Article 223 of the Constitution requires the Auditor General to annually audit the public accounts of Guyana and to submit his report to the Speaker of the National Assembly for presentation to the Assembly. By Section 25 of the Audit Act, the report is to be submitted within nine months of the close of the fiscal year. The Constitution defines the public accounts to include: (i) all central and local government bodies and entities; (ii) all bodies and entities in which the State has a controlling interest; and (iii) all projects funded by way of loans or grants by any foreign State or organisation.

Last Monday, the Speaker presented the 2021 Auditor General’s report to the Assembly. Since then the print media have been highlighting various aspects of the report. As has been the practice in the past, we begin in this article our review of the contents of the report by first examining the Auditor General’s overall certification of the public accounts in terms of their proper presentation and compliance with applicable laws, regulations and circular instructions, which is the culmination of his work.

The auditor’s opinion on the financial statements of an organization is the single most important aspect of his/her work. Extreme care must therefore be exercised in the crafting of the opinion to ensure that it is properly supported by the necessary audit evidence. The first thing stakeholders look at when examining the audited accounts of an organization and the related auditor’s report, is the auditor’s overall opinion on the financial statements. If that opinion is a qualified one, it raises serious questions about the overall management of the organization and may eventually result in some form of restructuring. If an investor or other stakeholder, relying on the auditor’s opinion and as a consequence suffers a loss, the auditor may be liable for professional negligence. One recalls the Enron and WorldCom accounting scandals that resulted in the United States Government passing the Sarbanes-Oxley Act of 2002 and the downfall of the then accounting giant, Arthur Andersen.

Consolidated financial statements constituting the public accounts

There are several statements that constitute the public accounts, as provided for under Sections 68-71 and 73 of the Fiscal Management and Accountability (FMA) Act. These are:

(a) Statement of Revenues and Expenditures in the

form of an End of Year Budget Outcome and

Reconciliation Report;

(b) Statement of the Public Debt;

(c) Schedule of the issuance and extinguishment of

all loans granted by the Government, other

levels of government and public enterprises;

(d) Schedule of government guarantees;

(e) Statement of contingent liabilities;

(f) Such other financial information relating to the

fiscal year that the Minister deems necessary to

present fairly the financial transactions and

financial position of the State:

(g) In respect of Extra-budgetary Funds, the

financial reports required by the enabling

legislation establishing those Funds;

(h) In respect of Deposit Funds, the financial

reports required by the Minister; and

(i) In respect of any other accounts approved by

the Minister, the financial reports required by the Minister.

As in the past, the Ministry of Finance submitted 12 statements to the Auditor General for audit examination and certification.

