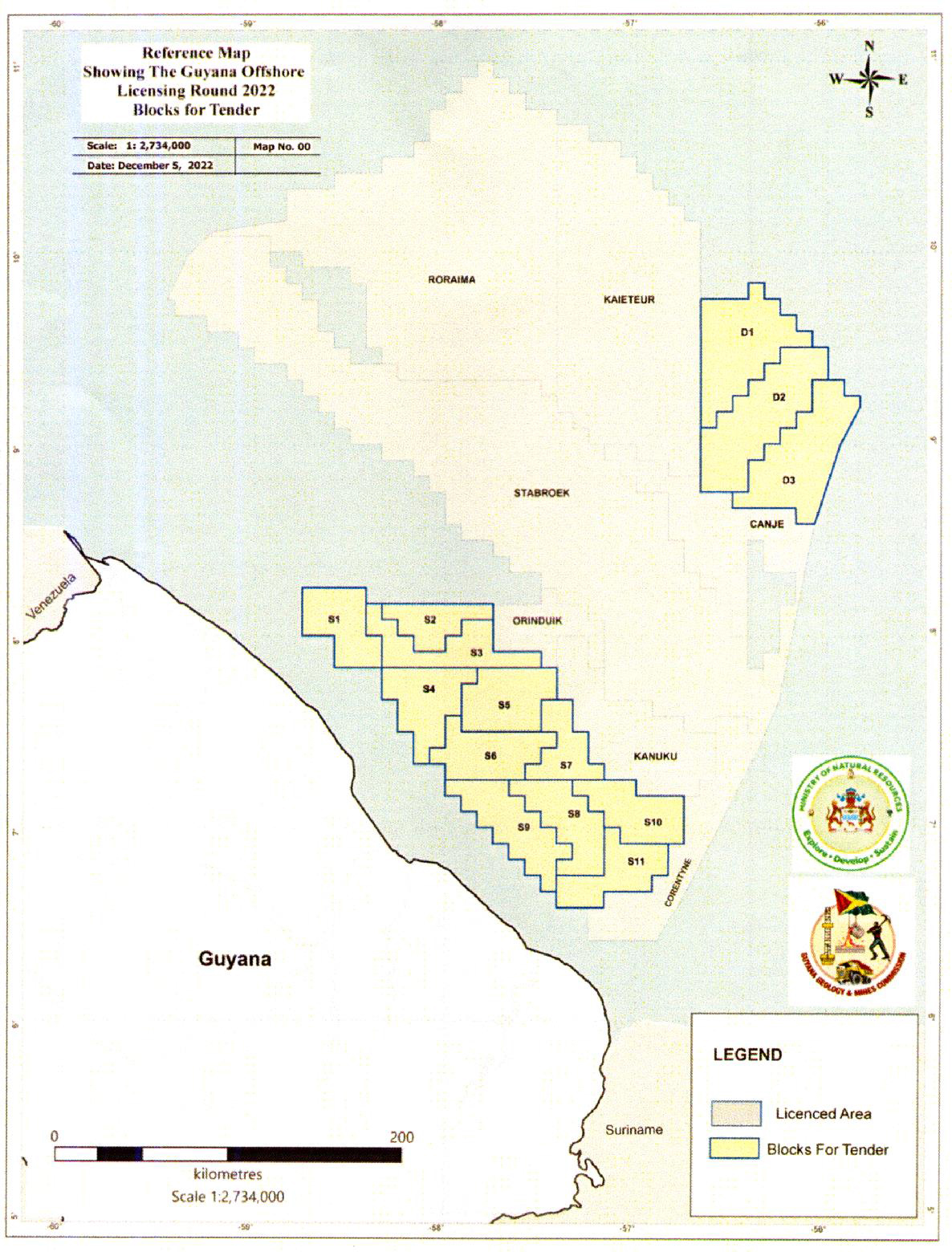

With President Irfaan Ali stressing the need to expeditiously move to develop the country’s oil and gas resources, the government on Friday launched the licensing round for 14 offshore oil blocks.

“We have a situation where there is a timeframe on oil and gas development. We understand the direction in which the world is going, so it is very important for us to have developers who are serious, who will expeditiously move towards developments of the oil and gas resources,” Ali said in an announcement broadcast on his Facebook page yesterday morning.

