Dear Editor,

The pace of discovery in the Stabroek Block has been astounding. There have been 32 major discoveries to date. There are currently 3 projects in production: Liza Phase 1, Liza Phase 2 and Payara. The current daily output is 620,000 barrels of oil. There are 2 additional projects approved for production: Yellowtail and Uaru. Plus, a third in the approval process, named Whiptail. With these 6 projects, there is an aim to produce 1.2 million barrels of oil a day by 2027. The six projects that are either producing or will be producing soon have an estimated capital cost of US$55 billion. The government has commissioned 2 audits thus far: the 1999 to 2017 audit, which was estimated to cover US$1.7 billion in claimed expenses, and the 2018 to 2020 audit that covered US$7.3 billion in claimed expenses. However, given that there is a 2-year time-window to audit [Article 23 and Section 1.5 (a) in Annex C of the PSA 2016], it is not clear what is the schedule to audit the remaining at least US$46 billion in expenses (US$55B – US$1.7B – US$7.3B).

To put US$55 billion in perspective, before oil production started at the end of 2019, Guyana’s annual national budget was US$2 billion/year. Thus, US$55 billion in expenses is more than what Guyana would have spent in the last 27 years combined. Given the astronomical sums involved and the controversies surrounding the 1999 to 2017 audit, see here https://www.oggn.org/2023/09/20/gra-is-not-the-competent-authority-to-lead-all-or-any-petroleum-audits/ and the 2018 to 2020 audit, see here https://www.oggn.org/2023/11/25/these-findings-justify-a-full-scale-forensic-audit-of-the-2018-2020-accounts-of-exxonmobil-guyana/, one would hope the government could be more transparent with these audits for the public’s benefit. However, both the 1999 to 2017 audit, which was completed in 2021, and the most recent audit have not been made public by the government. This would naturally raise the question – ‘is the government protecting the oil companies for overbilling Guyana’?

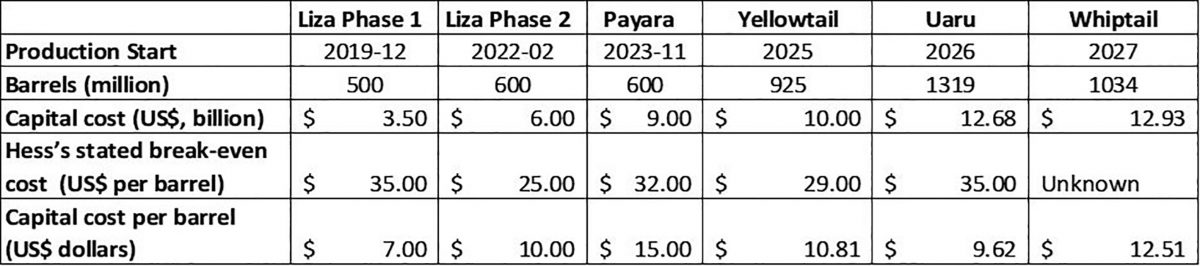

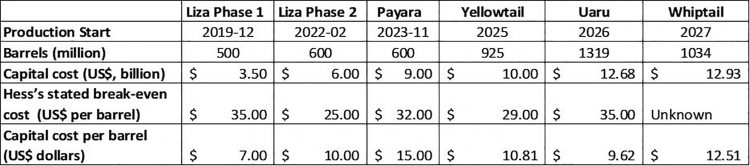

Now, let’s look at how the US$55 billion in capital cost is broken down across the 6 projects that are either producing or will soon be in production. The table (below) shows some of the details of these projects. There is a break-even cost per project as stated by one of the Stabroek Block partners, i.e., HESS Corporation [in September 2023 before it announced the sale of its interests to Chevron]. One would assume the break-even cost per project would be closely correlated with the capital cost, given that it seems from various reports the operational costs may be US$10/barrel. However, Uaru which has the same break-even cost as Liza Phase 1 is 37% more expensive in capital cost. Payara is more than double the capital cost per barrel for Liza Phase 1 although the breakeven cost differences between the projects are not that much.

Given the economies of scale and the lessons learnt along the way, one would expect that for newer projects the capital cost per barrel would trend downwards. For example, all but one of the six floating, production storage, and offloading (FPSO) vessels were commissioned from the same company, SBM Offshore, and four are identical in size, capacity and design. Hence, do the existing audit reports explain this anomaly or will the future US$46 billion plus to be audited tease out what may be going on here? But the Government of Guyana does not have unlimited time to do audits, they have to be undertaken within 2 years of the expenses being booked. In Annex ‘C’ Section 1.5 (C), it says “Without prejudice to the finality of matters as described in sub-sections 1.5 (a) and 1.5 (b) all documents referred to in those sub-sections shall be maintained and made available for inspection by the Minister for two (2) years following their date of issue providing, however, that where issues are outstanding with respect to an audit, the Contractor shall maintain documents for a longer period until the issues are resolved.”

In 2018, Dr. Jan Mangal and others, using the media, raised concerns about the US$4.4 billion in capital cost for Liza Phase 1. As a result, that figure was slashed by US$700 million, see here https://www.stabroeknews.com/2018/12/16/news/guyana/projected-cost-for-exxons-liza-phase-1-slashed-by-us700m/. After all the revisions, Liza Phase 1 went down from US$4.4 billion in capital cost to US$3.5 billion. Thus, Liza Phase 1 was inflated by 25%. No reduction has happened with subsequent oil field development projects. One has to wonder, given the anomalies in the above table, whether a forensic audit of the US$55 billion in capital cost might not uncover significantly inflated numbers. The government should request that Exxon provide more information to explain the discrepancies between the capital cost and break-even cost across the 6 projects. Finally, the Government of Guyana needs to demand more oversight in the process leading to the commissioning of new FPSOs.

Sincerely,

Darshanand Khusial

Andre Brandli

Janette Bulkan

Kenrick Hunte

John Palmer

Joe Persaud

Charles Sugrim