Auditor General’s certification

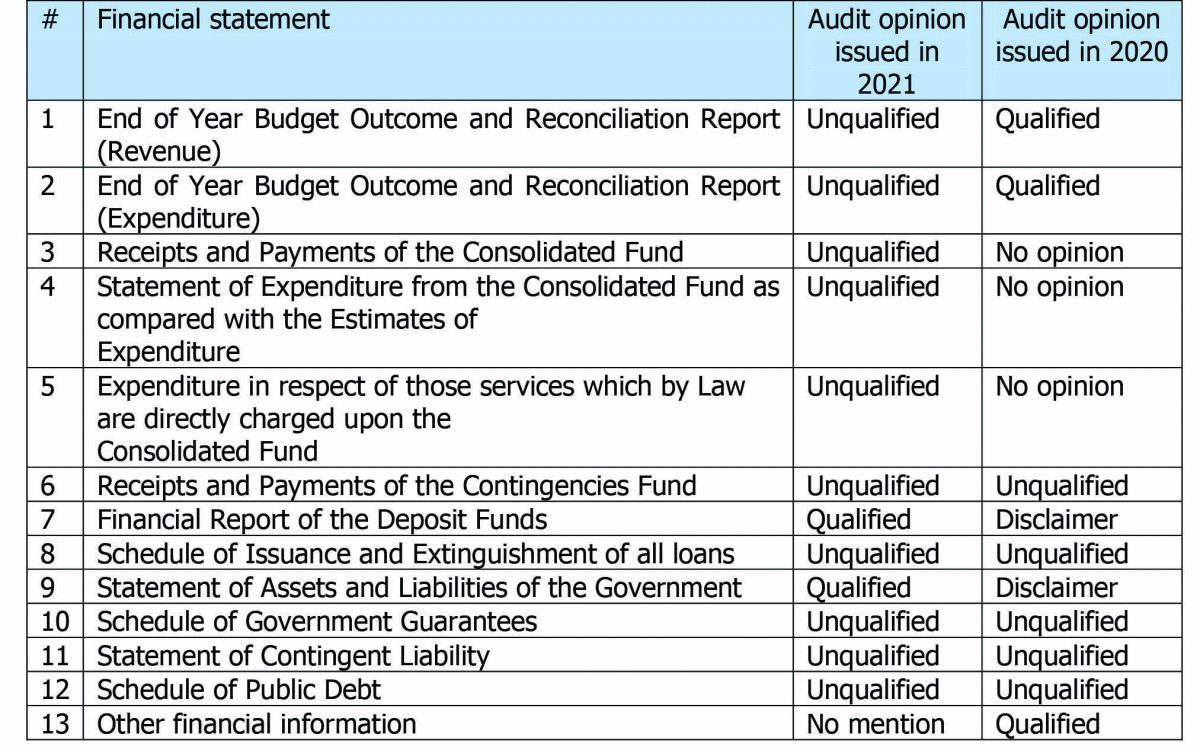

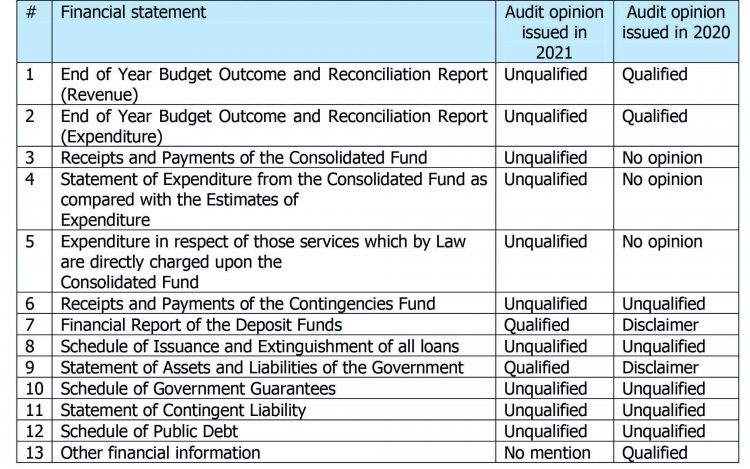

The following table provides a summary of the results of the Auditor General’s certification of the financial statements constituting the public accounts for 2021, compared with 2020:

In 2020, the Auditor General had issued unqualified opinions on five statements, qualified opinions on three, and a disclaimer of opinion for one. (A disclaimer of opinion is one in which the external auditor is unable to express an opinion on the financial statements because of reservations of a fundamental nature that affect their fair presentation.) He had also not issued opinions on three important statements in his overall certification of the public accounts, namely, Receipts and Payments of the Consolidated Fund; Statement of Expenditure from the Consolidated Fund as compared with the Estimates of Expenditure; and Expenditure in respect of those services which by Law are directly charged upon the Consolidated Fund. It is also important to note that the Auditor General’s findings were substantially the same for both 2020 and 2021 as well as earlier years.

For 2021, the Auditor General unqualified his opinion on the End of Year Budget Outcome and Reconciliation Report. This suggests that the matters giving rise to the qualified opinion issued in 2020 have been resolved. However, in the first place, there were no material findings in the latter report to justify the rendering of a qualified opinion. He also issued a qualified opinion on ‘the financial information necessary to present fairly the financial transactions and financial position of the State’, without identifying what statement(s) he was referring to.

As regards the Statement of Assets and Liabilities of the Government at the end of 2020, the Auditor General issued a disclaimer opinion. He has now issued a qualified opinion again despite the fact that the findings were materially no different from those contained in his 2020 report. In fact, paragraphs 52-63 of his report on this statement contain no adverse findings and were more information based.

