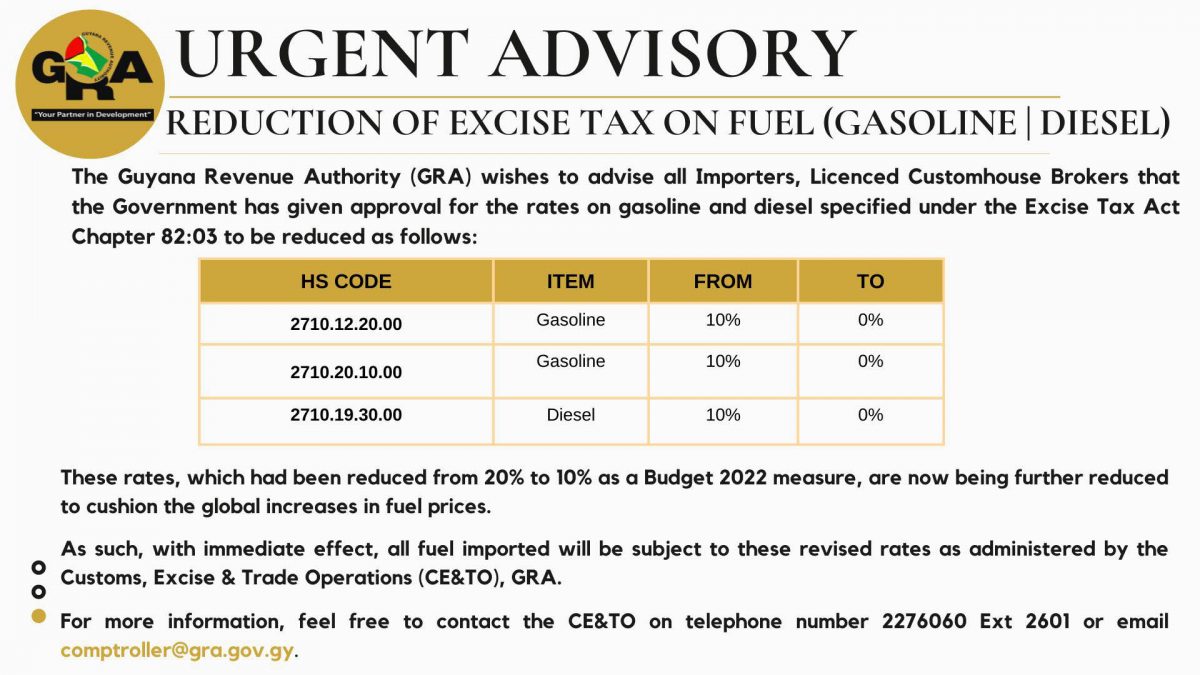

The Guyana Revenue Authority (GRA) has announced that government has approved a further reduction on the excise tax on gasoline and diesel.

Yesterday, in a public advisory, GRA said that the excise tax has been reduced from 10% to 0%.

“These rates, which has been reduced from 20% to 10% as a budget 22 measure, are now being further reduced to cushion the global increases in fuel prices. As such, with immediate effect, all fuel imported will be subject to these revised rates as administered by the Customs, Excise & Trade Operations (CE&TO), GRA,” the advisory stated.

Excise tax is a tax on items/goods/products imported that are considered consumables. This tax is charged on the following items alcoholic beverages, tobacco products, petroleum products and motor vehicles.

Petroleum is taxed at different rates depending on the product, that is, gasoline, diesel, oil and gas.

During his 2022 budget presentation, Finance Minister Dr Ashni Singh had announced that the excise tax rate on gasoline and diesel will be cut immediately from 20 to 10%. This was one of the measures to ease the cost of living burden.

He had noted that twice in 2021 the government lowered the excise tax rate on gasoline and diesel from 50 to 35% and then from 35 to 20%.

“I am pleased to announce that, utlilising the same established mechanism, we will be lowering the excise tax rate further on gasoline and diesel from 20 per cent to 10 per cent, with immediate effect”, Singh had said at the time.

Up to press time, the Finance Ministry had not officially made a statement on the reduction of the excise tax on fuel imports. President Ifraan Ali and Singh are in Dubai and Pakistan respectively.

In a post on his Facebook page, President Ali shared a graphic indicating the reduction with the caption “In response to the continuous increase in fuel prices on the world market, we have now reduced the excise tax on gasoline and diesel to zero.”

It is unclear when the decision was taken to remove the excise tax on fuel imports. Fuel prices have been skyrocketing owing to a number of factors but mainly the Russian invasion of Ukraine, the COVID-19 pandemic and global supply chain bottlenecks.

Yesterday, during his outreach on the Essequibo Coast, Vice President Bharrat Jagdeo also briefly mentioned the reduction.

“Oil prices are now 4 times than they were in 2015 and fertilizer prices have moved up and that is why it is affecting the farmers because fertilizers are made from petroleum – oil and gas. So we are in a period now where we are seeing a high cost of living. We are sure as the production increases back across the world and we get rid of the supply chain problems and if the war abates in Ukraine that the prices are going to come down, But at this point in time it is something that the government is taking seriously because it is affecting our people and there is very little we can do about it.

“Take for example there is a tax on fuel of 50%. Now it’s down to 0% and in spite of the fact that we removed the 50% tax, the price has still gone up so there is no tax. We can’t remove anything else, we removed all of it,” Jagdeo said.

Jagdeo also reminded the residents of all the government has done since taking office in August of 2020.

In the 2022 budget, government had set aside $5 billion to address the cost of living increases which were brought on by the COVID-19 pandemic and global supply chain bottlenecks.

Last week, President Ali assured that rising global fuel prices will not affect electricity or water rates here.

“Here in Guyana, the government is not going to allow that increase to be translated to the people of the country. We said to both entities Guyana Power and Light [GPL] and Guyana Water Inc [GWI] that you are not going to increase by a cent. The government will take up the additional expenditure and fill the gap…,” Ali had said.

The president also announced that the government is consulting with stakeholders to determine the best options to deal with the multifaceted problem of the rising cost of living.

We’ve already started that so the government will be continuing, aggressively, discussions with a cross-section of Guyanese communities so that we can come up with the best possible approach – listening to ideas, listening to some of the connected issues and then coming up with some policies. You know we set aside $5 billion in the budget to address this [rising cost of living],” Ali had said.

In 2021 Guyana saw food prices rising by some 11.6%.