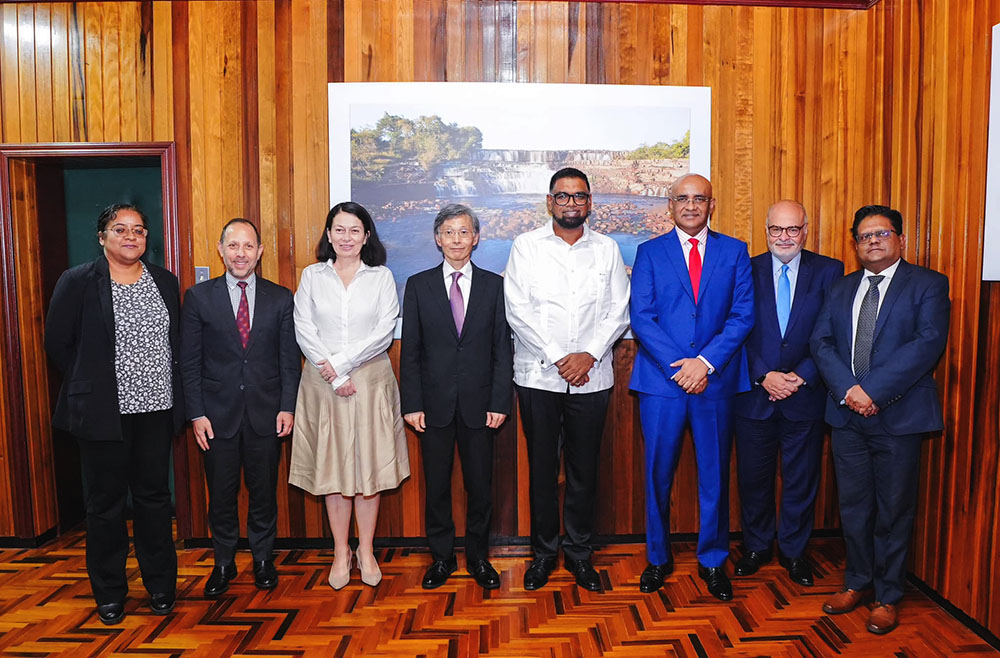

A delegation from the International Monetary Fund (IMF) including Deputy Managing Director (DMD) Kenji Okamura and Executive Director, Afonso Bevilaqua, yesterday met with Senior Minister in the Office of the President with Responsibility for Finance and the Public Service, Dr Ashni Singh, a release from the Ministry of Finance stated.

The IMF team is currently on a high-level two-day visit to Guyana where they will meet with President Irfaan Ali and other government officials as well as visit a number of developmental projects around the country, the release informed.

Dr Singh who is hosting the IMF delegation in Guyana, was accompanied by a team from the Ministry of Finance, while the IMF’s officials were accompanied by Alternate Executive Director, Reshma Mahabir; Mission Chief, Alina Carare; and Advisor to the Deputy Managing Director, Chad Steinberg.

During yesterday’s meeting, the finance minister emphasised that government values the longstanding relationship with the IMF, while providing an overview of economic developments over the years and prospects looking ahead. He also spoke of government’s policies and programmes to enhance the lives of the country’s citizens while containing risks during this current period of its stewardship of the country’s finances to improve all sectors of the economy.

In its December 2023 Article IV Consultation report, the IMF had commended the Government of Guyana for economic management, including the implementation of policies and initiatives geared at transforming Guyana’s economy. The findings were published following an official IMF mission visit to Guyana in September of that year.

According to the release, in its findings, the IMF had highlighted that Guyana’s real GDP is expected to continue to grow rapidly, and that Guyana achieved 62.3 per cent real Gross Domestic Product (GDP) growth, the highest in the world in 2022. It is estimated that Guyana’s economy should record a 38.4 per cent real GDP growth rate this year, while the country’s growth should continue with an expansion of an expected 26.6 percent in 2024.

The IMF had also noted that in relation to inflationary pressures, government had introduced a suite of measures in 2022 and 2023, which contributed to a decline in the inflation rate in 2023. The Fund had also reported that government’s current expansionary fiscal policy stance is appropriate, given the country’s development needs and is appropriately balanced by monetary policy.

Precautionary

While it noted that the economy has tripled in size since the start of oil production, fundamentals remain sound and there are no signs of inflationary pressures, the IMF had last December advised the government to establish a precautionary stabilization fund in the medium to long term as a hedge against shocks.

The recommendation contained in one of the annexes to its recent country report following its Article IV Consultation with Guyana earlier last year would have been seen as a criticism of the manner in which the current Natural Resource Fund (NRF) has been structured.

This recommendation came just days after the Inter-American Development Bank’s 2023 to 2026 country strategy for Guyana raised doubts about the frontloading of proceeds from the NRF.

Stating that fiscal policy can play a critical role in ensuring that Guyana’s oil wealth is managed effectively and equitably, the IMF country report said that issues of long-term fiscal and debt sustainability, while not of pressing concern, cannot be ignored as oil is an exhaustible resource.

It asserted that favourable debt dynamics signal that issues of overheating, absorptive and institutional capacity constraints, and inflationary and real exchange rate pressures are likely to be more pressing policy challenges over the near- and medium-term. It pointed out that savings accumulated in the NRF, consistent with a zero overall fiscal balance by 2028 and thereafter, are projected to rise substantially to around 36.5 percent of GDP by 2028.

“These considerations, together with the limitations of the current fiscal policy practices and practical challenges involved in calibrating a floor for the non-resource primary balance, usually recommended in resource rich countries, suggest adoption of a comprehensive fiscal policy framework that guides spending decisions based on a medium-term fiscal framework (MTFF) and updated public financial management (PFM) and public investment management frameworks”, the country report said.

This, it said, should be combined with an effective medium-term fiscal anchor, which staff suggests to be zero overall fiscal balance by 2028 following a transition path with higher public spending to meet urgent human capital and physical infrastructure needs.

It said that the authorities are encouraged to carry out an in-depth analysis, by an independent consultant, of existing absorptive and institutional capacity constraints on scaling up of public spending. This, it said, could be a crucial input in the setting of expenditure limits in the context of the MTFF.

The issues raised by the IMF are likely to become more critical considering that the government now plans to take even more money out of the NRF and has lifted massively the ceilings on the domestic and foreign debts.