In relation to the Financial Report on the Deposit Funds, the Auditor General issued a qualified opinion for 2021, compared with a disclaimer of opinion in 2020, again although the findings were almost identical to those contained in his 2020 report. That apart, he has incorrectly referred to a 14-year gap in financial reporting of the public accounts covering the period 1982 to 1995 when in fact the gap was ten years from 1982 to 1991. Additionally, the Auditor General raised some concerns regarding the amounts shown in the financial statement but the Ministry of Finance insisted on their accuracy. Despite this, he has recommended again that the Ministry ‘take urgent action to bring closure to these issues’.

“Properly presents” versus “presents fairly”

In rendering his opinion on the consolidated financial statements, the Auditor General has used the terms “fairly presents” and “properly presents” interchangeably. Notwithstanding reference to fair presentation in Section 73(2) of the FMA Act, since the financial statements have been prepared using the cash basis system of accounting, the Auditor General should have used the latter term. In fact, Section 24(2) makes reference to the use of term “properly presents”. Suffice it to state that the use of the term “presents fairly” is associated with financial statements that are prepared using the accrual basis of accounting, since several of the items reflected in the financial are estimates based on professional judgment, for example, provision for bad and doubtful debts, and certain valuations of assets and liabilities.

“For the year ended…” versus “as at the year ended…”

There is a fundamental difference between the use of the above two terms, the latter representing the cumulative position as at the end of a particular year; while the former covers transaction for that year. The schedules of the Public Debt, Assets and Liabilities of the Government, Issuance and Extinguishment of All Loans, Government Guarantees, and Contingent Liability all relate to the position at a particular point in time and not for a period. As such, the use of “as at the year ended …” is applicable. On the other hand, for Receipts and Payments of the Consolidated Fund, and Expenditure of the Consolidated Fund Compared with the Estimates of Expenditure, the use of “for the year ended …” is applicable. Despite this, the Auditor General’s certificate on the public accounts for 2021 and earlier years does not take into account this fundamental difference.

Certification of the appropriation and revenue accounts of budget agencies

Apart from the consolidated financial statements comprising the public accounts, there were 323 appropriation and revenue accounts of budget agencies that the Auditor General has audited. He has, however, not issued opinions on these accounts.

Other matters

It is normal auditing practice for the draft audit opinion on the financial statements to be discussed with the auditee, in this case the Minister of Finance who is a chartered accountant and who certifies the financial statements. Were the opinions on the public accounts statements not discussed with him? That apart, while the Auditor General is not a professionally qualified accountant, his undergraduate degree in accounting from the University of Guyana as well as on-the-job training at the Audit Office would have exposed him to the various types of audit opinion that are issued on financial statements. Besides, the Auditor General has in his employ a number of qualified accountants in the employ. Were they not consulted when the audit opinions are crafted?

Since our column began some eleven years ago, we have been pointing out the mismatch between the Auditor General’s opinions on the public accounts statements and the actual findings contained in his reports. Except for perhaps Mr. Chistopher Ram, none of our chartered accountants over the years have commented on this issue, understandably not wanting to get involved, especially in a society such as ours that is highly polarized where the slightest criticism can result in discrimination in one form or another. Additionally, our assessment of the contents of the Auditor General’s reports over the years is that they are substantially a copy and paste of previous reports going back to 2003 and earlier years, with appropriate amendments to reflect current year matters. The structure and the language use are substantially the same, with little or no evidence of any fresh initiatives. Were the templates for those previous reports cast in stone, considering developments since then in relation to State audit as well as information technology?

Finally, one recalls that the Auditor General was acting in the position when he was about to attain the age of 55 which is the retirement age for him in his substantive position. The Auditor General boasted that he could serve in this acting capacity until age 65. We had cause to point out that unless he is appointed substantively to the position, he would have to demit office. Within a day or two, the Auditor General was substantively appointed to the position and sworn in by former President Donald Ramotar. As the Auditor General is about to reach retirement age, it is our hope there will be no repeat of what happened some eight years ago and that the best from among the auditing fraternity is appointed as the next Auditor General. After all, the emoluments and conditions of service of the Auditor General are similar to those of the Chief Justice.