Pointing to the decline in taxes paid by the self-employed, accounting firm Ram and McRae says that evasion by professionals has “gone wild” and something has to be done.

In its annual review of the budget that appeared in yesterday’s Stabroek News, the firm noted that Finance Minister Dr Ashni Singh spent some time on Monday discussing tax administration and reducing tax compliance gaps across all categories of existing and potential taxpayers. “Whether by `gaps’ he meant tax evasion is uncertain, but there appears to be a gap as wide as the Demerara River when it comes to some categories”, the budget review said.

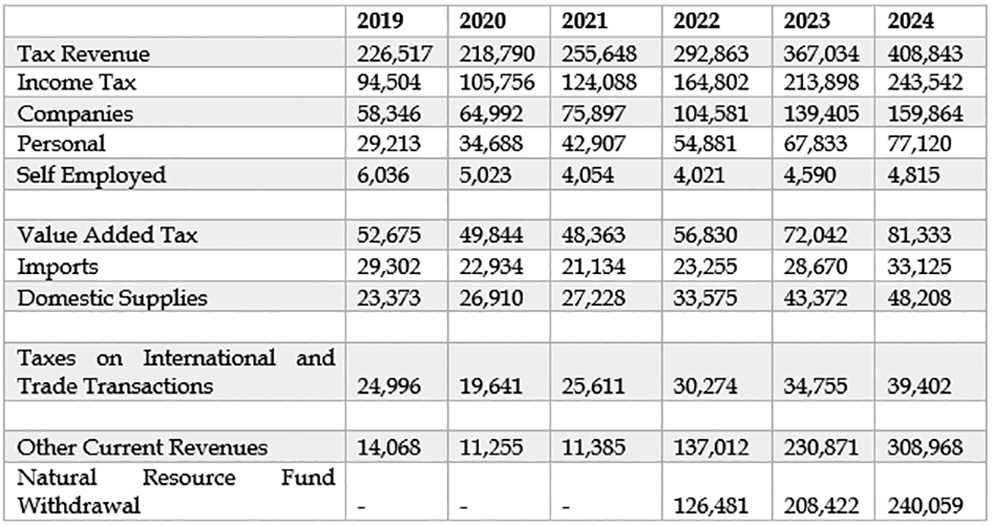

On the surface, it said that collections by the GRA appear fair. VAT on Domestic Supplies has increased from $33,575 million to $43,371 million, an increase of 33.6%. Company taxes have risen from $104,560 million in 2022 to $139,404 million on 2023, an increase of 33.2%. These are two different types of taxes administered by different departments. Contrast these with the tax paid by the self-employed rice farmers and millers, accountants, doctors, lawyers, contractors and miners and loggers. In 2020, the tax collected from this category amounted to $5,023.5 million. In 2023 that number had decreased to $4,589.9 million.

“Professionals may consider themselves a special group and enjoy special licences. But surely, this does not extend to making them immune from prosecution for tax evasion. It just cannot be right that the employed persons must pay their taxes at source while doctors, lawyers and accountants, some of whom hold important positions in our country, have a free ride. As for the contractors, the PPP/C recklessly and without consultation, repealed the APNU+AFC tax measure for a withholding tax on payments greater than $500,000 to contactors”, the budget review said.

It pointed out that tax evasion by this category of persons is considered a serious offence under the anti-money laundering law.

“One can only wonder how contractors, accountants, doctors, and lawyers obtain certificates of tax compliance on a regular basis”, Ram and McRae mused.

It said that as it did thirty years ago, it was restating the case for tax reform.

“Unfortunately, this call may go unheeded by the PPP/C whose own conduct and lack of understanding have contributed to the exacerbation of tax evasion. They regarded as a virtue the removal of the 2% withholding tax on contractors who make little contribution to the coffers to the country. This in no way exonerates the GRA from doing a better job. Regardless of who has friends in the government and in cabinet, they must administer the law fairly and without fear or favour”, the budget review said.