In response to the Stabroek News editorial of 20 March 2022 on the Marriott Hotel, former Finance Minister Winston Jordan provided some specifics on the loan of US$17.3 million that was taken from the Republic Bank of Trinidad and Tobago to finance the cost of construction of the Hotel. The repayment of the loan was to have been made over a 13-year period at interest rates of 9.15 percent and 8.65 percent during construction and post-construction phases, respectively. However, there was an 18-month moratorium on interest as well as a 24-month moratorium on principal from the date of first disbursement. The former Minister stated that neither Atlantic Hotel Inc (AHI), the owner of the Hotel, nor its parent company, National Industrial and Commercial Investments Ltd. (NICIL), was able to service the debt. As a result, the Government stepped in and took over the liability after an agreement was reached for the restructuring of the loan to reflect the repayment of the principal and interest of 6.28 percent over a 15-year period. The outstanding liability is now reflected as part of the public debt of Guyana.

Mr. Jordan also stated that the last set of audited accounts of AHI was in respect of 2014 and that draft accounts for the years 2015 and 2016 were submitted to the Audit Office but the audit of these accounts remained outstanding as of 31 December 2019. Further submissions were made for the years 2018 and 2019.

Stabroek News sought my views on the above two matters. I stated that it is unclear why the recommendation contained in my forensic audit report on the Marriott Hotel dated 27 October 2015 was not followed. The report referred to the serious risk of default in the repayment of principal and interest to the Republic Bank, should the hotel continue to make losses due to in part to the less-than-desirable rate of occupancy at the time. In the circumstances, it would be necessary for the loan to be paid off at the earliest opportunity. This was especially so, considering that the Republic Bank has a lien on the hotel and surrounding area via debenture and mortgages. The report recommended that the Government proceed without delay to advertise for the sale of the hotel. I should mention that, apart from the Republic Bank loan, AHI had received a loan of US$15.5 million from NICIL to finance the cost of the Hotel, with repayment terms similar to those of the Republic Bank, except that the loan was interest free.

I also indicated that I am still of the view that the Hotel should be privatized, considering that several other internationally branded hotels are being constructed in and around the city, not to mention the recently completed expansion of the Pegasus Hotel. These developments are likely to see a lowering of occupancy rates at the Marriott Hotel which in turn will have an adverse effect on its profitability and financial viability. I should mention that the feasibility study that was conducted prior to construction clearly indicated that the profitability of the Hotel was hinged on the construction and operationalization of an entertainment complex fitted with a casino. Apart from the requirement to repay the Republic loan, including interest charges, a significant portion of the revenue generated through the operations of the Hotel had to go towards meeting the contractual obligations to Marriott International based on four contracts entered into for the management and operations of the Hotel. These factors militate against the Hotel’s ability to turn in the desired level of profit, if any.

In support of my argument, I referred to a statement that the former Minister made in November 2015, three few weeks after the forensic audit report was issued to him. He stated that if the price was right, the Government would be willing to rid itself of the Marriott Hotel: ‘Let me put it this way, if government gets a credible offer or buyer, it will divest itself of the hotel’. He also indicated that the Government had made it clear on several occasions that it had no intentions of being competitively involved in the hotel industry and that a Cabinet sub-committee was looking at the issue. In this regard, I expressed the view that: (i) the Government should not be in the business of owning and operating hotels, which should be left to the private sector that is better equipped to deal with the risks and rewards associated with that industry; (ii) it seems unreasonable, indeed unfair, for taxpayers to bear the cost of servicing the indebtedness to the Republic Bank, including the repayment of the loan; (iii) the Government’s decision to construct the hotel was indeed a reckless one; and (iv) in the final analysis, it is the taxpayers, both present and future, who have to bear the financial burden of discharging the indebtedness to the Republic Bank.

As regards the status of the audit of AHI, an examination of the Auditor General’s report for 2018 indicates that the audit of AHI’s accounts for 2015 was completed and the related report issued. Similarly, his 2019 report indicated that the audit of the 2016 accounts was also completed and the related report issued. These audited accounts are required to be laid in the National Assembly within six months of the close of the financial year, but it is not clear whether this was done.

