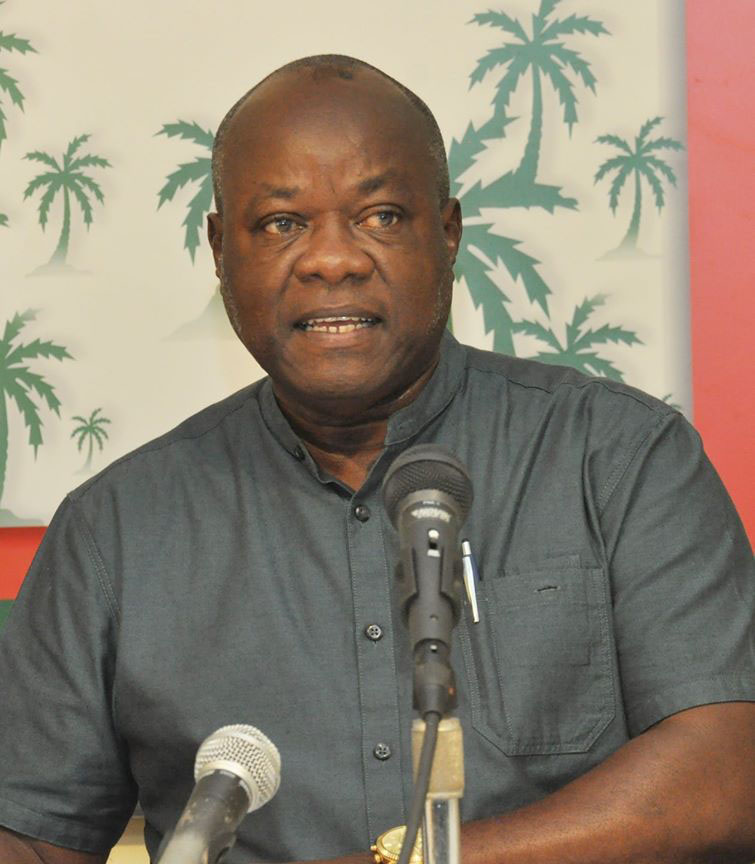

New PNCR Leader Aubrey Norton yesterday took President Irfaan Ali to task over the Natural Resource Fund Bill promulgated by the government, charging that the Minister of Finance has been given too much authority and that the committee for determining the economically sustainable amount for withdrawal from the fund had been discarded.

Norton adverted to a claim by Ali on Facebook yesterday that the APNU+AFC’s version of the bill did not have a governing body and that this was one of its major flaws.

Norton said that this was untrue and that in Section 11 of the Act passed by the APNU+AFC government, the Minister of Finance is responsible for the overall management of the Natural Resource Fund. Moreover, in Section 14 of The Act, the Investment Committee, comprising of investment professionals, advises the Minister of Finance on the

Overall objectives of the Fund

Conditions, constraints, and opportunities in the financial markets

Ensure sufficient monies are available for withdrawal from the Fund

Adhering to international best practices in investment portfolio management, which includes The Santiago Principles)

Ensure the fund is adequately diversified and so on. In addition, in Section 12 of The Act passed by the APNU+AFC government, the Bank of Guyana is responsible for the operational management of The Fund. There is an operational management agreement between the Minister of Finance and The Bank of Guyana.

“Clearly The Act has a governing body, and it complies with Principle 6 (Governance Framework) of the Santiago Principles”, Norton asserted.

He contended that all the President is really saying is that under the PPP/C government’s proposed Bill, the Minister of Finance will delegate Overall Management and Investment Mandate responsibilities to the Board of Directors and that board will enter into an operational management agreement with The Bank of Guyana.

However, Norton argued that the Board of Directors still needs to seek approval from the Minister of Finance before it executes the Investment Mandate and the Operational Agreement with the Bank of Guyana. Furthermore, the Minister of Finance is responsible for crafting and enforcing the code of conduct of the Board of Directors. Norton said that this code of conduct dictates how the Board of Directors must undertake their affairs.

“Clearly the Minister of Finance is still in charge. He or she has merely delegated some of its responsibilities to The Board of Directors”, Norton declared.

He also noted that President Ali said that the PPP/C government Bill enhances oversight on the Fund. He said that the President mentioned that parliament, particularly the Public Accounts Committee (PAC) and the Auditor General will all have oversight responsibilities but Norton contended that this was nothing new under the Act as these bodies have always had oversight responsibility over the Natural Resource Fund.

In the APNU+AFC Act, Norton pointed out that the Public Accountability and Oversight Committee (PAOC), an independent committee that represents a broad-based section of Guyanese society is responsible for the overall oversight of the Fund.

However, he said that President Ali failed to disclose that his government wants to wrest oversight authority away from this independent committee and place it in the hands of the same Board of Directors which is also responsible for the management of the Fund.

“How can a board provide oversight and hold itself accountable? This is a clear violation of principle 6 (Governance Structure) of the Santiago Principles. According to Principle 6 of the Santiago Principles, “The governance structure should be set out in the Sovereign Wealth Fund’s (SWF) legal framework, for example, in the relevant legislation, charter or other constitutive documents. It should ensure appropriate and effective division of oversight, decision making, and operational responsibilities”, Norton argued.

In the PPP/C’s proposed Bill, Norton said that the new role of this “independent” committee will be relegated to receiving and being briefed on the quarterly reports of the Fund.

“In fact, under Section 41 of The Bill, the Minister of Finance will craft the code of conduct of the Public Accountability and Oversight Committee. This diktat by the Finance Minister makes the PAOC dependent upon the Finance Ministry to determine how to conduct its affairs”, Norton lamented.

Referring to the Economically Sustainable Amount, the amount of funds that can be withdrawn from the Fund without adversely impacting the economy, Norton noted that the President had claimed that in the APNU+AFC version the Minister of Finance determines the Economically Sustainable Amount.

“That is a lie. Under Section 20 of The Act, the responsibility of determining the Economically Sustainable Amount was placed in the hands of the Macroeconomic Committee, which comprises of experienced economists. In fact, in the Bill that this government is proposing, they have gotten rid of in The Macroeconomic Committee and there is no longer an Economic Sustainable Amount. Therefore, there is no way for any of us to determine if the amount of funds this government wants to withdraw from the Fund will have (a) negative impact on our economy. We should just trust them”, Norton posited.

The Fiscally Sustainable Amount, Norton pointed out, sets the maximum amount withdrawn from the Fund while preserving the financial sustainability of the Fund and “ensuring we have enough funds left over for our future generations and making sure that the withdrawn amounts are stable”.

Norton added that even though the Minister of Finance is responsible for calculating the Fiscally Sustainable Amount, this amount could be ascertained by anyone who follows the criteria of Calculating the Fiscally Sustainable Amount located in the First Schedule of the extant Act.

“The government has scrapped The Fiscally Sustainable Amount and has (an) arbitrary withdrawal ceiling, which includes a sliding scale ranging from 100% of fund withdraws to 3% of fund withdrawals. For example, if US$2.5 Billion came into the fund within the previous year, this government can withdraw as much as $1.5 Billion or as much as 60% of the amount that came into the Fund for its own spending purposes. Keep in mind this amount does not include any emergency spending for events such as a natural disaster”, Norton stated.

He contended that the arbitrary approach to withdrawing the Guyanese people’s monies will ensure that “nothing is left over for our children and our grandchildren”.