CGX Energy has secured a US$35 million loan to continue to finance part of its share of costs for petroleum-related activities on the Corentyne Block offshore Guyana.

Frontera Energy Corporation and CGX Energy Inc. on Friday announced that they have entered into a financing agreement for a US$35 million loan that will enable CGX to continue to finance exploration activities on the Corentyne Block, the Berbice Deepwater Port, and other budgeted costs as agreed to with Frontera.

“We are pleased to complete this financing agreement in support of our joint venture as we build momentum towards spudding the Wei-1 exploration well in the second half of this year,” said Orlando Cabrales, Chief Executive Officer of Frontera, in a joint statement issued by the companies.

“These are exciting times for our joint venture and we look forward to working with our partner, CGX, as we build on our recent exploration success at the Kawa-1 exploration well and generating value for our shareholders and the people of Guyana in one of the most exciting basins in the world.”

Meanwhile, Professor Suresh Narine, Executive Co-Chairman of CGX, added, “With positive results and data supporting the 200 feet of net pay indicated, we have de-risked our exploration program and can continue to move forward with our overall plans, beginning with Wei-1.”

The loan to CGX will be available for drawdown in tranches on a non-revolving basis until whichever is earlier of either July 31, 2022 or the date on which CGX has drawn down the maximum amount of the Loan.

The statement explained that the loan, together with all interest accrued, shall be due and payable July 31, 2022, or such later date as determined by Frontera, at its sole discretion. Interest payable on the principal amount outstanding shall accrue at a rate of 9.7% per annum payable monthly in cash, with interest on overdue interest. “If the Loan is extended by Frontera past July 31, 2022, in its sole discretion, the new interest rate will be 15% per annum,” it added, while noting that the loan will be secured by all of the assets of CGX.

A standby fee of 2% per annum multiplied by the daily average amount of unused commitment under the loan in excess of US$19 million shall be payable quarterly in arrears by CGX, on the last business day of each fiscal quarter, during the drawdown period, according to the terms of the agreement.

CGX is also required to repay all of the Loan that is outstanding in the event that without the consent of Frontera, it issues any security that would dilute Frontera’s current ownership of CGX, or any of its subsidiaries enters into any transaction the proceeds of which are used by CGX to pay its part of the authorized costs of Wei-1.

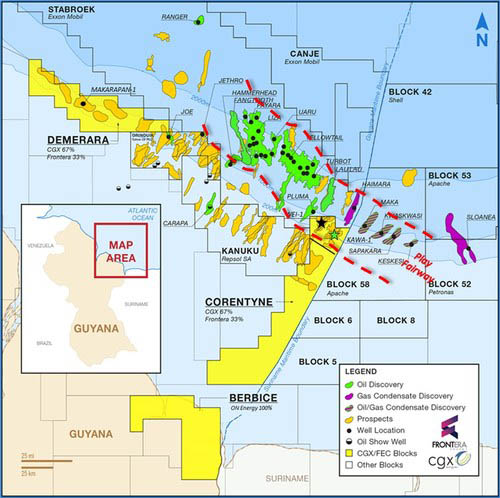

CGX and Frontera, which is its majority shareholder, on February 4, 2022, said they would be focusing on developing the Corentyne block this year due to the initial positive results at the now abandoned Kawa-1 exploration well and that it would not engage in drilling activities on the Demerara block in 2022.

However, with just under a year remaining before the expiration of its prospecting licences, CGX Energy has been informed by the government that it is expected to drill exploration wells in the offshore Demerara and Berbice blocks. CGX have since indicated that it doesn’t have enough finances to embark on any additional activities and hence will be seeking talks with the Natural Resources Ministry.