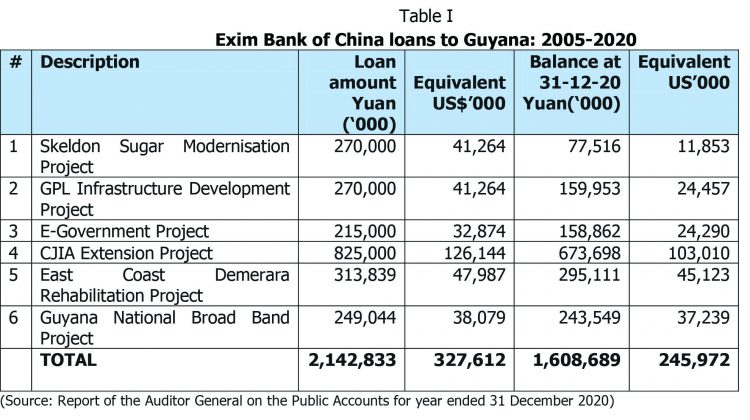

In last week’s article, we discussed the Cheddi Jagan International Airport Expansion Project which, after ten years since the design and construction contract was signed, is yet to be completed. The main reason for this state of affairs is the absence of feasibility studies prior to the contract award, to determine the precise nature and scope of the works to be undertaken, coupled with a lack of effective supervision as the works progressed. The Project is financed by a loan from the Exim Bank of China, with counterpart funding from the Government of Guyana. Table I shows the list of projects in Guyana that are financed by loans from the Exim Bank of China since 2005:

In today’s article, we discuss some of the above projects that also ran into serious difficulties during their execution. We refer to the Skeldon Sugar Modernisation Project, the One Laptop Per Family and the Fibre Optic Cable Project.

The Skeldon Sugar Modernisation Project

The reported US$200 million Skeldon Sugar Modernisation Project (SSMP) project commenced in September 2005. Completed in March 2009, it has so far been non-operational because of major defects in construction, including alleged use of inferior materials. This was despite efforts by a South African firm in 2012 to rectify the defects. The SSMP was financed by a loan of ¥270 million, equivalent to US$41.283 million from the Exim Bank of China, as well as two loans from the Caribbean Development Bank amounting to US$28.356 million, giving a total foreign financing of US$69.639 million. This is in addition to counterpart financing from the Government of Guyana over the five-year period of construction.

The Government’s decision to proceed with the Project came at a time when it was known that the preferential prices that ACP countries were receiving for their sugar exports to the European Union were being removed. This was as a result of the World Trade Organisation (WTO) ruling in a case brought by Australia, Brazil and Thailand in 2003. It therefore meant that Guyana had to sell its sugar to the world market at a time when its cost of production far exceeded the world market prices. The WTO ruling forced other Caribbean sugar-producing countries – Belize, Jamaica, Barbados, St. Kitts, Trinidad & Tobago – to scale back significantly or abandon producing sugar for export. Guyana did the opposite and proceeded with the SSMP in the hope of modernizing the sugar industrial and reducing the cost of production.

The assets of the SSMP along with other assets of the closed sugar estates have since been transferred from the Guyana Sugar Corporation to the NICIL in keeping with a Vesting Order signed by the then Minister of Finance. However, an examination of the Auditor General’s reports indicated no evidence that NICIL’s accounts were audited beyond 2003. The related report was issued some eight years later in 2011. A Google search for NICIL’s website was unsuccessful, suggesting that it is no longer in existence or that it might have been down.

The One Laptop Per Family and the Fibre Optic Cable projects

Two other major projects that failed to deliver are the One Laptop Per Family (OLPF) and Fibre Optic Cable Project. Both of these were financed by the Exim Bank of China – the former from a grant of ¥50.267 million, equivalent to US$7.686 million; the latter, from a loan of ¥215 million, equivalent to US$32.874 million. Numerous irregularities relating to the acquisition, storage and distribution of the computers were uncovered by the auditors; while the Fibre Optic Cable Project had to be abandoned because numerous problems were encountered in the laying of the cables from Brazil through Guyana’s interior towards the coast.

These failed projects financed by the Exim Bank of China reminds us of the statement by Chinese President Xi Jinping after announcing a new round of grants, loans and credit of some US$60 billion for African nations. When asked about allegations that too many poorly thought-through projects were receiving funding from China, he stated that the resources provided should not be spent on vanity projects but in areas that are most needed and that the investments must give ‘both Chinese and African people tangible benefits that can be seen, that can be felt’. (Page 232 of the book by Peter Frankopan titled “The New Silk Roads”).

The problem also appears to be a lack of effective accountability mechanisms to ensure that the funds are spent with due regard to economy, efficiency and effectiveness in the achievement of the stated objectives, outputs and outcomes. For example, in relation to World Bank and IDB loans, one of the conditionalities is for separate financial reporting and independent auditing of the projects within specified deadlines. This is in addition to the submission of periodic reports to these institutions of the status of the projects, financially and otherwise, as well as periodic inspection visits by bank staff. One recalls one such visit resulted in the termination of the World Bank-funded Essequibo Road Project because of credible allegations of corrupt behaviour as well as mismanagement, as detailed in a special report prepared by the then Auditor General.

To be continued