World Bank

In an address to the World Economic Forum last Wednesday, United Nations Secretary-General Antonio Guterres was once again relentless in his criticisms of fossil oil producers and their financial backers. He accused them of ignoring their own science on climate change and ‘racing to expand production, knowing full well that their business model is inconsistent with human survival’. He further stated that:

We are flirting with climate disaster. Every week brings a new climate horror story. Just like the tobacco industry, they rode rough-shod over their own science. Some in Big Oil peddled the big lie. And like the tobacco industry, those responsible must be held to account.

The Secretary-General called on companies to ‘put forward credible and transparent transition plans on how to achieve net-zero – and submit those plans by the end of the year. The transition to net-zero must be grounded in real emissions cuts – and not rely on carbon credits and shadow markets.’ See https://www.cnn.com/2023/01/18/business/davos-climate-un-warning-fossil-fuels-intl/index.html#:~:text=United%20Nations%20Secretary%2DGeneral%20Ant%C3%B3nio,Switzerland%2C%20January%2018%2C%202023.

Last Monday, the Minister of Finance presented to the National Assembly the Estimates of Revenue and Expenditure for the fiscal year 2023. The presentation was made 74 days ahead of the 31 March 2022 set by Article 219 (1) of the Constitution. Prior to 2015, the Estimates were presented close to this deadline. Taking into account the general debate that followed and the detailed consideration of the Estimates by the Commit-tee of Supply, it was not until the end of April that they were approved. Budget agencies therefore had eight months to execute a 12-month programme, especially in relation to infrastructure development works, the implications of which were discussed in last week’s article.

For the years 2017, 2018 and 2019, the Estimates were presented to and approved by the Assembly before the commencement of the fiscal year in keeping with the Government’s Budget Transparency Action Plan developed in late 2015. However, in view of the political situation that the country was faced with, the 2020 Estimates were not presented until September 2020. This created huge problems for the financing of the expenditure on public services for the first nine months of the year, considering the restrictions placed by the Constitution on access the Consolidated Fund in the absence of a budget. A similar situation existed in 2015. In both of these years, Parliament was dissolved without a budget in place.

While the Constitution is clear on access to the Consolidated Fund in the first four months of the fiscal year pending the approval of the Estimates, there are differences in opinion as to the extent to which such access could take place beyond this period. By Article 220 (3), where Parliament is dissolved before any provision or insufficient is made for carrying on of the business of the Government, the Minister is authorized to approve of withdrawals from the Consolidated Fund until ‘the expiry of a period of three months commencing with the date on which the National Assembly first meets after that dissolution’. We hope that future dissolutions of Parliament will take this into account and ensure that an approved budget is in place first. We were hoping that the 2023 Estimates would have been presented to and approved by the Assembly before the end of 2022. However, this was not to be.

In today’s article, we highlight the performance of the country’s economy in 2022 and its state of affairs at the end of the year, as contained in the Minister’s budget speech.

Real GDP growth

The projected total growth in the gross domestic product (GDP) for 2022 was 47.5 percent while non-oil growth was expected to be 7.7 percent. The actual growth was 62.3 percent, with non-oil growth accounting for 11.5 percent. This performance was primarily due to the expansion in the production of crude oil which also had a positive effect on the non-oil growth, including mining and quarrying, construction activities and the services sector. However, sugar production declined by 18.9 percent. Other key areas of economic decline include fishing, and the production of milk and eggs.

Shown below is Guyana’s performance in 2022, compared with economies of other countries and regions:

For the period 2022-2026, Guyana’s average growth rate is projected at 25.8 percent See https://www.focus-economics.com/blog/fastest-growing-economies-in-the-world. According to a World Bank report of October 2022:

Guyana’s increasing reliance on the extractive sector raises its vulnerability to oil-related shocks. It also faces well-known risks associated with resource-dependent economies, increasing reliance on the state which can affect private sector competitiveness, and an erosion of institutions. Maintenance of an operational [sovereign wealth fund] is central to mitigating the imbalance between the resource inflow and the economy’s absorptive capacity while also limiting waste. Moreover, oil production has environmental consequences that must be carefully considered, and the sector may face additional risks as the world transitions away from fossil fuels…Given Guyana’s history of ethnically polarized protests, the possibility of civil unrest challenging the government’s authority constitutes another a risk to the economic outlook.

Further assessment of Guyana’s economy by the Bank can be found at https://thedocs.worldbank.org/en/doc/e408a7e21ba62d843bdd90dc37e61b57-0500032021/related/mpo-guy.pdf.

Balance of Payments

The Balance of Payments is the net effect of trade in goods, services and capital between a country and the rest of the world. A positive balance means that the value of exports exceeds that of imports, and has the benefit of boosting production and hence employment. On the other hand, a negative balance indicates that the country is a net consumer rather than a net producer. If this negative balance persists, it has the effect of increased borrowings and hence the country’s indebtedness. It can also put pressure on the country’s exchange rate.

The Balance of Payments has two main components – the Current Account and the Capital Account. The Current Account essentially reflects transactions in goods and services for short-term consumption; while the Capital Account records transactions of a capital nature, or investments, which have long-term implications.

