While the Guyana Revenue Authority (GRA) collected $255 billion in taxes for the fiscal year ending December 2021, some $266.7 billion in tax exemptions were also granted with that amount slated to increase as the government further develops the oil and gas industry.

The information was contained in the Auditor General’s report examining the public accounts of Guyana for the year 2021. The report was laid in the National Assembly yesterday.

Auditor General Deodat Sharma said that the government estimated 2021’s revenue collection to be $242 billion but that number was surpassed with $255.086 billion collected and paid over to the Consolidated Fund. This represents a positive variance of 5%, equivalent to $12.995 billion.

However, the report highlighted that despite the positive performance, there were substantial shortfalls for the revenue categories of Income Tax on Self-employed, Other Personal Tax, Corporation Tax on Public Sector Companies, Environmental Levy, Liquor Licence, Miscellaneous Penalties, Travel Voucher & Travel Tax, VAT on Import Goods and Domestic Supply and Excise Tax on Petroleum Products and Tobacco totalling $10.349 billion.

According to the GRA, for the period August to December 2021, a revised revenue target was used. This revision was done subsequent to the mid-year reporting having considered the performances of each tax type during the first half of 2021. The approved target was set at $242.09 billion, this was revised upwards to $254.96 billion, an increase of $12.87 billion or 5.3% (VAT and Excise Tax was increased by $9.43 billion or 10.1% to $103.13 billion).

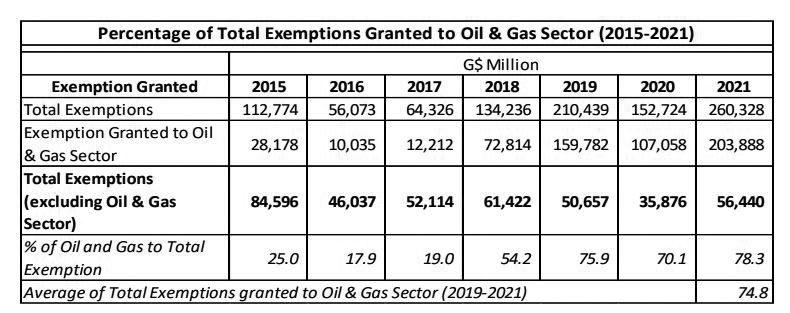

For 2021, the Auditor General reported that tax exemptions amounted to $266.774 billion when compared to $134 billion in 2020 representing an increase of 94.7%. The report pointed out that revenue “forgone” for the year 2021 represented 97.09% of the total revenue collected by the GRA whereas it was only 62.75% in 2020.

Tax exemptions granted to companies and businesses represented 95.1% or $235.486 billion of the total conditional exemptions granted with it amounting to 97.5% or $116.252 billion more than the previous year. This increase resulted from the upsurge in the conditional Investment Agreements facilitated through the Guyana Office for Investment (G-Invest) and the Guyana Geology and Mines Commission (GGMC), as well as exemptions granted to the oil and gas sector, the report said.

In response to the AG’s findings, GRA Commissioner General Godfrey Statia reiterated that the authority’s role with the exemptions regime is merely administrative.

“…the Commissioner General is on record as stating his preference for the removal of the concession regime and to replace such with the system of tax credits, as practised in the developed nations, thereby allowing for improved compliance with the tax laws and the conditions of Investment Agreements (IA). More importantly, as the tables below show, total exemptions have over the year experienced marginal increases, and in some years comparatively decreased when exemptions/concessions which were granted to the oil and gas sector are excluded,” the report highlighted.

The Authority also said that exemptions to the oil and gas sector have a legal underpinning as a result of the provisions of the Pro-duction Sharing Agree-ment (PSA) between the Companies and the Government of Guyana. GRA said that it expects exemptions to increase “exponentially” as oil and gas production is ramped up.

“It should be noted that time is no correlation between the revenue loss as a result of the exemptions regime and the revenue the GRA collects from Tax Administration. It is general knowledge that investment schemes, concession regimes, tax breaks/holidays and other macros to incentivize investments are designed, with intended benefits, at the level of governance and policymakers, to encourage investment and create investment conditions with an expected return of many factors and not just taxes. There is therefore no parallel and matching proportionality between creating lucrative and attractive investment conditions and collections of taxes,” GRA explained in the report.

The Auditor General’s report informed that $209.5 billion in tax exemptions were granted to 256 companies through investment agreements. Additionally, tax exemptions under the Additional National Code (ANC) I12, were $195.516 billion or approximately 79% of the total conditional tax exemptions granted during 2021. The ANC was created for the oil and gas sector and the Authority would have administered these tax exemptions in line with the Production Sharing Agreement (PSA) of the Stabroek block.

In December 2021 tax exemptions totalling $54.504 billion were administered under the Investment Agreements. Included in this amount is the sum of $48.469 billion for exemption of tax for the importation of Liza-Unity FPSO. In addition, 7,312 of the 18,247 transactions that were administered for exemption from tax under companies/businesses during the year 2021 were in relation to the same company.

An examination of the tax exempted and the taxes paid under ‘Conditional Tax Exemption’ for the year under review revealed that the tax exempted was in the sum of $247.632 billion, whereas the taxes paid amounted to $22.401 billion. This represents only 9.05% of the tax exempted. Similar observations were made in 2020 and 2019, where taxes paid represented only 2.91% and 4% of taxes exempted, respectively, the report said.