On 11 December 2023, the audited public accounts for the fiscal year ended 31 December 2022 along with the report of the Auditor General thereon were presented to the National Assembly. Since then, the print media has been highlighting aspects of the Auditor General’s report on these accounts. In our article of 18 December 2023, we stated that public accountability does not end with the availability of the audited public accounts. The Public Accounts Committee (PAC) must carry out a detailed examination of these accounts and submit a report of its findings and recommendations to the Assembly. However, the Committee is five years in arrears in its examination of and reporting on the public accounts. Its last report to the Assembly, issued on 21 July 2022, was in respect of 2016.

Since Guyana gained Independence in 1966, there had been undue delays in the PAC’s scrutiny of the public accounts, except for the years 1992 and 1993. The situation has recently been exacerbated after the quorum change in April 2022 that saw fewer meetings of the PAC being held. Previously, three members, inclusive of the Chairperson, formed the quorum which has now been increased to five members: two members from both sides of the House, along the Chairperson.

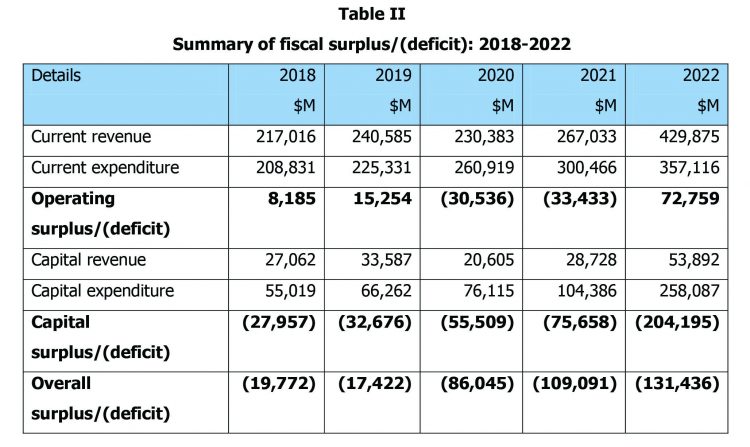

Table I shows the trend in reporting by the PAC for the period 1992 to 2022.

Certification of the accounts

Of the eleven sets of financial statements constituting the public accounts, the Auditor General has issued a qualified opinion on two statements – Statement of Current Assets and Liabilities of the Government; and Financial Report of the Deposit Fund. In relation to the first statement, the Auditor General has stated that ‘[e]xcept for the effects of the matter, which might have been shown to be necessary as a result of the observations contained in the relevant sections of my Report, in my opinion, the Statement of Asset and Liabilities…presents fairly, in all material respects, the Assets and Liabilities as at 31 December 2022’. It is, however, unclear what matter the Auditor General was referring to since his observations, as contained in paragraphs 47 to 57 of his report, did not reflect any adverse comments that warrant a qualified opinion to be issued.

That apart, the Auditor General once again omitted the use of the word “Current” in his certification of this statement. The terms “assets and liabilities” and “current assets and liabilities” are not the same. The former includes not only long-term assets such as land, buildings, machinery, infrastructure development works, among others, but also long-term debts such as outstanding loans from international funding agencies as well as internal debt mainly in the form of debentures. On the other hand, current assets and liabilities include cash and cash equivalents as well as receivables and payables that are due for collection/payment within 12 months of the end of the fiscal year, inclusive of Treasury Bills. Using the cash basis of accounting, as opposed to the accrual basis, long-term assets and liabilities are reported separately, as in the case of the public debt, and loans guaranteed by the government.

Since 2015, the Authorities had decided to move away from the cash basis of accounting to an accrual based one through the adoption of the International Public Sector Accounting Standards (IPSAS). This would have ensured full and complete financial reporting of the Government’s performance, its financial condition and cashflows as well as providing a set of comprehensive notes to the accounts for a better understanding of the financial statements. However, after seven years little progress has been made. The Ministry of Finance’s explanation was that the focus was on the upgrade of the Integrated Financial Management and Information System, including the restructuring of the chart of accounts as a prerequisite for the adoption of IPSAS. However, the same explanation was provided to the Auditor General as far back as 2018.

