With Venezuela’s once powerful oil industry now badly fractured largely on account of United States sanctions imposed on the administration of President Nicolas Maduro, Caracas would appear to be looking to China to help restore the industry to global prominence in the shortest possible time.

The South American nation depends almost exclusively on its oil exports to keep its economy afloat and the US sanctions have all but brought the country to its knees, disfiguring its economy, unleashing an avalanche of poverty and provoking the hasty migration of Venezuelans now numbered at least in their hundreds of thousands to mostly neighbouring countries.

Reports from the international oil & gas sector indicate that China, which ranks behind the United States as the world’s second largest oil producer, is believed to have purchased a total of 324 million barrels of oil from Iran and Venezuela in 2021 alone. Energy news site, Oilprice.com, also reports that with the support of China and to a lesser extent, Indonesia, Guyana’s South American neighbour is “once again profiting from its long-embattled oil industry.”

“Venezuela appears to be following in Iran’s footsteps by starting to ignore U.S. sanctions on its oil industry to once again develop its substantial crude reserves. After years of stalling and losing out on international investment as well as vital revenues, Venezuela looks to be set to increase its oil production, fostering relationships with key export markets that are willing to risk U.S. retaliation to the move,” the Oil price.com report says.

The site says in a recent article authored by Felicity Bradstock that the Maduro administration has been “working with China and Indonesia to put the country’s oil industry back together again following several years of ‘halted operations,” though it adds that Washington “is unlikely to drop its sanctions on Venezuela while the current political power maintains its rule, even with the potential for oil prices to improve upon an influx of Venezuelan crude.”

The Oilprice.com report also cites the Lloyds List Intelligence as stating that in 2020 around 150 ships transported Venezuelan oil to Asia, mainly via Malaysia to be moved to China and Indonesia. Asian demand, it adds, is expected to increase by 1.7 million bpd in 2022, a market opportunity which Venezuela can cash in on if the country can deliver at competitive prices.

China, the report says, appears unfazed by any likely potential repercussions that might arise from buying Venezuela’s “sanctioned oil,” much of which finds its way to private Chinese refiners. Venezuela, at the same time, may now be better positioned to take advantage of the available Asian market since it was able to significantly increase its oil production in 2021 over the previous year largely because the state-owned Petroleos de Venezuela (PDVSA) was able to secure the support of a number of small external drilling companies. The international marketability of Venezuela’s oil was also reportedly enhanced on account of Venezuela’s acquisition from Iran of a dilutant with which to refine its extra-heavy crude.

At the end of last year, Venezuela reportedly reached a production level of 1 million bpd, marking a major turnaround from the previous year. Back in 1999 the country’s oil production had peaked at a staggering 3.2 billion barrels per day.

These days, however, PDVSA’s ability to return even close to that level is believed to be hamstrung by scarcity of both foreign investment and drilling equipment, factors which are being influenced by the prevailing U.S. sanctions and which limits the firm’s oil output capabilities, the Oilprice.com article says.

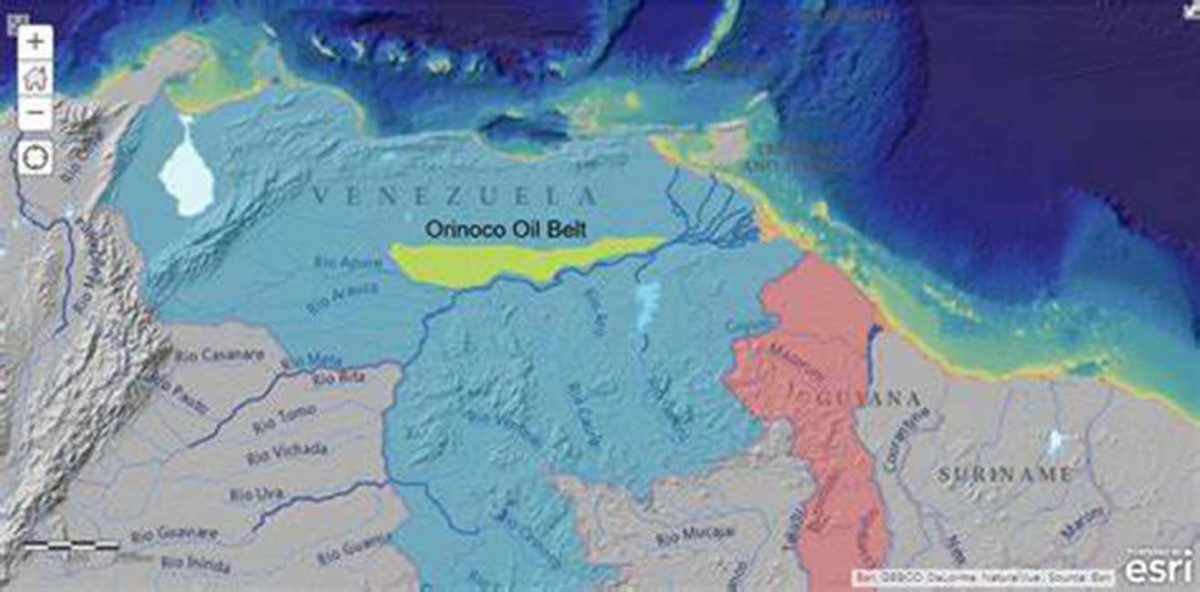

Much of what is believed to be the gradual change in fortunes of Venezuela’s oil industry is also believed to have been occurring on account of the support that the country has been receiving from Iran including Tehran’s supply of dilutants, such as naphtha, to Venezuela and which are key to reducing the viscosity of the Venezuelan heavy crude located in the Orinoco belt.

The thinners are transported from Iran to Venezuela via complex routes in order to circumvent US detection. Juan Fernández, a former Executive Director says that owing hugely to Iran’s intervention, oil production estimates for the belt currently add up to 450,000 to 500,000 barrels a day.

But while its recent oil output looks promising, Venezuela still relies on the US dropping its sanctions on the country’s oil industry to gain greater foreign investment and maintain its currently high oil output, the report concludes.