Amid heightened complaints from businessmen about the unavailability of foreign currency, the Bank of Guyana (BoG) on Friday issued a circular to bank cambios which is intended to crack down on shadowy transactions.

Bank cambios will have to submit invoices against which foreign currency is sold to the Guyana Revenue Authority (GRA).

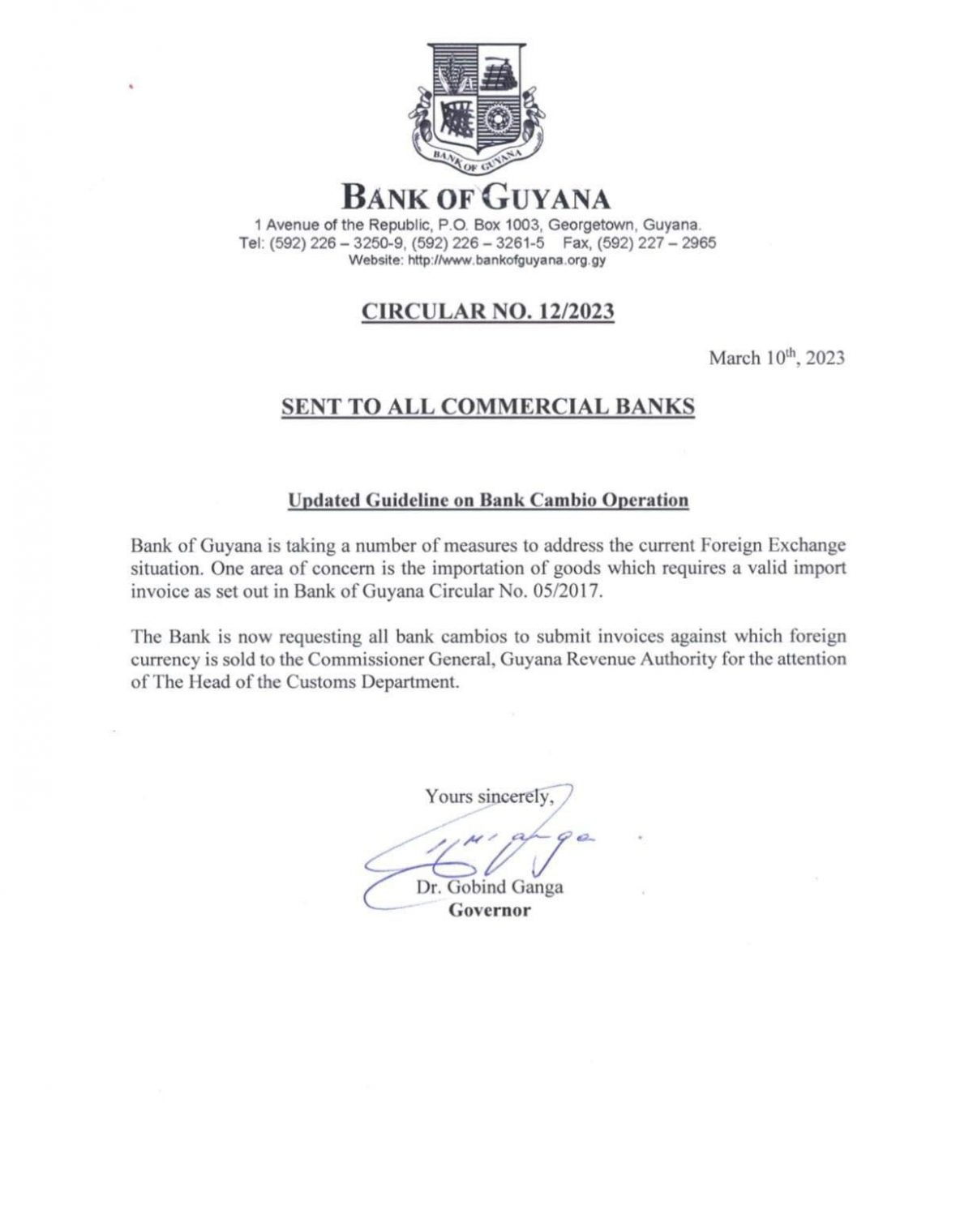

The updated guideline on bank cambio operations said that the “Bank of Guyana is taking a number of measures to address the current Foreign Exchange situation. One area of concern is the importation of goods which requires a valid import invoice as set out in Bank of Guyana Circular No.05/2017.

“The Bank is now requesting all bank cambios to submit invoices against which foreign currency is sold to the Com-missioner General, Guyana Revenue Authority for the attention of The Head of the Customs Department”.

Well-placed sources say that it is felt that this guideline will expose shady operations that are accessing foreign exchange not for the stated purpose. The updated guideline is part of inter-agency work between the BoG and the GRA and is also seen as enabling checks and balances.

While businessmen have complained about availability, BoG Governor Gobind Ganga has asserted that there is sufficient foreign currency within the banking system.

The Guyana Association of Bankers Inc (GABI) through an invitation from the Private Sector Com-mission (PSC) met with the Bank of Guyana on March 6th to discuss the prevailing foreign exchange situation.

GABI said that a number of issues were identified and all parties agreed to work constructively to resolve them.

“GABI and its members are committed to collaborating with all stakeholders to ensure that every aspect of the financial industry, including the foreign exchange market, remains stable and efficient”, the statement said.

The bankers’ association offered no information on the concerns of some businesspersons that when they approach banks they are told point-blank that foreign currency was not available.

Coming out of the meeting on March 6th, the PSC said in its own statement that day that it was agreed that there is no overall shortage of foreign currency in Guyana despite there being a shortage at some banks. Nonetheless, the Commission committed to working with GABI and BoG to address the issues raised and promised to collaborate and work together for the benefit of all concerned.

It was stated that the aggregate supply of foreign exchange is meeting the aggregate demand and therefore the market remains in equilibrium.

“The Governor of the Bank confirmed that while there is an intrabank market which enables banks to share, the Central Bank must rely on moral persuasion in an effort to achieve a more efficient distribution of foreign currency availability, while emphasizing the fact that it is the responsibility of the Central Bank to ensure that the Government meets its macro-economic objectives,” the PSC statement said.