Dear Editor,

I refer to a letter published in the July 3, 2022 Sunday Stabroek, captioned, ‘Depending on the amount of wells explored Guyana’s 14.5% take will increase at some point in the future’, and I would like to make a few observations.

First, the writer states that, ’… Guyana’s take will increase beyond 14.5% of total revenue at some point in the future. Exactly when this will happen depends on the amount of wells explored before the contractor’s exploration license expires…’ In response, there are no legally binding clauses or any economic framework in the contract that supports this outcome, so this prediction is just ‘false hope’. Moreover, wishful speculation is further enhanced when the writer confirms that he does not know ‘…when this will happen…’ And again, more troubling is the notion that more wells explored will increase the 14.5 percent share for Guyana.

Editor, may I remind the writer that 14.5 percent of revenue is written in the contract and increasing the number of wells explored, which may result in an increase in production, will not change the contractual 14.5 percent. Instead, it will shorten the number of years required to exhaust the oil reserves in that hole. Consequently, if the government had agreed to a tax-exempt status for 20 years and all the oil is extracted in ten years, there will be no taxes for Guyana. We had this experience before with other non-renewable resources and we should not repeat it again.

Second, the writer takes issue with the manner in which it is stated that EEPGL’s ‘… share of Total Revenue is 5.896 times that of Guyana’s share… (lamenting that) … the writer did not take into account ‘…the cost of production…’ (and concluding that)…‘this is a complete non sequitur and does nothing to enlighten the reader on this very important matter. ’

In response, it is unfortunate that Table (a) was not printed in the letter (space limitations, perhaps), but a clarification will now be provided based on the data in the unpublished Table (a). Total Revenue (TR) is equal to price (P) times quantity of oil (Q): TR = PQ. In 2020, Total Revenue (TR) is equal to G$M176, 088. Guyana’s Net Take (GNT) is G$M25, 532 consisting of 2 percent of TR which is royalty and is equal to G$M3, 532; plus, 50 percent of total Profit Oil. Total profit Oil is G$M44, 022, and therefore 50% would be G$M22, 011. Therefore, Guyana’s Net Take of Total Revenue = Royalty + Profit Oil = G$M25, 532. Now since Guyana’s total share of Total Revenue is G$M25, 532, it therefore follows that EEPGL’s total share is: G$M176, 088 – G$M25, 532 = G$M150, 556. Using this information, it is clear that Guyana’s share of Total Revenue is 14.4995 percent and EEPGL’s Share of Total Revenue is 88.5 percent. By dividing EEPGL’s Share (88.5%) by Guyana’s Share (14.4995%), this yields 5.8966 which can be transformed into an equation: EEPGL Barrels of Oil = 5.8966 (Guyana Barrels of Oil). This sharing model between EEPGL and Guyana implies that every time Guyana receives one barrel of oil, EEPGL receives 5.8966 barrels of oil. Since Guyana is the sole owner of the resource, this is the identified inequity; and it is based on the parameters in the contract: 14.5 percent for Guyana and the rest to EEPGL. Given this contracted outcome, the writer excuses himself from the main problem by stating, ‘To be clear, I am not commenting on whether or not Guyana receives a fair share of the oil produced.’ In response, it is pellucid that our perspectives differ, for receiving a fair share of our oil is the main concern for myself and most Guyanese.

