We face a world in peril. From the war in Ukraine in all its dimensions to the deepening impacts of the climate crisis; from the COVID-19 pandemic to escalating humanitarian needs, hunger and poverty, the months ahead will test the multilateral system.

UN Secretary-General António Gutteres

The two Gupta brothers, Rajesh and Atul, have been arrested in the United Arab Emirates (UAE) for political corruption in South Africa and are awaiting extradition. Their arrest was made following a warrant issued by INTERPOL relating to their alleged involvement in fraud and money laundering. The Guptas are accused of using their close connections with former South African President Jacob Zuma to win contracts, misappropriate state assets, influence cabinet appointments and siphon off state funds. When Zuma resigned in 2018, the brothers fled to the UAE.

The US Treasury Department has sanctioned the Guptas and their associates for being part of a significant corruption network, and for leveraging on their political connections in South Africa to engage in State capture, including corruption and bribery, undue influence in obtaining government contracts, and misappropriate state assets. Transparency International refers to State capture as ‘a situation where powerful individuals, institutions, companies or groups within or outside a country use corruption to shape a nation’s policies, legal environment and economy to benefit their own private interests’. A 2016 report by the South African Public Protector titled “Capture of the State” shows the results of the investigation into the allegations against the Guptas. (See http://www.saflii.org/images/329756472-State-of-Capture.pdf.) A judicial commission of inquiry later found that the brothers and their business associates siphoned off billions of dollars of public money.

There are two issues relating to the 2016 Petroleum Agreement between ExxonMobil’s subsidiaries and the Government of Guyana that were in the public domain recently. The first is whether the Agreement can be renegotiated, especially in the light of actions taken by the United States, Canada and the United Kingdom to increase royalties and/or taxes payable for the extraction of petroleum products. Contrary to certain assertions made, the Agreement does not prohibit renegotiation of any of its provisions, but all the parties involved must agree to do so. Article 31.2 of the Agreement states that ‘[t]his Agreement shall not be amended or modified in any respect except with the written agreement entered into by all the Parties which shall state the date upon which the amendment or modification shall become effective”. (Emphasis added.)

In its 2020 election manifesto, the present Administration had stated that it would renegotiate all oil and gas contracts, including the above Agreement. Was this not one of the influencing factors that might have caused the electorate to vote for a change in Administration? We had stated several times over that what Guyana gets from the Agreement is merely a pittance, especially the two percent royalty, and that the Agreement is weighted overwhelmingly in favour of the oil giant. Therefore, in the national interest and for the sake of future generations, the Government must make all efforts to renegotiate the Agreement. The refusal to do so does not send the right signal. After all, Guyana is a sovereign State and cannot find itself in a helpless situation where a foreign multinational corporation has taken advantage of our leaders’ failure to put the nation’s interest first and foremost above all other interests. After all, Exxon needs Guyana perhaps more than Guyana needs it. According to the US President Joe Biden, ‘Exxon made more money than God this year’. We have survived as a nation before Exxon, and there is no reason why we will not continue to do so when Exxon leaves our shores.

The second issue relates to the Government’s liability to Exxon. In a previous article, we had referred to a news item indicating that ExxonMobil had submitted an invoice to the Government in the sum of US$460 million for costs incurred prior to 2016. Annex C of the Agreement states that costs incurred by Exxon pursuant to the 1999 Agreement shall include: (a) an amount of US$460,237,918 to 31 December 2015; and (b) such other costs incurred between 1 January 2016 and the effective date of the Agreement. Various estimates have put the latter at around US$500 million.

At that time, it was not clear how this liability would be discharged, and given our precarious financial situation, we had considered that it would have been better for such costs are treated as recoverable costs. It turns out that these costs are indeed recoverable costs and not a liability of the Government to Exxon, and therefore have no implications for the national debt. No doubt, as in the case of exploration and development costs, the estimated US$960 million will be spread over the life of the Agreement. Indeed, had it not been for the Bridging Deed that was signed between Exxon and the Government around the same time the 2016 Agreement was entered into, the above costs would have been considered pre-contract costs and hence not recoverable. The Deed effectively joins 1999 and the 2016 Agreements. Regrettably, this document is yet to be made public.

Article 11 of the 2016 Agreement provides for all costs associated with the petroleum operations to be borne by Exxon. However, 75 percent of recoverable costs incurred in any one month is to be deducted from “cost oil” and/or “cost gas”. The balance of the value of production, known as “profit oil” and/or “profit gas”, is shared equally between Exxon and the Government. The remaining 25 percent of the recoverable costs is carried forward in the following as the opening balance for that month, and the process is repeated throughout the life of the Agreement. However, if in any month, recoverable costs exceed the value of “profit oil” and/or “profit gas”, the excess is recoverable in the next succeeding month. Because of the carrying forward arrangement, recoverable costs will keep building up, and in the long-run Exxon will be able to recover all of its recoverable costs and not just 75 percent, thereby reducing the value of “profit oil” and/or “profit gas” and hence Guyana’s share thereof.

To illustrate, take the hypothetical example where for each of the months of January, February and March, recoverable costs amount to $100. For January, 75% of such costs is $75, with $25 million carried forward to February. In February, 75% of the recoverable costs is 75% of ($25 + $100) = $93.75, an increase of $18.75; while the remaining 25% of ($25 + $100) = $31.25 is carried over to March. In March, 75% of the recoverable costs will be 75% of ($31.25 + $100) = $98.44; while the remaining 25% balance of $32.81 will form the opening balance for April. In short, assuming the same level of production and costs in the above three months, Exxon will be able to recover $267.19 out of $300, or 89.26% of recoverable costs.

