For the first time since it found oil here in 2015 and inveigled a scandalous Production Sharing Agreement (PSA) out of the APNU+AFC government in 2016, ExxonMobil finds itself in uncharted waters. A decision of the High Court has quite properly placed the onus on it to indemnify Guyana from any financial liability that could arise from its operations here.

Usually Exxon is comforted by its excellent access to the executive – both this one and the previous one. The judiciary is quite a different matter and Exxon does appear to have been blindsided by the decision of Justice Sandil Kissoon on May 3rd in the matter of insurance for the Liza-1 permit. Strangely, at last word ExxonMobil was still studying the decision. It has not yet appealed.

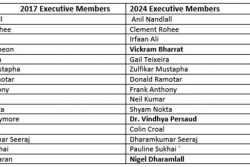

It appears that where studying is concerned the Environmental Protection Agency (EPA) has outrun Exxon. It has already moved to appeal the decision. The EPA has functioned with little to no independence since the PPP/C government dismissed its former Head, Dr Vincent Adams and so the appeal reflects clearly the intent of the executive which intent had been swiftly telegraphed by Attorney General Anil Nandlall SC.

Just on the face of it, the EPA’s decision to appeal a ruling that could only be interpreted as protecting the environment and the country’s financial health is befuddling. It is as if the EPA is turning logic on its head in a bid to aid ExxonMobil rather than shepherd the interests of this country and its people. In its pleadings submitted to the Court of Appeal, the EPA also counter-intuitively raised economic considerations as one of the planks of its case.

Among other things, the EPA argued that the directions given by the court have the effect of entirely removing its discretion, while adding that there would be “severe disruption to the national economy and financial well-being of the public and private sector.”

Describing Guyana as the “fastest growing economy in the world,” which it said was a “notorious public fact…due in large part to the exploitation” of its petroleum, the EPA said the order made by the court was critical to Guyana’s economic activity.

The EPA added that Guyana now earns billions annually from its petroleum extracted on the Liza 1 and Liza 2 fields, both of which are subject to the permit. Against this background, the EPA advanced that suspension or cancellation would have a “catastrophic effect” on national funds for development and also the private sector which supports the activities on both Liza 1 and 2.

Those arguments are extraneous to the EPA’s mandate. Its only concerns should relate to a possible catastrophic mishap at ExxonMobil’s operations in the Atlantic, its impact on the environment and its cost. Therefore it should have welcomed Justice Kissoon’s decision fortifying Guyana’s insurance coverage or at least stayed out of the fray.

The emphasis on the possible loss to the country from an interruption of oil extraction probably explains why on Thursday it issued a press release setting out its reasons for appealing the judge’s decision and asserting “We wish to emphasise that we take our mandate and responsibility seriously and have at all times discharged our statutory functions without fear or favour. We at all times make decisions informed by available information, research and in accordance with the Environmental Protection Act Cap 20:05”.

However, even the reasons cited on Thursday raise questions as to why it was appealing this decision.

Among its averments, the EPA said that it at “…no time had any doubts that the Permit Holder was strictly and fully liable under the Environmental Protection Act Cap 20:05 (EP Act) and the Permit for any pollution or damage to the environment, including compensation of affected parties. The EPA always maintained that the Permit Holder had full and strict liability to clean up, restore, remediate, and compensate for any harm caused by pollution whether wilfully or by accident”. If this is indeed the case, why in the name of the environment would it appeal a decision that seeks to ensure full liability?

The EPA further said that it “had to be diligent and ensured that it negotiated an Affiliate Company Guarantee that fulfilled the requirement of section 31 (2) of the EP Act which states that a requirement for Financial Assurance shall specify the amount. The question therefore became, what amount can be specified and how can this be estimated? Further, the EPA wanted to ensure that any amount agreed upon, was not arbitrary, and could be renegotiated based on increased risks and any circumstances that resulted in the amounts specified being exceeded”.

That the EP Act says that a requirement for financial assurance must specify an amount shouldn’t override the EPA’s own awareness that the oil company bears full liability were anything to go wrong.

Compounding the quagmire it has found itself in, the EPA then adverted to negotiations with ExxonMobil for a dollar figure to comply with what it said was a requirement of the Act.

“At the time of the hearing of this matter, the EPA had received the estimate to the tune of US$1.5 to US$2 billion dollars and had several engagements discussing results and using same to inform its final negotiations on the agreement. Negotiations concluded on April 27, 2023 on the amount guaranteed, the terms and conditions for renegotiations based on increased risks, and next steps if unfulfilled obligations exceeded the US$2 billion guaranteed amounts”, the EPA said.

This ignores the fact that the EPA is affixing a finite figure which ExxonMobil no doubt finds to its liking. Guyana should not be in a bazaar haggling about what is a clear-cut obligation on behalf of the American oil major to foot every single dollar of a potential liability. If the Government of Guyana and the EPA were to consider the cost of the most recent and best known oil well blowout in this region, British Petroleum’s Macondo in 2010, it would well be aware that estimates of the total liabilities and damage go as high as US$70b. Were the worst to occur, Guyana would be left facing major lawsuits without the umbrella of an ironclad guarantee from ExxonMobil and its partners.

It should not go unnoticed that ExxonMobil has been extracting oil here since December 2019 without sufficient insurance as is clearly accepted now by the government, the EPA and the oil company. That must rank as one of the most reckless acts of dereliction by the previous government and this one.

If as argued before the Court of Appeal by the EPA that the judge’s order would result in “severe disruption to the national economy and financial well-being of the public and private sector” that may well be justified to secure the environmental and financial shield that the country seeks from the current two oil extraction operations in Guyana’s waters, the one that is about to start, two others that have been greenlighted and up to five more avariciously eyed by the oil companies and the Government of Guyana. It would be a small price to pay to avoid financial calamity.

In the meantime, their expanding insurance liability should spur ExxonMobil and its partners to conduct their operations to the highest safety standards and then some.