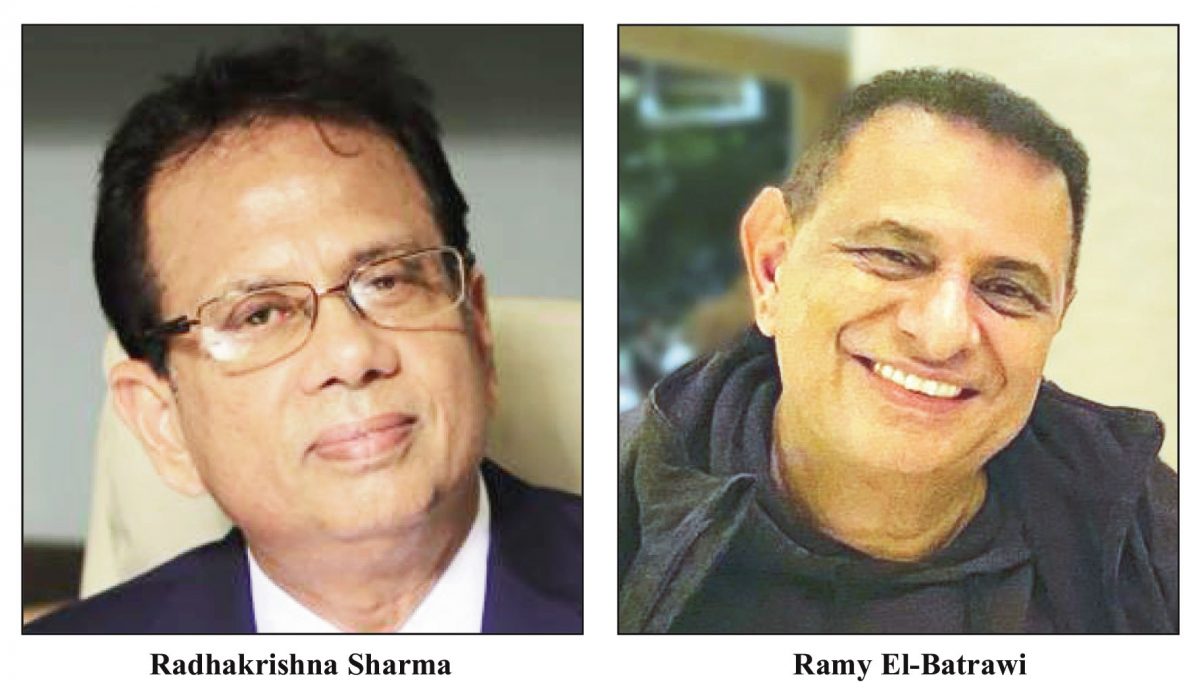

State holding company, the National Industrial and Commercial Investments Limited (NICIL) has finalized sale negotiations for the Guyana Marriott Hotel with US investor Ramy El-Batrawi.

Responding to questions from Stabroek News, NICIL CEO Radhakrishna Sharma said yesterday that the business and operations at the hotel would continue in accord with the existing agreement with Marriott International.

“NICIL is selling its shares in Atlantic Hotel Inc. (AHI). The status quo of the business and operations of the Hotel would therefore remain the same as the new owner of the shares of AHI would continue to be bound by the terms and conditions of the said agreements between AHI and Marriott International. In other words, NICIL is selling the company (AHI) as a whole, `as is where is’, he told this newspaper.

“The Parties have completed negotiations of the principal terms and conditions of the sale. NICIL’s legal team has drafted the necessary transactional documents in that regard, and they were submitted to Mr. El-Batrawi, whose legal team has completed their initial review” the NICIL CEO said.

According to Sharma, El-Batrawi possesses the resources to enhance the services and appeal of the hotel to residential, expatriate and vacationing guests, and business travellers, through innovative operating within the confines of the existing agreements between AHI and Marriott International.

He said that as per the agreements with Marriott International, the Marriott Brand standard will at all times be maintained.

“In our current (emerging) oil economy, the services of the Marriott Hotel will continue to cater to the needs of our local, regional, and international guests, while remaining Guyana’s flagship Hotel”, Sharma asserted.

The NICIL CEO added that all maintenance and development, structural and otherwise, will continue within the confines of the agreements between AHI and Marriott International that govern the business and operations of the Hotel.

Vice President Bharrat Jagdeo a few months ago announced at press conference that the government has given NICIL the go-ahead to engage the company to facilitate the sale.

“NICIL has completed that evaluation. They have ranked the firm that had a bid of US$90 million as the highest bid, the number one bid and they have been given the authority to engage in negotiations with that company,” Jagdeo disclosed at the press conference at the Office of the President.

El-Batrawi, founder of investment group X, LLC, upped his bid by US$25 million from his initial offer in the second round of bidding.

Responding to the concern that El-Batrawi had faces charges in the US from the Securities Exchange Commission, Jagdeo said that it was in the past and the potential buyer has the support of the US government.

Integrated Management Group Guyana Inc, another company, also expressed interest in purchasing the hotel and submitted a tender of US$86.1 million – US$31.1 million above its previous offer.

The Government of Guyana had publicly rejected the first round of bids. It held the view that all six bids submitted for NICIL’s shares in Atlantic Hotel Incorporated (AHI) for the acquisition of the Guyana Marriott Hotel came in at a figure that was not acceptable. X, LLC in the previous round of bidding had tendered the highest bid at US$65 million while Integrated Management Group – which runs the Palm Court – bid US$55 million.

On May 2, the six bidders were contacted and advised their submitted bids had been rejected, NICIL reported at the end of the second round of bids. At that point, the six bidders were invited to resubmit new bids with a minimum bid price of no less than US$85 million.

According to the X LLC website, the group’s primary focus is to invest in and enhance target industries. El-Batrawi was described as a highly accomplished entrepreneur offering 35 years of experience in spearheading substantial business transactions, both nationally and on a global scale.

Controversially built by taxpayers’ money and a loan, the hotel was opened on April 16, 2015, but was not able to service its loan. It was also reported that the hotel benefitted substantially from an accommodation deal struck with oil companies operating in Guyana.