Globally, corruption is a corrosive influence that undermines public faith in institutions resulting in diminished citizen security, stunted economic growth, and a drain on public and private resources. As such, we underscore the importance of ensuring improved accountability, increased transparency, and the dismantling of corruption in all its forms to build a more inclusive future for all.

… However, combatting corruption requires more than a robust legislative framework. In each case where the legal framework allows for best practices, those practices must be implemented for all to see and experience. As corruption disproportionately impacts the most vulnerable in society, governments have a duty to hold to account those who engage in fraud, bribery, and collusion with criminal elements. Governments alone cannot solve this social disease, however – civil society and the private sector must also do their part to work collectively with governments to eradicate corruption at all levels.

Ambassadors from the ABCE countries on International Anti-Corruption Day

Last Tuesday, Argentina’s Vice President Cristina Fernandez was convicted and sentenced to six years’ imprisonment in a $1 billion fraud case. She has also been given a life-long ban from holding public office. According to the prosecutors, the Vice President accepted bribes from construction companies in exchange for the grant of public works contracts during her two terms as president from 2007-2015. One of the companies involved was owned by a friend and business associate of Fernandez and her late husband who served as president of Argentina during the period 2003 to 2007. It is also alleged that she was at the helm of a broad corruption network involving business people and government officials set up by her late husband; and on at least 87 occasions sacks full of cash were delivered to her private residence. The sentence marked the first time an Argentinian vice-president has been convicted of a crime while in office. See https://www.theguardian. com/world/2022/dec/06/cristina-fernandez-de-kirchner-argentina-sentenced-prison-fraud-case).

In Peru, President Pedro Castillo was ousted from office after he attempted to dissolve Congress to stave off impeachment proceedings against him. It is alleged that he has been leading a criminal organization that profits from the award of state contracts and for obstructing investigations. See https://www.reuters. com/world/americas/perus-president-says-will-dissolve-congress-calls-elections-2022-12-07/. Last Wednesday, in the “La Linea” case, a Guatemalan court sentenced former President Otto Perez and his vice president to 16 years’ imprisonment on corruption charges. According to investigators, they led a customs fraud network that siphoned off some $3.5 million in state funds during their tenure. They were specifically accused of receiving bribes from importers to avoid payment of customs duties. Perez served as president from 2012 to 2015. See https://www.reuters.com/world/americas/guatemala-court-convicts-ex-president-perez-ex-vp-graft-case-2022-12-07/.

And in Mozambique, the son of former president Armando Guebuza, was sentenced to 12 years’ imprisonment for his role in the “tuna bond” scandal that saw the disappearance of hundreds of millions of dollars in government-backed loans for a fishing project. The scandal, which involved some $2 billion, caused the country’s economy to crash. Guebuza served as president for ten years until 2015. See https://www.reuters.com/world/africa/mozambique-court-finds-former-presidents-son-others-guilty-over-2-bln-scandal-2022-12-07/).

In today’s article, we suspend our discussion of the 2021 Auditor General’s report on the public accounts to make way for coverage of the two supplementary estimates totalling $47.3 billion that the National Assembly approved last Monday via Financial Papers 2 and 3.

Revised budgetary estimates and fiscal deficit

This is the second time within the last five months that supplementary estimates were approved, the first being for the sum of $44.8 billion via Financial Paper 1 that the Assembly approved last August. Taking these into account, the revised estimates for 2022 is now $645.0 billion. Compared with the revised estimates of $404.9 billion for 2021, this represents 59.3 percent increase in budgetary allocations. As a result, the budgetary fiscal deficit for 2022 has increased from $86.046 billion to $178.046 billion.

The fiscal deficit is being financed partially from withdrawals from the Natural Resource Fund (NRF). At the beginning of the year, the Fund had a balance of G$126.694 billion. By Section 17(2) of the NRF Act, the maximum amount that can be withdrawn in 2022 is the full balance on the Fund at the beginning of the year. At the end of September, two amounts totalling $86.4 billion were withdrawn from the NRF and transferred to the Consolidated Fund. Assuming that by year-end the balance of $40.294 billion is withdrawn, the budgetary fiscal deficit will still be $51.382 billion.