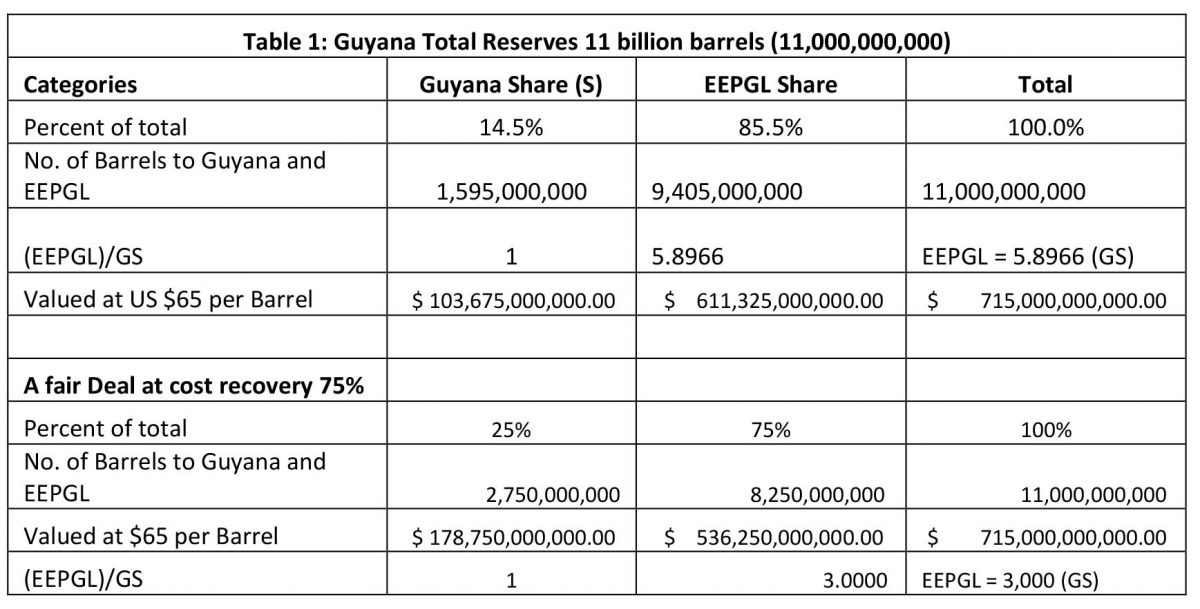

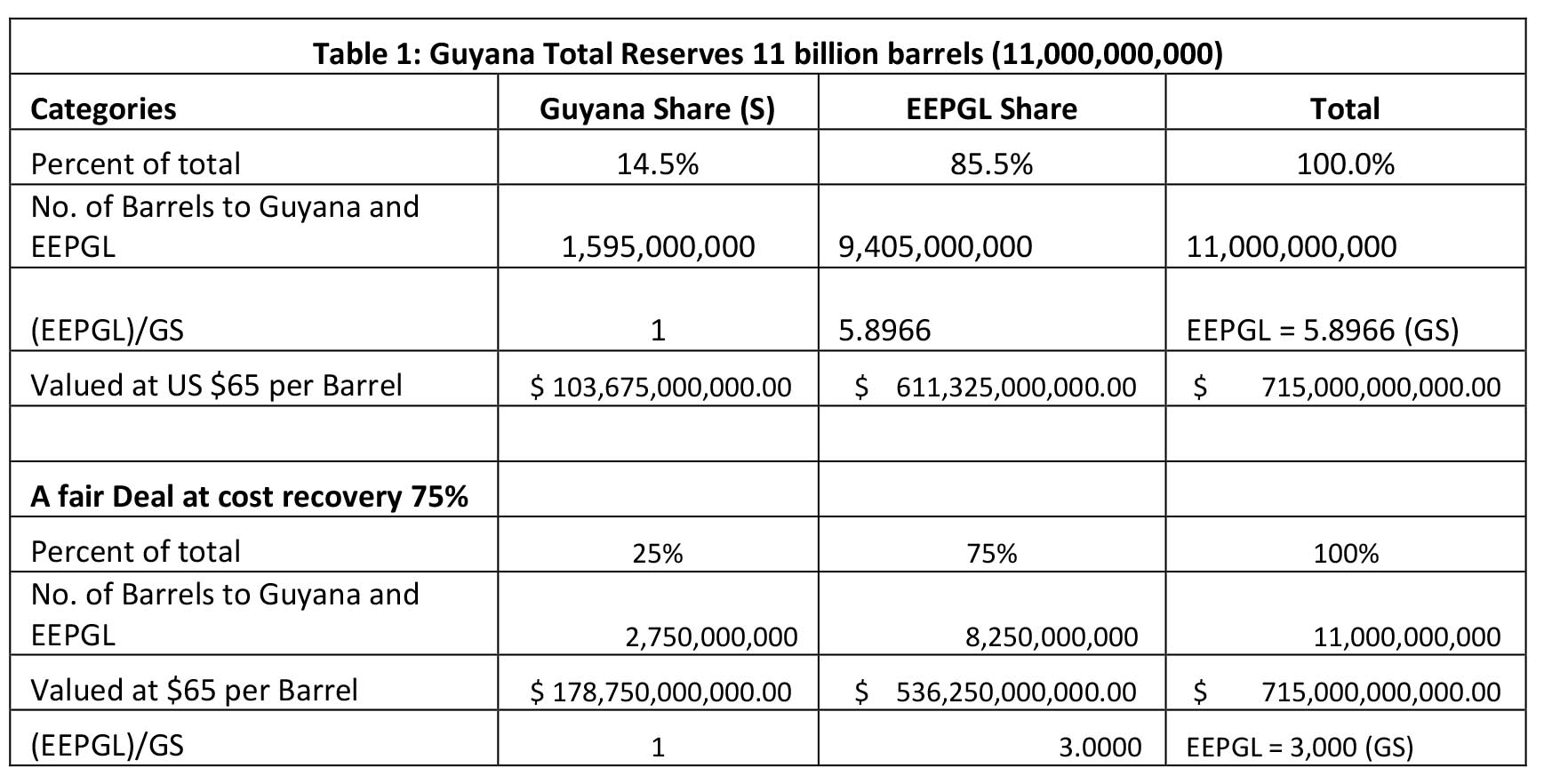

Published data confirm that Guyana has eleven billion barrels (Table 1 below) of oil and from this I have produced two scenarios; the first is the current production sharing model in which Guyana’s Share (GS) is 14.5 percent of total revenue and EEPGL‘s share is 85.5 percent of total revenue. The second scenario is maintaining the cost recovery at 75% of total revenue for EEPGL and Guyana’s share at 25% of total revenue, which is three barrels of oil for EEPGL and one barrel of oil for Guyana, whenever four barrels oil are produced. At a price of US$65.0 per barrel the total value of the oil is revealed (Table 1).

In conclusion, my primary objective for this industry is for Guyana to receive a fair share of the oil produced; and the business model employed must be consistent with protecting the environment. Additionally, and as previously stated in my last letter, building and maintaining a transparent system that monitors exploration, investment, employment, daily production, marketing and hiring the best and brightest, regardless of their political affiliations, is the best model for Guyana. This is the hill we must climb.

Not surprisingly, the traditional financial auditing will not address these matters for this approach is limited; instead, this work in the oil industry must be done in real time. Saudi Arabia, one of the main oil producers, monitors production on a daily basis; and this should be our goal, if we want to build a nest-egg for our future generations. Finally, in the words of Bill Pilgrim: Can we do it? Yes, we can!

Sincerely,

C. Kenrick Hunte, Ph.D.

Professor and former Ambassador