Last Wednesday, the Minister responsible for Finance presented to the National Assembly the Estimates of Revenue and Expenditure for the fiscal year 2022. The presentation was made 64 days ahead of the 31 March 2022 set by Article 219(1) of the Constitution. Prior to 2015, the Estimates were presented close to this deadline. Taking into account the general debate that followed and the detailed consideration of the Estimates by the Committee of Supply, it was not until the end of April that they were finally approved. Budget agencies therefore had eight months to execute a 12-month programme, especially in relation to new infrastructure development works.

The above practice to a large extent explained the tendency towards the acceleration of expenditure in the last quarter of the year mainly to exhaust budgetary allocations. In such a circumstance, all sorts of irregularities took place, including overpayments to suppliers/contractors, defective work performed, short or non-supply of goods/services; executing large contracts close to year-end for which advance payments were made; drawing cheques in the new year and back-dating them to 31 December although full value (or no value) was not received as at that date; and failure to pay over to the Treasury all unspent balances at the end of the year. This does not suggest that these irregularities did not continue in years 2015 through 2020, as highlighted in the Auditor General’s reports.

It is a step in the right direction for an early budget to be prepared and presented to the Assembly for its approval. For the years 2017, 2018 and 2019, the Estimates were approved before the commencement of the fiscal year in keeping with the Government’s Budget Transparency Action Plan developed in late 2015. However, in view of the political situation that the country was faced with following the vote of no confidence in the Government, the 2020 Estimates were not presented until September 2020, while for 2021 they were tabled on 12 February 2021. It is also understandable that the 2022 Estimates had to await the passing of Natural Resource Fund (NRF) Act to enable withdrawals from the Fund to assist in the financing of the budget. One hopes that the 2023 Estimates will be presented to and approved by the Assembly before this year-end.

Section 16 of the NRF Act provides for the approval of Assembly before any withdrawals are made from the Fund. This raises the question as to whether the Assembly’s specific approval is not required before the amounts involved are incorporated in the Estimates. Or, is it a case where once the Assembly approves the Estimates, it also approves of the related withdrawals? We believe that the former should be the case. In this regard, we note that an amount of G$126.694 billion, representing the entire balance on the Fund as of 31 December 2021, has been earmarked to fund the proposed expenditure of G$552.9 billion for 2022.

In today’s article, we highlight the performance of the economy in 2021 and the budget measures for 2022, as contained in the Minister’s budget speech.

Real GDP growth

The projected total growth in the gross domestic product (GDP) for 2021 was 20.9 percent while non-oil growth was expected to be 6.1 percent. The actual growth was 19.9 percent, with non-oil growth accounting for 4.6 percent. While this performance was largely in line with the projections, it must be viewed against the following: severe impact of the COVID-19 pandemic; extensive flooding in various parts of the country, especially during the May-June period; and global growth of 5.9 percent, Latin America and the Caribbean growth of 6.9 percent, and growth in the Caribbean region of 1.2 percent, if Guyana were excluded. Growth for 2022 is projected at 47.5 percent with non-oil growth accounting for 7.7 percent.

Some observers have questioned the meaningfulness of the GDP as a measure of economic wellbeing for the average citizen when account is taken of oil production by Exxon’s subsidiaries for which Guyana receives a mere two percent royalty and 50 percent profits after a deduction of 75 percent of all recoverable costs. They suggest that a more meaningful measure is the gross national product (GNP). By definition, GDP measures the value of goods and services produced within a country’s borders, by citizens and non-citizens alike. On the other hand, GNP measures the value of goods and services produced by only a country’s citizens but both domestically and abroad. We will leave this matter to our distinguished economists to reflect on, since we do not hold ourselves as experts in the field.

Balance of Payments

This is the net effect of trade in goods, services and capital between a country and the rest of the world. A positive balance means that the value of exports exceeds that of imports. It has the benefit of boosting production and hence employment. On the other hand, a negative balance indicates that the country is a net consumer rather than a net producer. If this negative balance persists, it has the effect of increased borrowings and hence the country’s indebtedness. It can also put pressure on the country’s exchange rate.

The Balance of Payments has three components – the Current Account, the Financial Account and the Capital Account. The Current Account essentially reflects transactions in goods and services for short-term consumption. The Financial Account records foreign ownership of domestic assets as well as domestic ownership in foreign assets. An increase in the former adds to the balance on the Financial Account, while an increase in the latter has a reverse effect. The Capital Account reflects transactions of a capital nature, or investments, which have long-term implications.

Guyana’s Current Account reflected a deficit of US$822.9 million at the end of 2020. This deficit was projected to show a positive balance of US$65.7 million in 2021. However, the actual deficit at the end of 2021 was US$1,533.1 million. This was mainly due to: the importation of Guyana’s second floating, production, storage and offloading (FPSO) vessel at a cost of US$1,658.6 million; and net service payments totalling US$2,557.1 million.

