing or forthcoming applicable laws, rules and regulations related to insurance for petroleum operations within or out of the jurisdiction of Guyana. Further, it was stated that the permit is issued subject to the fulfillment of the obligations outlined in article 12.1 and in correspondence dated March 20, 2019 indicating the commitment of EEPGL to obtain such insurance for coverage of environmental liabilities, in accordance with the requirements of the EPA and the Bank of Guyana.

“Failure to fulfil such obligations or commitments is in breach of this and will result in its immediate cancellation,” the permit states.

Meanwhile, Article 12.4 of the permit says that the EPA shall reserve the right to request and review the environmental liability insurance policy and that such review is subject to the provision of documentary evidence that the insurer is authorized to provide the insurance in the jurisdiction and to provide evidence of the insurer’s financial strength and the details of the amount of cover and the cost profile, and evidence of authorization of the institution or insurer to provide insurance.

Article 12.5 of the Environmental Permit states, “The Permit Holder must, as soon as reasonably practicable, provide from the Parent Company or Affiliate Companies of Permit Holder and its Co-Venturers (“Affiliates”) one or more legally binding agreements to the EPA, undertaking to provide adequate financial resources for Permit Holder and its Co-Venturers to pay or satisfy their respective environmental obligations regarding the Stabroek Block if EEPGL or its Co-Venturers fail to do so. As a consequence, EEPGL will be required to:

1) Provide evidence of the following: That the Affiliate(s) are authorised to provide that guarantee or agreement in this jurisdiction.That the Affiliate(s) have sufficient financial strength for the amount of the potential liability. That the Affiliate(s) have the corporate legal capacity to enter into the agreement.”

Additionally, Article 12.6 stated that the permit holder, its servant and agents shall be strictly liable for the adverse effects of any discharge or release, or cause or permit the entry of the pollution, contaminant in any amount, concentration or level in excess of that prescribed by the regulations or stipulated by any environmental authorization which are attributed to any project in accordance with section 19 (1) and (2) of the Environmental Protection Act.

The contract signed with EEPGL in 2016 states that to the extent permitted by applicable laws, rules and regulations, such insurance may be provide through the contractors’ affiliate insurance company. “Subject to the Minister’s approval, which shall not be unreasonably withheld, the contractor, notwithstanding the provisions of article 20.2(a) shall have the right to self-insure all or part of the aforementioned insurances in article 20.2 (a),” it further states.