Guyana’s Current Account balance at the end of 2022 was US$4,262.4 million, compared with a deficit of US$1,995.0 million at the end of 2021, an increase of US$6,257.4 million. This increase was due to a favourable trade balance, mainly from export earnings from the sale of Guyana’s share of crude oil production. However, imports have declined by 17.2 percent because there was no new arrival of any new Floating Production Storage and Offloading (FPSO) facility in 2022.

The Capital Account recorded a deficit of US$4,120.1 million, compared with a surplus of US$1,678.7 million at the end of 2021, a decrease of US$5,798.8 million. This was mainly due to a significant contraction in net foreign direct investment amid no new FPSO arriving in 2022.

Taking the above into account, the Balance of Payments Account at the end of 2022 showed a surplus of $128.3 million, compared with US$130.2 million at the end of 2021, a slight decrease.

Inflation

The rate of inflation was 7.2 percent, compared with 5.7 recorded in 2021. This was mainly due to higher food prices, which contributed 6.4 percentage points to the inflation rate. However, there was no mention of the extent of the increase in food prices, unlike 2021 where it was stated that they rose by 11.6 percent.

Based on their experience, most Guyanese are likely to find it difficult to agree with the Authorities’ assessment of the extent to which food prices contributed to the above inflation rate. Indeed, Guyana is not immune from ‘the persistent inflationary pressures triggered by the COVID-19 pandemic and exacerbated by the Russian invasion of Ukraine’, especially as regards shipping costs on machinery and equipment, materials, food items, and fertiliser. The Authorities took certain measures to mitigate the impact of inflation, such as the adjustment to freight costs to pre-pandemic levels in the calculation of import taxes; the reduction of excise tax on the importation of petroleum products; and distribution of subsidized fertilizer. However, food prices remained high, raising questions as to the extent to which these measures have impacted on the cost of living.

Interest rate

As in the case of 2021, interest rates remained stable throughout 2022. For small savings, the rate decreased from 0.83 percent to 0.81 percent, while the average lending rate fell from 8.88 percent to 8.54 percent. The 91-day, 180-day and 364-day Treasury Bills attracted rates of 1.54 percent, 1.0 percent and 0.99 percent, respectively.

Income

In 2022, there was an eight percent increase in wages and salaries for public servants; while the Disciplined Services received an additional one-month tax-free bonus. However, there was no mention of any increase for 2023. No doubt, this will be announced close to Christmas retroactive to January, a practice inherited in the pre-1992 era as an appeasement to government employees struggling to make ends meet. However, employees need immediate relief in the coming days and months to cope with the rising cost of living. Indeed, it is an established practice elsewhere for wages and salaries increases to be granted at the beginning of the year. A recently released study by the Food and Agriculture Organisation indicates that 43 percent of Guyanese cannot afford a healthy diet; while five percent of the population is under-nourished. See https://www.fao.org/3/cc3859en/cc3859en.pdf.

That apart, we continue to ask: why is it that other categories of government employees are not in receipt of the additional benefit given to the Disciplined Services? If the Disciplined Services are deserving of such a benefit, there is a greater argument for such benefit to be extended to public servants, teachers, doctors and nurses, among others. In his budget speech, the Minister considered that the previous Administration’s discontinuation of the practice of granting end-of-year bonuses to the Disciplined Services an “unconscionable”. But is it not true that the denial of this benefit to other categories of employees unconscionable?

Revenue and expenditure

According to the Minister, a fiscal deficit of G$155.5 billion, or 11.8 percent of GDP, was recorded in 2022, compared with G$115.7 billion, representing 10.2 percent of GDP, incurred in 2021. This was due mainly to an increase in overall expenditure that outweighed the increase in revenue generated. Current revenue, net of inflows from Guyana REDD+ Investment Fund and the NRF was G$302.1 billion; while non-interest current expenditure amounted to $326.1 billion. On the hand, total capital expenditure amounted to $258.1 billion.

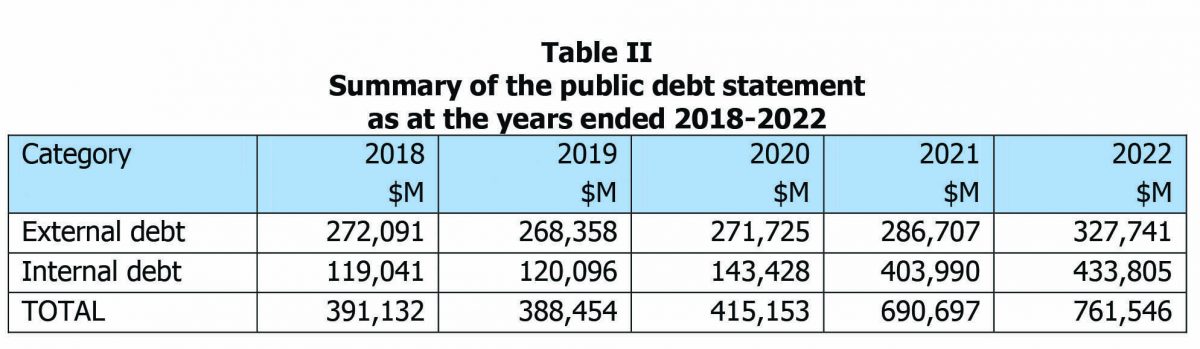

Table I provides a summary of the financial performance of central government activities over the five-year period 2018 to 2022. The figures in the first four columns were taken from the audited public accounts for the years 2018 to 2021; while those for 2022 were extracted from Tables 1-7 of Volume II of the 2023 Estimates.