Last week, we discussed the results of the first validation exercise carried out by the Extractive Industries Transparency Initiative (EITI) on the work of the Guyana EITI. Guyana received an overall score of 52 out of 100 which the EITI considered to be fairly low, with only six of the 26 indicators assessed on as having been fully implemented. Guyana has the next two years to remedy the deficiencies identified in the validation report, failing which it may be suspended temporarily from membership of the EITI.

In today’s article, we begin to discuss Guyana’s third EITI annual report that was published last month. It will be recalled that since Guyana acceded to the membership of the EITI in 2017, two annual reports were issued by the Independent Administrator, the results of which highlighted significant deficiencies in terms of disclosure requirements and non-compliance with the several of the requirements of the EITI Standard. As a result, the Independent Administrator was unable to determine that all significant contributions made by the extractive entities to the revenues of Guyana were included in the report.

Revenue reported

Total revenue received by the various government agencies from the extractive sector amounted to G$68.30 billion, compared with G$27.63 billion for 2018, a 147% increase. This increase was mainly due to reporting by the oil and gas sector which accounted for G$43.33 billion, representing a 474% increase over 2018. The Guyana Revenue Authority (GRA) accounted for 72%, followed by the Guyana Gold Board (GGB) – 15%, and the Ministry of Finance – 6%. The oil and gas and the mining sectors combined accounted for 97% of the total revenue.

Contributions to the economy

The report referred to the Statistical Bureau’s analysis of the contributions to the economy of the various sectors in 2019. The extractive sector’s contributions were as follows: 19.42% to the Gross Domestic Product (GDP); 24.94% to revenues; 72.66% to exports; and 17.40% to employment. The forestry, fisheries, mining, oil and gas sectors’ contributions were: 19.42% to GDP; and 24.94% to revenues. The value of exports from the extractive sectors amounted to G$236.89 billion, representing 72.66% of the total exports.

According to the Guyana Labour Force Survey, a total of 239,014 persons were employed in Guyana, of which 41,589 were in the forestry, fisheries, mining, oil and gas sectors, or 17.4% of total employment.

Production data

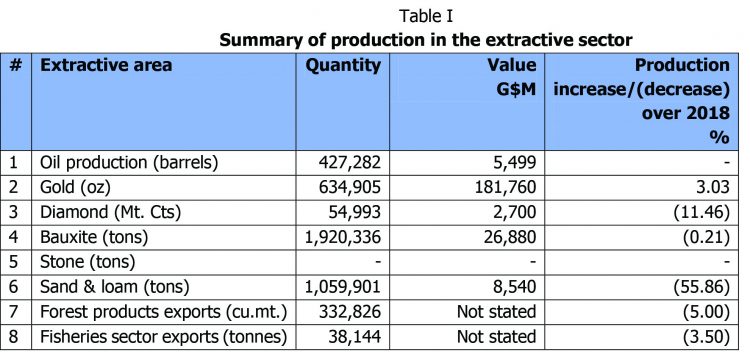

Production declined in all the sectors of the extractive industry, except for gold. As regards stone production, there was no disclosure. However, reference was made of the Bank of Guyana report indicating that stone production in 2019 was 592,077 tons, compared with 625,949 tons in 2018, a decrease of 33,872 tons or 5.41%. Table I provides a summary of production in the extractive sector:

Data submission

Six out of seven oil and gas companies included in the reconciliation exercise submitted reporting templates amounting to G$12.43 billion, representing for 99.99% of the reconciled revenues. However, due to legal confidentiality constraints, GRA did not submit reporting templates for one oil and gas company and the certain other mining companies. GRA also provided a statement of revenues collected from oil and gas, mining forestry and fisheries companies but without disclosing their names or their Taxpayer Identification Numbers.

The National Insurance Scheme (NIS) provided a statement of revenues collected from only 37 mining companies totalling G$782 million, accounting for less than 1% of the total extractive revenues. Similarly, the Pesticides and Toxic Chemicals Control Board submitted a statement of aggregated revenues collected from the oil and gas and mining totalling G$372 million but without disclosing the details by company, accounting for less than 1% of the total extractive revenues.

In view of the above, the report concluded that it was not possible to determine that all significant contributions made by extractive entity to the revenues of Guyana in the fiscal year 2019 were included in the report.

Data reliability

The Guyana Geology and Mines Commission submitted partially completed reporting templates signed by an authorised officer; while the Ministry of Finance submitted unsigned reporting templates for Troy Resources Guyana Inc. and Aurora Gold Mine. All reporting templates that were submitted by Government Agencies were not certified by the Auditor General.

Three oil and gas companies submitted unsigned reporting templates. These are EEPGL, Repsol Exploration Guyana S.A. and Mid Atlantic Oil and Gas Inc. The revenues reported by government agencies in respect of these companies amounted to G$12.34 billion, representing 99.26% of the total reconciled revenues. Repsol submitted reporting templates but without its audited financial statements; while none of these companies submitted reporting templates certified by an external auditor.

The report concluded that, given the significance of the above, it was not possible to determine that the financial data submitted by reporting entities and included in this report were subject to audits that have been performed in accordance with international standards.