The Statement of Current Assets and Liabilities shows a net liability of $267.131 billion as at 31 December 2022, compared with $97.771 billion at the end of 2021, an increase of $169.360 billion, or 173 percent. This significant increase in current liabilities was mainly due to the issuance of additional Treasury Bills to finance the National Budget. The net liabilities also included an overdraft on the Consolidated Fund which has increased from $4.425 billion at the end of 2021 to $90.695 billion at the end of 2022. As at May 2021, the overdraft on the Consolidated Fund was $171.363 billion. It was liquidated through the issuance of debentures, which in effect converted a short-term debt to a long-term liability, resulting in a significant increase in the domestic public debt. The overdraft, which was held at the Bank of Guyana, did not attract interest charges, unlike debentures where interest charges are payable at the maturity dates of the debentures.

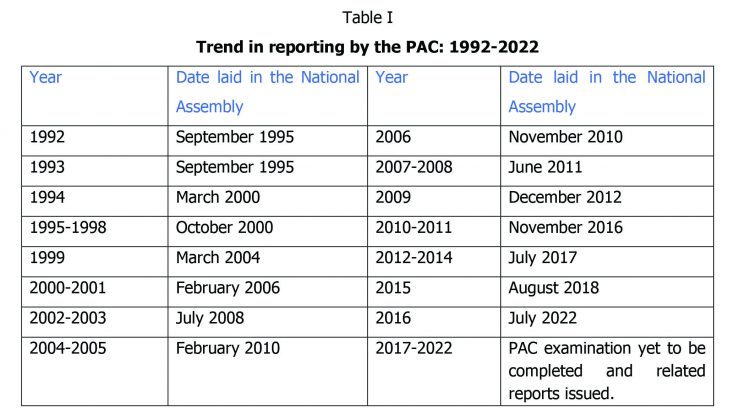

Ignoring transactions relating to Treasury Bills for the purpose of this analysis, had the overdraft as of May 2021 not been cleared, it would have increased to $262.058 billion at the end of 2022. The accumulated overdraft was mainly due to expenditure exceeding revenue over the years, especially in the last three years, as shown in Table II.

For 2023, the budgeted fiscal deficit is expected to be $92.049 billion. In its 2022 Article IV Consultation Report, the IMF had advised that the overall fiscal deficit should not exceed the amount withdrawn from the Natural Resource Fund (NRF), which in effect means that there should be no deficit when the withdrawals from the Fund are taken into account.

The Financial Report of the Deposit Fund relates to public funds that are held pending repayment or payment for the purpose for which they were deposited. The Report shows that amounts totalling $13.853 billion were held in deposit, some of which remained static (or in some cases showed little movement) and have been coming forward for years. The Ledger had also not been written up and reconciled since 1987. Key agencies shown in the Report include Dependents’ Pension Fund ($3.484 billion), the four sugar industry welfare funds ($711 million), and the Guyana Gold Board ($8.650 billion). There is also an amount of $3.665 billion shown as Miscellaneous for which no details were provided. Other major items include Gratuity ($1.185 billion), Imprest & Cash on Hand ($1.719 billion), and Statutory & Other Bodies ($1.554 billion).

The comments of the Auditor General indicated that the accounts were in a very bad shape, an observation that has been made since 1992. As a result, the Auditor General was unable to verify the completeness, accuracy and validity of the individual balances shown in the Fund. He should have issued a disclaimer of opinion on these accounts but has instead chosen to issue a qualified opinion. The Ministry of Finance should investigate all the balances on the Deposit Fund and take appropriate action to enable the Auditor General to issue an unqualified opinion. This may entail transfers to the Consolidated Fund as has been done at the end of 2003.