Financial Paper No. 2

In accordance with Section 41 of the Fiscal Management and Accountability (FMA) Act, the Minister of Finance may authorize advances from the Contingencies Fund to meet urgent, unavoidable and unforeseen expenditure which cannot be postponed without jeopardizing the public interest, and for which no provision or inadequate provision has been made in the Estimates, or moneys cannot be reallocated in accordance with Section 22. This section nevertheless permits variation in budgetary allocation not to exceed ten percent of the total amount appropriated for a programme. All such variations made up to the tenth month of the fiscal year must be included in a supplementary appropriation Bill to be tabled in the Assembly.

By Section 24 (1), ‘any variation of an appropriation, other than those variations referred to in section 22, shall be authorised by a supplementary appropriation Act prior to the incurring of any expenditure thereunder’. No more than five supplementary estimates are permissible in any one fiscal year, except in the case of grave emergency where an emergency appropriation Bill is tabled in the Assembly.

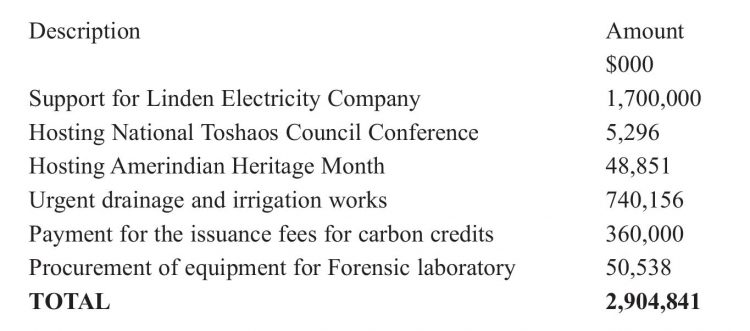

Financial Paper No. 2 relates to the reimbursement of five advances totalling $2.904 billion that were made from the Contingencies Fund during the period 15 August to 29 November 2022, as shown below:

Except for the urgent drainage and irrigation works which would have met the above criteria for the grant of the advance, it does not appear to be so in respect of the remaining five advances. The latter could have been more appropriately dealt with by way of supplementary estimates.

In his 2021 report, the Auditor General stated that 19 advances totalling $7.019 billion were made from the Contingencies Fund, without indicating whether they met the criteria for the grant of such advances. This is in contrast to previous years where he highlighted the abuse in the use of this Fund to meet routine expenditure. In particular, in his 2019 report, the Auditor General reported that seven advances totalling $4.150 billion were made from the Contingencies Fund, none of which met the criteria for the grant of such advances. He also produced a table showing the purpose for which each advance was given in support of his contention.

Financial Paper No. 3

Financial Paper No. 3 provides for an additional amount of $44.4 billion for both current and capital expenditure, of which sums totalling $28.4 billion relate for the Ministry of Public Works. Other provisions include: $1.4 billion for support to the electricity companies in Linden, Lethem, Mabaruma, Kwakwani, Port Kaituma, Mahdia, and Matthew’s Ridge; $6.6 billion for Guyana Power and Light in respect of arrears in electricity charges; and $3.0 billion for support to the Guyana Sugar Corporation and the National Drainage and Irrigation Authority.

As regards the Ministry of Public Works, Opposition Member of Parliament David Patterson pointed out that at the end of November only 51 percent of the $88 billion budgeted for the Ministry’s capital works was expended. It therefore means that expenditure of $73.4 billion is expected to be incurred before year-end. The Minister responded by stating that the Ministry’s engineering team is looking at ways of advancing projects to ensure that the monies are spent. At budget time every year, we boast of the budget being the biggest ever, and tend to focus on spending rather than on savings without due regard to the achievement of programme objectives and their related outputs, outcomes and impacts.

