If we are to meet the 1.5-degree limit and protect ourselves from climate extremes, climate champions, particularly in the developing world, need solidarity. We must make up time lost to foot-dragging, arm-twisting and the naked greed of entrenched interests raking in billions from fossil fuels.

UN Secretary-General Antonio Guterres

Ontario Premier Doug Ford announced that he would reverse plans to open the protected Greenbelt lands for housing development after expressing regret at reneging on his promise not to touch the Greenbelt. Last year, the provincial government took 7,400 acres of land in the Greenbelt to build 50,000 homes in order to ease the housing crisis. However, the province’s Auditor General found that the process to select lands was rushed and favoured certain developers. The Housing Minister has since resigned from the Cabinet for his failure to properly oversee the process that led to protected Greenbelt lands being selected for housing development. The Greenbelt was created in 2005 to permanently protect agricultural and environmentally sensitive lands from urban development. See: https://nationalpost.com/ news/politics/d-ends-greenbelt-development#:~:text=Ontario%20Premier%20Doug%20Ford%20is,and%20two%20top%20staffers%20resign.

Two weeks ago, we raised the issue of the disputed pre-contract costs of US$214.4 million being reduced to US$11 million, as indicated by the Vice President at a press conference of 24 August 2023. We expressed surprise that: (i) this could have been done considering that the auditors had issued their final report more than two years ago after a series of comprehensive and exhaustive reviews by the Guyana Revenue Authority (GRA); and (ii) it was possible for Exxon to now submit additional documentation in support to the disputed expenditure. We then called on the Authorities to clarify to the public what really happened.

The Vice President then sought to lay blame on the Ministry when he indicated that the latter would no longer be involved and that he would be relying on the work the GRA. This prompted the Minister to issue a media release within hours, endorsing the Vice President’s statement that the GRA is the “competent” authority to deal with the matter. Additionally, the Minister stated that: (i) the Ministry’s Petroleum Unit was assisting in the audit process, but had engaged in an unauthorized examination of documents submitted by Exxon; and (ii) both he and the Vice President were under the impression that the information provided to them on subsequent reductions emanated from the GRA.

But, did the Minister not receive a letter earlier from the GRA stating that it had no objections to the auditors’ report that identified US$214.4 million in disputed costs? How could the Minister then state that he and the Vice President were under the impression that the GRA was involved in a reduction of the disputed expenditure? In other jurisdictions, heads would have rolled. For example, as indicated above, the Housing Minister of Ontario, Canada, resigned for his failure to properly oversee the procedures leading to the slicing off and use of 7,400 acres of the protected Greenbelt lands for housing purposes.

The Minister further stated that upon learning of this development, corrective action was taken immediately and staff was instructed to cease such engagements and deliberations. Should the services of those responsible not be terminated with immediate effect? And, should the Minister not be held responsible? After all, the buck stops with him. And what of the Vice President who, all probability, would not have accepted information from the Ministry without verifying its accuracy with the Minister? It is not a case where the Vice President is paying a passing interest in relation to this matter. Rather, he is integrally involved in all matters relating to the oil and gas industry, as if he is the overarching Minister.

And what of Exxon’s engagement with the staff of the Ministry in what the Minister considered unauthorized reduction of the disputed costs? The U.S. oil giant ought to have been aware that the auditors’ report on the disputed costs is final, and that the matter ought not to have been re-opened. Last week, Member of Parliament David Patterson stated that Exxon’s Alistair Routledge indicated that the disputed costs have been reduced to US$3 million. Should the authorities in the United States not initiate a probe into the matter?

The confusion regarding the disputed costs could have been avoided, had the Petroleum Commission been in place. The draft legislation to establish such body was tabled in the National Assembly in 2017 and was referred to a Special Select Committee for detailed review. However, it lapsed with the new Parliament in place. Since then, no efforts have so far been made to re-table the draft legislation, with appropriate amendments to take into account concerns expressed by key stakeholders. This was despite an assurance given by the present Administration that this would be done as a matter of priority.

We welcome a probe into the matter, as announced by the Vice President. However, such a probe must be carried out by a person(s) who is/are not in any way involved in what has so far played out. Perhaps the Public Accounts Committee should take over the responsibility for initiating the probe and for reviewing the results. Additionally, we reiterate our call for the auditors’ report to be released to the public to enable

citizens to understand what really happened.

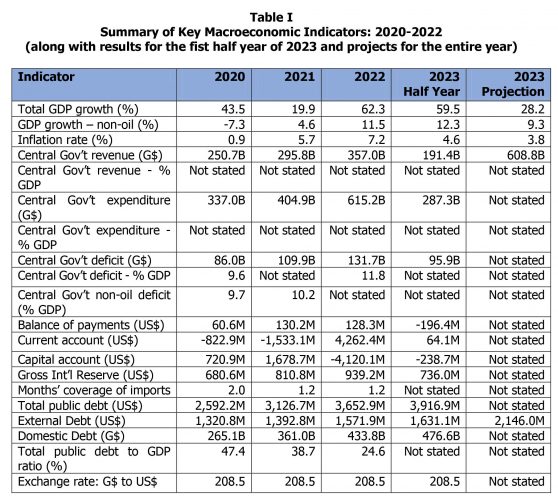

Last week, we began a discussion of the report on the execution of the annual budget and the performance of the economy, as reflected in the Minister of Finance’s 2023 Mid-Year Report that was recently released. So far, we have discussed real Gross Domestic Product (GDP) growth, balance of payments, Central Government revenue and expenditure, inflation, interest rates an exchange rate. In today’s article, we conclude our discussion on the subject.

Public debt

The total public debt, inclusive of publicly guaranteed debt of US$2.4 million, was US$3.917 billion, compared with US$3.653 billion at the end of 2022, an increase of US$264 million, or 7.23 percent. The external debt accounted for US$1,631.1 million, compared with US$1,571.9 million at the end of 2022, an increase of US$59.2 million or 3.8 percent. This was mainly due to inflows from bilateral creditors. The external debt is projected to increase by 31.6 percent to US$2,146.0 million by the end on 2023.

The internal debt was G$476.6 billion, equivalent to US$2,285.8 million, compared with G$433.8 billion at the end of 2022, an increase of G$42.6 billion, or 9.87 percent. This was mainly due to an increase in the stock of Treasury Bills by 21.7 percent to G$278.7 billion through the issuance of new Treasury Bills. These are short-term borrowings to finance the National Budget.

Debt service payments amounted to US$92.3 million in the first half of 2023. The internal debt payments grew by 224.4 percent compared with the corresponding period last year, while external debt servicing increased by 16.6 percent. The increase in the internal debt servicing was mainly due to the commencement of the redemption of the Bank of Guyana debentures issued in 2021 mainly to liquidate the overdraft on the Consolidated Fund overdraft at the end of 2020.

Natural Resource Fund

The Government received US$705.2 million in revenue from its share of profit oil, along with royalties totalling of US$110.8 million relating to the last quarter of 2022 and the first quarter of 2023. The cumulative balance, inclusive of interest income of US$35.6 million, at the end of June was US$1,723.5 million, after taking into account withdrawals of US$200 million each in February and May 2023.

Oil revenue for 2023 is projected at US$1,629.3 million, comprising US$1,410 million in profit oil and US$219.3 million in royalties. It is also anticipated that the balance on the Natural Resource Fund will be approximately US$2 billion.

Summary of key macroeconomic indicators

Table I provides a summary of key macroeconomic indicators covering the period 2020 to 2022, along with the results for the first half year of 2023 and projections for the entire year.