End-of-Year Budget Outcome

The total amount budgeted to be collected in relation to current revenue was $432.014 billion, inclusive of $126.694 billion from the NRF. Actual collections amounted to $429.875 billion, giving a shortfall of $2.139 billion. One would have thought that the NRF funds would have been used to finance infrastructure development projects in which case they would have been reflected as capital revenue. However, this was not to be, and the funds along with internally generated revenue were used to finance operating expenditure. The NRF Act specifically states that all withdrawals are to be used only to finance: (i) national development priorities, including any initiative aimed at realizing an inclusive green economy; and (ii) essential projects that are directly related to ameliorating the effects of a major disaster.

As regards capital revenue (derived mainly from disbursements of contracted external loans and grants as well as counterpart funding), amounts budgeted to be collected totalled $56.032 billion while actual collections amounted to $53.892 billion, giving a shortfall of $2.140 billion.

The budgeted amount for current expenditure, inclusive of Supplementary Estimates, was $364.234 billion, while actual expenditure amounted to $357.116 billion, giving a saving of $7.118 billion. As regards capital expenditure, of the $284.663 billion budgeted, inclusive of Supplementary Estimates and an outstanding advance from the Contingencies Fund, amounts totalling $258.087 billion were expended, resulting in an under-expenditure of $26.576 billion.

Taking the above into account, of the budgeted fiscal deficit of $160.851 billion, the actual deficit was $131.436 billion.

Receipts and Payments of the Consolidated Fund

The opening balance on the Consolidated Fund reflected an overdraft of $4.425 billion. Amounts paid into the Consolidated Fund totalled $713.641 billion, inclusive of withdrawals from the NRF totalling $126.483 billion as well as proceeds from the issue of Treasury Bills amounting to $229.874 billion. Withdrawals to finance the National Budget as well as to redeem Treasury Bills amounted to $763.598 billion. This gives a net outflow of $49.957 billion.

Taking into account the opening balance, the Consolidated Fund would have been overdrawn by $54.382 billion. The actual overdraft on the Consolidated Fund as at 31 December 2022 was $90.695 billion. The difference of $36.313 billion might have been due to the use of the bank balance as opposed to the cash book balance. However, it is unclear whether the account has been reconciled, and if so, how up to date was the reconciliation. This is an area that the Auditor General may wish to look into.

Statutory expenditure

Statutory expenditure relates to expenditure in respect of those services, which by Law is directly charged upon the Consolidated Fund. It is not voted for by the Assembly and includes pensions and gratuities, repayment and servicing of the public debt, and emoluments of holders of constitutional offices. In relation to the public debt, amounts totalling $37.338 billion were expended, of which sums totalling $8.736 billion relate to the payment of interest. In 2021, interest charges amounted to $7.620 billion. Therefore, there has been an increase of $1.116 billion, or 14.6 percent, attributable mainly to increases in interest charges on local borrowings.

Receipts and Payments of the Contingencies Fund

Receipts of the Contingencies Fund as per Financial Paper No. 2 amounted to $2.905 billion while advances made amounted to $6.718 billion. This gives an unreplenished balance of $3.813 billion as at 31 December 2022. This outstanding balance relates to an advance granted to the Office of the Prime Minister on 29 December 2022. According to the notes to the accounts, this balance was subsequently cleared in 2023 by way of a supplementary estimate.

There were seven advances made from the Contingencies Fund. However, it is unclear whether these advances met the criteria set out in the Constitution and the Fiscal Management and Accountability Act, as there was no comment from the Auditor General to this effect. For an advance to be granted: (i) the related expenditure must be urgent, unavoidable and unforeseen, and for which no funds have been appropriated or the sum appropriated is insufficient; and (ii) funds cannot be reallocated; or (iii) the expenditure cannot be deferred without injury to the public interest.

To be continued –