By Section 26 of the FMA Act, all appropriations lapse at the end of the fiscal year, and all unspent balances must be refunded to the Consolidated Fund. Any unfinished works will have to be re-budgeted for in the next fiscal year. With less than three weeks before the books of the Government are due to be closed, it is extremely unlikely that the latter amount can be expended and full value received before the close of the year. This is especially so in the case of the execution of works and procurement of goods and services, all of which will require adherence to competitive bidding procedures; receipt and evaluation of bids; award of contracts; and ensuring the completion of the related works and the delivery of goods and services before the close of the year. The same applies to transfers to public corporations and other State-owned/controlled entities by way of subsidies and contributions, otherwise public expenditure will be overstated. It would have been more appropriate for the supplementary estimate to be presented to the Assembly at the end of September to allow for a period of three for the execution and completion of the related projects. It is also a breach of Section 26 if mobilization advances are granted close to year-end since the related works would not have commenced, and expenditure overstated.

In last week’s article, we referred to the 2021 Auditor General’s report which stated that a total of 12,242 cheques valued at $18.592 billion were drawn on the Consolidated Fund bank account during the period 31 December 2021 to 8 January 2022. We stated that it is unclear what these payments represent, as there was no further comment from the Auditor General. Most of these payments might have been in relation to Supplementary Estimate in the amount of $21.4 billion that the Assembly approved on 16 December 2021 via Financial Paper No. 4 of 2021. We thought that it was most regrettable that the Auditor General did not consider it necessary to carry out any further analysis of these payments, considering that he had reported on the other areas of lesser importance. In this regard, we raised the following questions: Could it be a case where the cheques were drawn at year-end and early into the new year (and in all probability backdated to 31 December 2021) to exhaust budgetary allocations? Was this not a serious violation of Section 26 of the FMA Act which the Auditor General failed to mention, considering that his mandate includes assessing compliance with applicable laws, regulations and circular instructions?

Additional considerations include: To what extent value was received in respect of these payments at the time of reporting by the Auditor General some nine months later? Are we going to have a repeat of what transpired in 2021 where books of accounts were kept open beyond the end of the fiscal year, and payments made for which value might not have been received? Was public expenditure not overstated as a result of these payments? And, will the Auditor General continue to remain silent in the midst of not only the apparent manipulation of budgetary allocations but also this serious breach of Section 26 of the FMA Act for which there are penalties, including fines and imprisonment, as provided by Section 85 of the Act?

The failure to report on the non-compliance with Sections 26 and 41 the FMA Act, or casual reporting thereof, and their implications for public financial management, will only serve to embolden those in authority to continue these and other violations. Section 26 is fundamental to the cash-basis of accounting that the Government uses in the recording and reporting of its financial transactions and therefore the evaluation of compliance with this requirement is of utmost necessity.

National Procurement and Tender Administration Board

The National Procurement and Tender Administration Board (NPTAB) plays a key role leading up to the award of contracts above a certain amount. The Procurement Act provides for the tenure of office of its members to be for two years. However, it is silent as to whether the appointments can be renewed. Last September, the life of the Board came to an end but it is not clear whether a new Board have been appointed, as no public announcement was made to this effect. If the NPTAB continues to function with the old Board still in place, it could very well be that all contracts adjudicated upon by this body are invalid.

The chairperson of the last Board holds a senior position at the Ministry of Finance as the head of Project Cycle Management Division, responsible for monitoring the Government’s Public Sector Investment Programme. He therefore held two full-time positions at the same time since Section 16 (4) of the Act specifically provides for the chairperson to serve on a full-time basis. Concern had also been raised about apparent conflict of interest. According to the Minister of Public Works, the appointment of the last chairperson was to have been a temporary one. However, as of 23 October, the official was still functioning as chairperson of the Board. See https://www.stabroeknews.com/2022/10/23/news/guyana/almost-80-of-govt-contracts-awarded-to-small-medium-sized-businesses-nptab-ceo/.