Dear Editor,

A few days ago I overheard an ad on the radio from a popular auto dealership in Guyana. They were advertising a 2009 model year vehicle with higher than average mileage for $2.6M!

Let’s take a 2009 Toyota Allion with 33,000KM with a list price of $4,270 USD + $2,700 Freight = $6,970. When this vehicle reaches Guyana the government automatically slaps $4,000 USD as excise tax. Cost is now $10,970 USD then dealer adds $1,470 USD.

My question is how did the government come up with a flat rate of $800,000 GYD which is almost the sale price of the old car. Most vehicles with ~1500 cc are in that price range, so is this just a way to get tax revenues without actually providing a basis for the flat rate? I’m aware that the government did overhaul the vehicle taxes but there’s a reason most cars in Guyana are very old. The taxes are simply too high to import new vehicles. The case for vehicles 4 years and newer is worse.

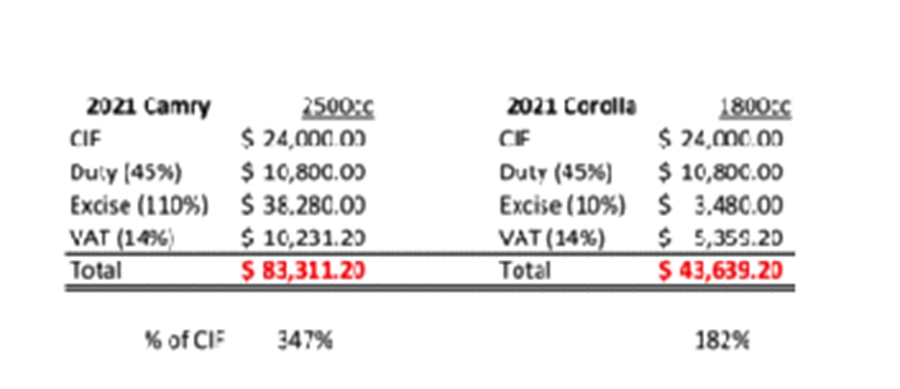

Comparing a 2021 Camry (2500cc) and a 2021 Corolla (1800cc) at similar CIF results in CIF+Tax that are 2-3x the CIF.

I would have to ask again, what services is the government providing to its citizens that demand these absurd taxes? Are most Guyanese in a position to purchase a car while making an average wage?

(Name and address supplied)