Dear Editor,

Guyana’s profits taxes that are required under the 2016 Stabroek Contract should count as tax revenues. Here are the relevant points from the contract:

● Tax is required to be calculated for the contractor, Article 15.2.

● Tax is required to be paid by the Minister of Natural Resources on behalf of the contractor, Article 15.4.

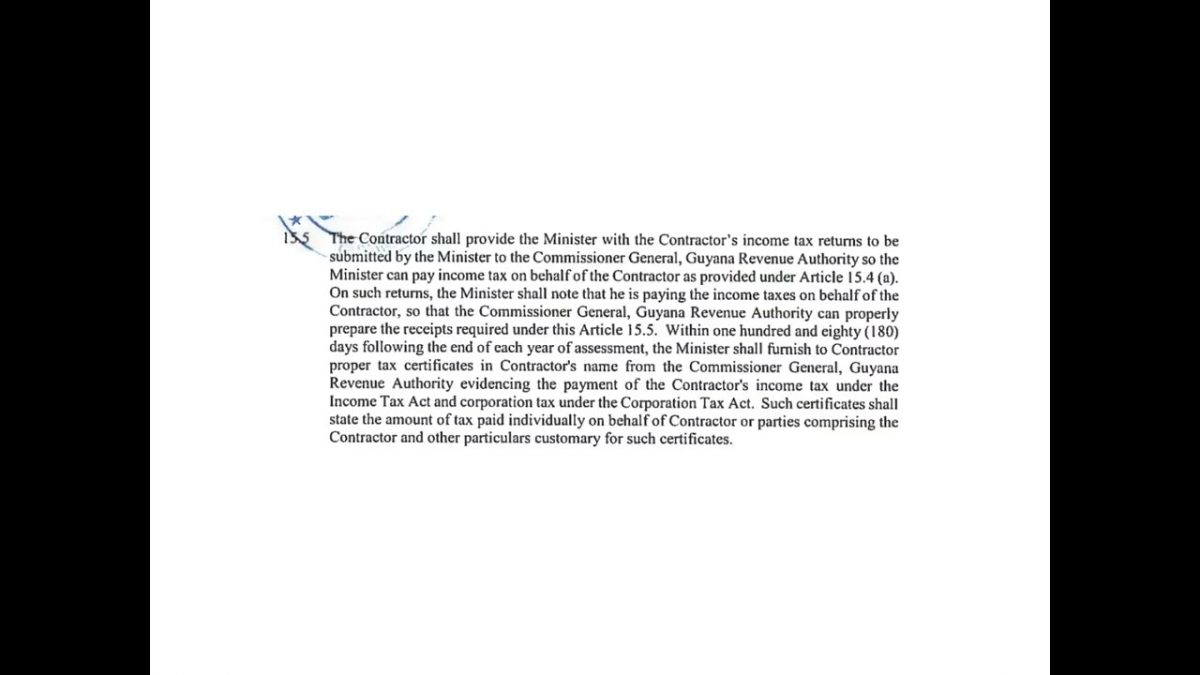

● A tax receipt is required under Article 15.5. (see: https://youtu.be/XLdzaa_K3co)

● Taxable income of the contractor share of profits is defined in Article 11.4.

The amount of receipts is quite substantial. For 2021, I estimate total production and sales by assuming 120,000 barrels for 365 days, at average Brent Crude oil price of US$70.68 a barrel, totalling US$3,095,784,000. With a 75 percent cost recovery, the net amount available for profit sharing is US$773,946,000. The marketing and distribution costs are unknown, while the 2% royalty is assumed to be included in the 75% cost recovery. The contractor’s approximate 50% pretax profit share is US$386,973,000. For a Guyana commercial corporation, the tax rate is 40 percent. This should yield approximately US$154,789,200 in profit taxes owed by the contractor and paid by Guyana’s Minister of Natural Resources, as these numbers illustrate, approximately. All profits taxes under Guyana’s tax laws should be reported as the country’s revenues and reflected as such in all public documents such as the auditable national budget; see https:// youtu.be/sOlNx6iCRkg.

The missing profits tax revenue in the national budget raises a serious question as to whether the Guyana corporation taxation revenues are fact or fiction. These annual petroleum oil profit tax revenues estimated at over US$154 million, with an average price of US$71 per barrel, representing a fifth of the National Resource Fund for 2021 should be available to the Government of Guyana to pay its citizens and not subtracted from Guyana’s profits to benefit foreign corporations and their shareholders. More importantly, is Guyana’s 50/50 profit share under the 2016 Stabroek Contract still valid if Guyana’s Minister of Natural Resources pays the profits tax owed out of Guyana’s share of profits? Guyana’s payments appear to negate the equal profit share inducement in the provisions of the 2016 Contract. It is a mere transfer of wealth from Guyana’s owners to the multinational corporations.

Sincerely,

Ganga Persad Ramdas