Dear Editor,

Guyanese are faced with several factors impeding the normal life of our relatively poor economy. Though we have found large sums of oil wealth and are expected to become the crown jewel in the Caribbean it is hard to overlook the volatile nature of our economy. Our governments continue to sit idly by and do the bare minimum to satisfy the needs of our poor whose lives become harder every day. The higher echelons of society are profiting from these gaps that will get larger as the country utilizes trickle-down economics that continues to fail us.

A major issue is the current prices of fuel in our country. Post Covid oil prices were slowly increasing after the major decrease in prices during the pandemic. However, the outbreak of the Ukraine conflict sent the oil prices on a catastrophic rise. Smaller economies were under pressure as the importance of a resource we are trying to move away from was laid bare. Commodities that rely on the transportation industry saw prices increase. Guyana, where most of the agriculture sector is dependent on the movement of goods, saw major price increases in almost every commodity imaginable while service prices remained constant. This created a difficult situation as the poor struggled to make ends meet. February looked extremely bleak for many countries as economies who were now beginning to see the light at the end of Covid were met with a major challenge.

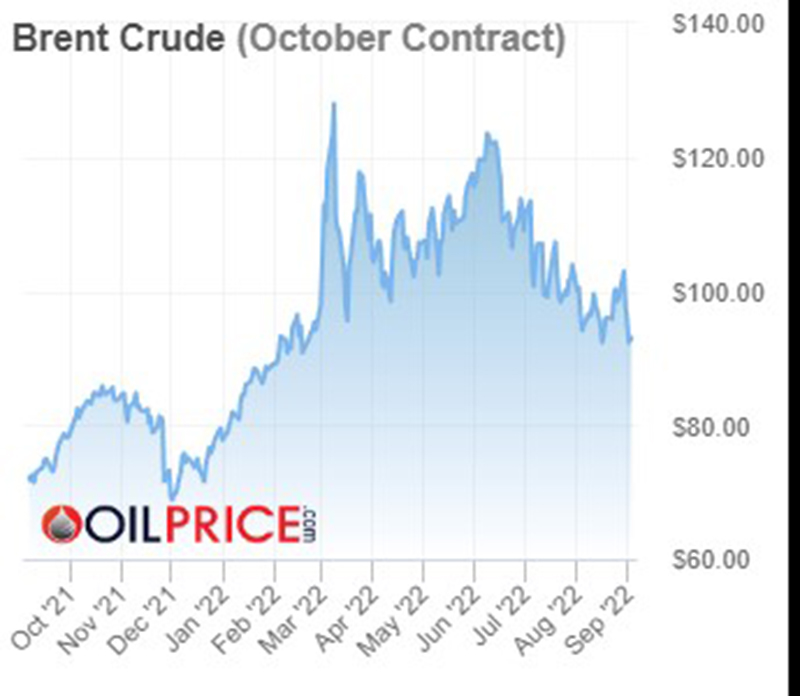

Our government did try to cushion these prices initially by removing taxes on fuel. Six months later there has been an intriguing situation brewing that I cannot quite understand. During the month of June oil prices began to fall as Russian oil was being sold even though they were sanctioned causing a reduction in prices even felt by the USA which had banned the import of Russian oil. Brent crude which is the most popular sold crude used to make byproducts such as gasoline is currently being sold today at USD 93.02 an almost 30 percent reduction in price from the USD 130 in March when the oil prices had peaked. In fact, international oil prices are even lower today than they were before the conflict in Ukraine started. Yet we, the poor Guyanese consumers, have not seen any decrease in our oil prices.

It is deeply saddening that this is the current state of affairs here, especially while we were so quick to react to the increases observed on the international market, with companies like Shell having major supplies when prices decreased, but like magic having none when prices increase, clearly exploiting the populace. Guyoil is supposed to be a state-run service station whose sole purpose is intended for the benefit of the people in the country but what is apparent is that the company is clearly indulging in exploitation. With no taxes currently on the price of fuel, I am very curious as to where the big windfall of money is going as the country continues to grapple with some of the highest prices of fuel in decades.

Sincerely,

Michael Philander