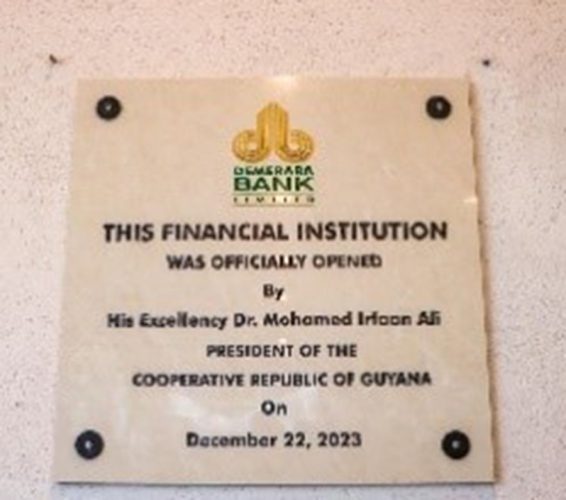

Demerara Bank Limited (DBL) yesterday opened its ninth branch to the tune of $485 million at Leonora, West Coast Demerara as it celebrates its 29th anniversary.

Chief Executive Officer (CEO) Pravinchandra Dave, while announcing his retirement, noted that the commercial bank is working towards doubling its profits and introducing online banking systems in 2024.

Noting his more than 22 years of service to the bank, Dave said that he is gratified and deeply proud of the progress of the commercial entity over the years despite challenges and obstacles.

According to the CEO, the bank was launched in the community of Leonora to alleviate traffic woes for those who have travel to the capital city and other locations to do their transactions. In addition, there have been innumerable complaints by customers about insufficient parking at many of the bank’s outlets in central Georgetown, hence, the new Leonora branch has been equipped with a spacious parking lot. Further, the state-of-the-art facility boasts a solar system which provides 100 per cent renewable energy for the branch.

The CEO, who will be retiring at the end of December, noted that while there is a perception that commercial banks are only about “making money,” Demerara Bank over the years has been the “catalyst” for national development.

“We have a policy that our people must undergo development and we have contributed to that over the years and will continue to do that even as I retire.”

The outgoing executive said that commercial banks also play a pivotal role in assisting entrepreneurs with loans to kick start their micro- and macro-enterprises.

Chairman of Demerara Bank, Komal Samaroo, also congratulated the bank for its achievements during its 29 years of existence. He observed that with the constant digital advancement globally, many commercial banks have endorsed electronic banking which this branch and other respective locations will capitalise on in 2024.

The Chairman said with DBL being one of the leading commercial banks in Guyana, the entity must now up its game in the delivery of customer service through the use of electronic banking, an initiative that the board and management is fully behind.

Meanwhile, President Irfaan Ali during his feature address at the opening ceremony, said that DBL has been responsive to national development and urged the bank to continue its forward-thinking approach.

He noted that as Guyana advances in the area of finance and commerce, there will be a need for additional human resources at these financial institutions.

The President said that the government is working towards creating more jobs in this particular area, since human resources are the fundamental drivers for efficient services at many financial institutions.

Senior Minister in the Office of the President with responsibility for Finance, Dr Ashni Singh, in his remarks, also lauded DBL for its exemplary quality customer service during its years of existence.

The Bank was founded by the late Dr Yesu Persaud.

Stabroek News in a November 8 article, reported that DBL had registered a whopping after-tax profit of $4.06 billion for the financial year ending September 30, 2023, compared to $2.95 billion last year – an increase of 37.5 per cent.

According to its Consolidated Financial Statements published in today’s Stabroek News, a significant portion of the expanded profit, which comprises other income, moved from $758 million in 2022 to $2.74 billion this year. The deposits of the bank also registered substantial growth, rising by 30 per cent from $106.9 billion to $139.1billion. Loans and advances jumped by 22.7 per cent from $58.1 billion to $71.3 billion.

Chairman Samaroo in his review noted that it had been an outstanding year for DBL as it had recorded the best financial results in its history.

He disclosed that the Board of Directors have recommended a final dividend payment of $1.80 per share. This proposed dividend when combined with the interim dividend of $0.45 per share already paid would bring the total dividend for the year to $2.25. The total dividend paid in 2022 was $2.

Interest income from loans and advances was $5.17 billion in 2023 compared to $4.29 billion in 2022. Interest income from investments totalled $2 billion in 2022 compared to $1.6 billion in 2023.

Meanwhile, net credit impairment in 2023 was $825 million compared to a recovery of $362 million. And income before taxation was $4.88 billion in 2022 as against $5.9 billion this year.

Demerara Bank in a statement, credited its “exceptional performance” to several key factors – financial discipline, a strategic investment approach, coupled with the continuous development of human resources – which have paved the way for the bank’s success.

Further, the bank has actively driven economic growth by diversifying its credit portfolio and making credit accessible across all major sectors.

“To put this in perspective, when compared to the banking sector’s advances as of September 30, 2023, Demerara Bank has made significant contributions, accounting for 61% of Agriculture, 27% of Mining, 55% of Manufacturing, 24% of Construction and Engineering, and a remarkable 90% of Telecommunications.”

And in an industry where non-performing loans are often a concern, Demerara Bank boasts “a spotless record with no non-performing loans for two consecutive years.”

The statement added that the Bank’s asset base expanded by 26 per cent to $159.589 billion by the close of the 2023 financial year, compared to the $126.570 billion recorded in the prior year. The Return on Average Assets as of September 30, 2023, was 2.85 per cent which it said is higher than the industry average. The bank says it has also maintained a Capital Adequacy Ratio well above the prudential benchmark of 8.0 set by the Central Bank.

Concerning investments, the bank said that despite the challenging global market landscape, the bank’s investment portfolio delivered strong returns.

It added that the Return on Shareholders’ Funds was substantial, recording a 20.6% return for the year ending September 30, 2023. Earnings Per Share also rose from $6.57 to $9.06 per share as of September 30, 2023, indicating an increase of 37.9 per cent.