The year 2022 represents the third consecutive year an operating deficit was recorded; while the capital expenditure rose by 469.1 percent over the amount expended in 2018. This performance is notwithstanding amounts totalling G$126.481 billion withdrawn from the NRF. In its 2022 Article IV Consultation Report, the IMF had advised that the overall fiscal deficit should not exceed the amount withdrawn from the NRF, which in effect means that there should be no deficit when the withdrawals from the Fund are taken into account.

Public debt

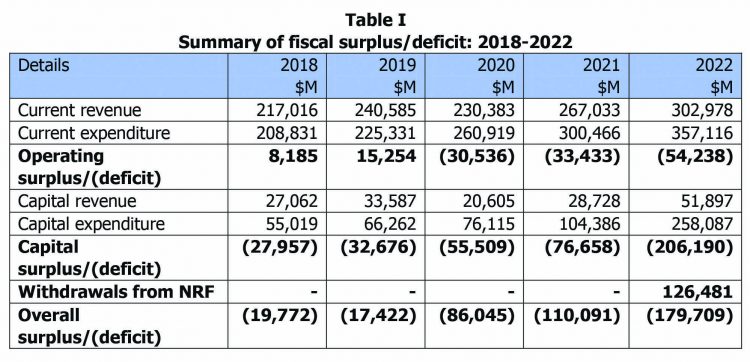

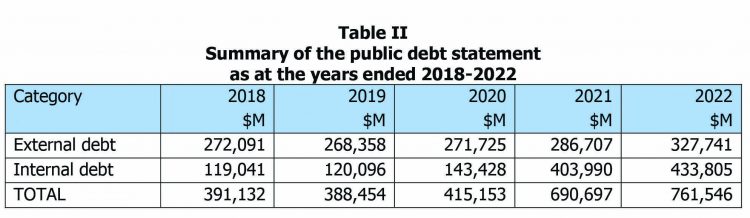

The total public debt, inclusive of publicly guaranteed debts, at the end of 2022 was US$3,654.9 million, compared with US$3,312.7 at the end of 2021 (per audited accounts), an increase of U$342.2 million or 10.3 percent. The Minister’s budget speech, however, indicated that the increase was 16.9 percent. Table II provides a summary of the public debt at the end of the last five years. The amounts shown in the first four columns were taken from the audited public accounts.

The public debt has almost doubled over the last five years, mainly due to an almost three-fold increase in the internal debt arising from the issuance of Treasury Bills and debentures in 2021 mainly to liquidate the overdraft on the Consolidated Fund. At the end of 2020, the overdraft was $163.340 billion which was accumulated over the years because of expenditure exceeding revenue. There was, however, no mention of the balance on the Consolidated Fund at the end of 2022. Considering the opening balance of $12.484 billion, and taking into account the fiscal deficit of $179.709 billion, the Consolidated Fund would have once again gone into an overdraft by an estimated $167.625 billion!

According to the IMF, ‘[a] country’s public debt is considered sustainable if the government is able to meet all its current and future payment obligations without exceptional financial assistance or going into default’. An important tool used for this purpose is the debt-to-GDP ratio. Notwithstanding the increase in the public debt, the debt-to-GDP ratio decreased from 38.9 percent at the end of 2021 to 24.6 percent at the end of 2022. This was mainly due to the significant increase in the GDP as a result of increase production of crude oil. Considering the particular situation of Guyana, a more appropriate measure of economic performance is the Gross National Product (GNP) and not the GDP, as discussed in last week’s article.

According to the 2022 IMF Article IV Consultation Report, Guyana has been rated as moderate in terms of external and overall debt distress, and ‘has substantial space to absorb shocks, reflecting the current low level of external debt’. The IMF, however, issued the following warning:

Increased dependence over time on oil revenue could expose the economy to oil price volatility and that excessively rapid increases in government spending from oil revenues could subject Guyana to the “natural resource curse”, with significant inflationary pressures, eroding competitiveness from real exchange rate appreciation, and governance concerns…Prolonged disruption of international commodity markets and heightened oil price volatility, aggravated by the repercussions from the Russian invasion of Ukraine, also represent (both downside and upside) risks to the outlook.

See https://www.elibrary.imf.org/view/journals/002/2022/317/article-A003-en.xml.

Net foreign reserves

The net international reserves at the Bank of Guyana stood at US$810.8 million at the end of 2021, compared with US$680.6 million at the end of 2020. The reserves represented 14 months of import cover. However, there was no mention of the extent of the reserves at the end of 2022.