The Capital Account was a projected to show a surplus of US$810.6 million at the end of 2021. The actual surplus at the end of 2021 was US$1,678.7 million, due mainly to an increase by 110.5 percent in net foreign direct investments. This has resulted in the Balance of Payments reflecting an overall surplus of US$130.2 million, a 24.4 percent improvement over 2020.

For 2022, the Balance of Payments Account and the Current Account are forecast to show surpluses of US$403.4 million and US$2,441.4 million, respectively. The Capital Account is, however, expected to record a deficit of US$2,037.9 million, ‘reflecting the operator’s share of oil production applied to cost recovery, as well as a moderation of FDI inflows also as a result of no new FPSO being imported this year’. Hopefully, the Minister will elaborate further on this matter during the debate that commences today.

Inflation

Inflation was 5.7 percent against a projection of 1.6 percent, due mainly to the impact of the floods which saw sharp increases in prices. Food prices, which rose by 11.6 percent, accounted for 5.0 percent points to the inflation rate. For 2022, the inflation rate is expected to be 4.1 percent.

Interest rate

Interest rates remained low throughout 2021. For small savings, the rate decreased from 0.91 percent to 0.83 percent, while the average lending rate fell from 8.95 percent to 8.88 percent. The 91-day, 180-day and 364-day Treasury Bills attracted rates of 1.54 percent, 1.0 percent and 0.99 percent, respectively.

Revenue and expenditure

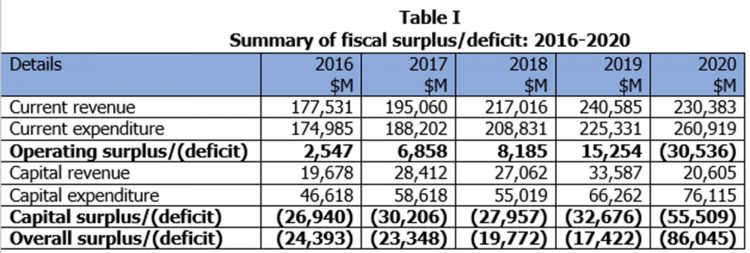

A fiscal deficit of G$115.7 billion was recorded in 2021, representing 10.2 percent of GDP. This was due mainly to an increase in expenditure that outweighed the increase in revenue generated. Current revenue, net of inflows from Guyana REDD+ Investment Fund, amounted to G$265.8 billion, while Central Government expenditure was G$387.3 billion, inclusive of capital expenditure of G$104.386 billion. In 2020, the fiscal deficit was G$90.5 billion, representing 9.4 percent of GDP, while for 2018 and 2019, it was G$19.7 billion and G$17.4 billion, respectively. Table I, extracted from the Auditor General’s reports, provides a summary of the fiscal surplus/deficit for the years 2016 through 2020:

The year 2021 therefore represents the second consecutive year in the last six years that an operating deficit was recorded, while the capital expenditure deficit rose over three-fold over this period. On several occasions, we bemoaned the fact that the Government continued to record large fiscal deficits, mainly due to easy access to the overdraft facility from the Bank of Guyana. In fact, during the 28-year period from 1992 to 2021, there were only four occasions when a fiscal surplus was recorded: 1994, 2006, 2010 and 2011. Further analysis revealed that during the period 1992 to 2013, the total recorded deficit was $103.525 billion, giving an average annual deficit of $4.706 billion.

In contrast, during the period 2014-2021, the total recorded deficit was $363.787 billion, giving an average annual deficit of $45.493 billion – an almost ten-fold increase. These deficits have resulted in the cumulative increase in the overdraft on the Consolidated Fund from G$26.136 billion at the end of 1992 to an estimated G$398.456 billion at the end on 2021. The latter amount does not take into account transfers in 2018 and 2019 of G$75.678 billion from the Monetary Sterilisation Account representing proceeds from the issue of Treasury Bills and US$959.2 million through the issue of debentures in June 2021.

Public debt

The total public debt at the end of 2020 was U$2.592 billion, inclusive of publicly guaranteed debts and the overdraft on the Consolidated Fund, representing 47.4 percent of GDP. The external portion was US$1.321 billion. It was projected that the public debt would increase to US$3.138 billion at the end of 2021. The actual public debt was US$3.128 billion or 38.7 percent of GDP, the external portion accounting for US$1.393 billion.

Net foreign reserves

The net international reserves at the Bank of Guyana stood at US$810.8 million, compared with US$680.6 million at the end of 2020. The reserves represent 14 months of import cover.

To be continued –