He added that April 14, 2023 has been set as the deadline for the close of submission for bids and contracts are expected to be awarded by the end of May, 2023, following evaluation of bids and negotiations.

The bidding process was officially launched with the publication of the Notice under the Petrol-eum (Exploration and Pro-duction) Act, in the Offi-cial Gazette by the Minis-ter of Natural Resources Vickram Bharrat.

According to Ali, bidders would have to pay a US$20,000 participation fee in order to gain access to the virtual data room and participate in the competitive bidding process.

He also noted the minimum signature bonus requirement of US$10 million for shallow water blocks and US$20 million for deepwater blocks under new fiscal terms and conditions that were announc-ed last month.

One of the key features of this competitive round, Ali said, is to ensure the “best possible outcome” under new terms and conditions. “What we are seeking to do is to have the best possible outcome for Guyana…This bidding round is being launched taking into consideration the lessons learnt, the experiences and the new terms and condition,” he said, in reference to the country’s lopsided agreement with ExxonMobil and its partners for its holdings in the offshore Stabroek Block area.

Ali reminded that there are improved fiscal terms that provide a greater balance of the share of revenue between the government and contractor, while maintaining Guyana’s competitive edge in the region and globally.

“…We understand that the cost for capital for oil and gas exploration and development is going up also and we also understand the access to capital has become quite more cumbersome,” Ali said. “So we have to ensure that there is a balance in what we do,” he said.

Ali explained that the process will be transparent and there will be different requirement and qualifications for shallow and deep-water operations reflective of international best practices given the different type of expertise and capabilities that are required.

“So, the criteria used in this bidding process take that into consideration to ensure that there is great transparency, that those who are participating in the bid meet the minimum requirement but at the same time there is enough room for greater participation in the bidding,” he said.

“…As is said, the deeper areas are more complex, the deeper area require stronger capabilities and as a result of that there are stronger qualification requirements and the bar is set quite higher in relation to the deep-water exploration,” he added.

He further explained that the minimum work commitment specified for the initial and renewed periods of prospecting licence consists of a combination of seismic surveillance and drilling of exploration wells with the fulfilment of prior commitments as a precondition to enter into the subsequent renewal period. “So this is really attached to the relinquishment clause in which there is specific commitments that must be met in a phased manner, specific commitments that must be met in a specific time-bound, deliverables, so that we don’t have blocks held up for a very long time with minimum investment,” Ali explained.

Government is in the process of developing a new model production sharing agreement which will set out the terms and guidelines for the licensing round and introduce comprehensive provisions reflective of the developments in the oil and gas industry in keeping with international best practices.

Meanwhile, the Ministry of Natural Resources said that the indicative terms and guidelines and the new model contract will be opened for consultation and are expected to be finalised and published on March 8, 2023 through a Notice in the Official Gazette by the Minister of Natural Resources. (The ministry’s statement advised prospective participants of the licensing round to visit https://petroleum.gov.gy/guyana-offshore-licensing-round-202223 and contact the Ministry of Natural Resources at licensinground2022@petroleum.gov.gy.)

Last month, Vice President Bharrat Jagdeo disclosed that the new model oil and gas Production Sharing Agreement (PSA) will see big changes such as the upping of royalty from 2% to 10%, corporation tax of 10% and a limiting of the amount of blocks for companies.

“The new fiscal regime …will now govern not only the award and the contracts that we will sign with the bidders who are successful, but [it] will govern all of the subsequent PSAs that we will sign for any other exploration that will take place in the other areas. The 50/50 profit sharing will be retained. That is the fifty percent [each], yes. The royalty rate will go to 10%. There shall be a corporate tax of 10%. The maximum for any given year going to cost oil will be 65%. These are the key fiscal conditions,” he had announced.

The 2016 PSA with ExxonMobil and its co-venturers, based on a model from the PPP/C’s Ramotar administration, has been trenchantly condemned for six years over the paltry 2% royalty, the 75% cost recovery ceiling and an arrangement that sees the government paying corporation tax for ExxonMobil and its partners.

There are no restrictions on tendering by current block holders.