(Part 97)

It is more than five months since the 96th column was published in the Stabroek News on January 22nd of this year. That column summarised the court action brought by citizen Glenn Lall seeking declarations against the tax provisions contained in the 2016 Petroleum Agreement. The respondent named in the action was the Attorney General. But Exxon, which is the largest investor and the Operator (Co-ordinator) in the Stabroek Block could not leave the matter to be settled between a Guyanese and his Government. It sought the Court’s permission to be joined in the action with the unpleasant consequence that the case is now Esso and the Government of Guyana vs. a citizen of Guyana.

In seeking to convince the Court of its right to be joined in the action, Esso declared that the Petroleum Agreement was “solemnly negotiated with the Guyana Government” and that certain fiscal arrangements made the various Projects “financially feasible and commercially viable.” Solemn for Esso includes bullying GGMC Head Newell Dennison on a trip to the Exxon Campus in Texas which has been repeatedly commented on in my writings on oil and gas, and the arm-twisting of then Natural Resources Trotman’s Ministry into the signing of the 2016 Agreement, so well documented in the Clyde & Company report on the circumstances surrounding the signing of the Agreement.

It is unfortunate that senior members of the current Administration seem unmindful of the experience of Dennison or the damning indictment of the APNU+AFC in the Clyde & Co. report, regardless of the fact that it involved a major heist of the country’s natural resources by Exxon and its partners.

The citizenry had long lamented the damage which Trotman and the Granger Administration had caused Guyana, through one of the most lopsided petroleum agreements of the modern age.

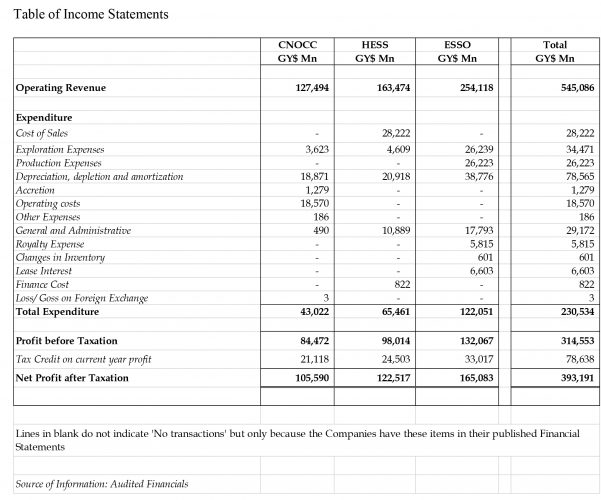

The extent of that damage has manifested itself in the audited results of the performance of the three members of the Consortium – Esso, Hess and CNOOC – in 2021. They not only show exactly what Esso means by “financially feasible and commercially viable” but also that there is neither shame nor limit to the greed of Esso and its partners. To put it in a nutshell, or rather a simplified Table, Esso and its partners made more money in 2021 from the Stabroek Block than all the money raised by the whole of the Government in 2021, including its takings from oil. Not by a few millions but by billions. The following two Tables put it more starkly than any column can.

Oil Companies income

A brief comment on the item Tax Credit in the Table above. Article 15.4 of the Petroleum Agreement requires that the tax liability computed under the Income Tax Act and the Corporation Tax Act be paid to the GRA on behalf of the oil company and that “such sum will be considered income of the oil company. The income statements of Hess and CNOOC state that they are subject to Corporation Tax without disclosing that the payment is to be made by the Government of Guyana and that the amount of the tax paid by the Government is considered income of the company! Esso’s financials are simply silent on taxation altogether.

Current year profits would attract tax credits of $78,638 Mn. so that the total earned by the oil companies would be $391,191 Mn, or the equivalent of $1,862 Mn US Dollars, reduced by any set-off of losses. There is however, another unknown element: the tax laws require branches of overseas companies to pay income tax withholding tax of 20% of the after-tax income, other than in the reinvestment in fixed assets or short-term securities. I think that that would more than compensate for any adjustments to the tax credit for prior years unrecovered costs or accumulated losses.

It would be interesting but unduly optimistic to learn from the Government the exact amount included in the Certificate of Taxes paid issued to the three oil companies under section 15.4 of the Petroleum Agreement.

Government Revenue

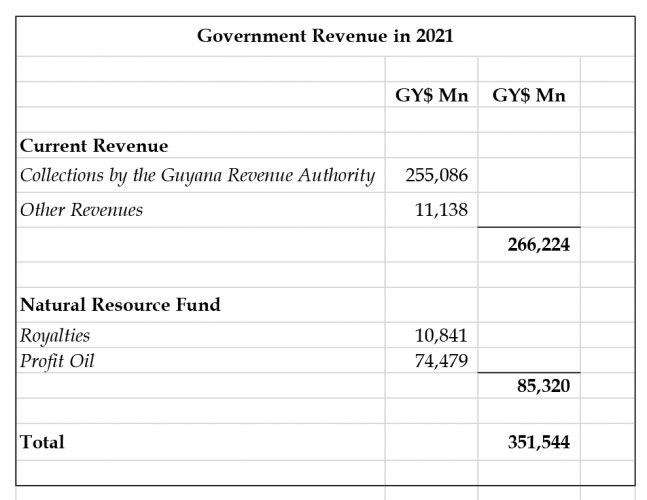

Now let us see what Guyana received in the same year from two sources – the National Budget and the Natural Resource Fund.

As noted in the Table above, the total Government revenue in 2021 was $351,544 Mn. of which 76% came from tax revenues and 24% from oil revenues. Some brief points of analysis.

Inclusive of tax credits, the oil companies netted in 2021 from their Guyana operations, a total of $393,191 Mn. while the Government earned a gross sum of $351,544 Mn.

Exclusive of tax credits, the three oil companies earned $314,553 Mn. from petroleum operations while the Government earned in Profit Share $74,479 Mn., a ratio of 4.22: 1.

The earnings of the three oil companies from petroleum operations were 3.7 times the earnings of the Government from those operations, inclusive of Royalties.

Part of the disparity in points 2 and 3 is attributable to the recovery of previous years’ expenses which have now been recovered in full. So much for all the talk about risks and the uncertainties associated with extended timelines. Those expenses were always magnified to justify the giveaway of the patrimony.

The 2016 Petroleum Agreement provides for a 50-50 split of net revenue, between the Government and the Oil Companies. The Consortium is entitled to 50% of Profit Oil and the Government to the remaining 50%. Yet, the Government’s share of Profit Oil is comparable to that of CNOOC which has a 25% interest in the Consortium!

It is unknown in recorded history where three companies of a single country accounted for more revenue than the entire Government of that country in any single year.

Conclusion

President Biden said that Exxon is making more money than God. I am not sure about God but what is true is that locally, Exxon and its two partners have made more money net, than their host country was able to earn gross.

Next week we will start reviewing the financials of each of the three companies. That will allow for a more detailed analysis of the income of each of those companies, including any unrecovered costs.