Introduction

Today’s column reviews the Annual Report – including the financial statements – of Banks DIH Limited, a group of companies comprising the food and beverage giant and Citizens Bank Limited in which it has a 51% interest. A new addition to the group is Banks Automotive and Services Inc. which is a 99.99% holding of Banks DIH Limited. An old member of the group Caribanks Shipping Co. Ltd. is no more. Today’s Commentary will discuss both the company and the group but will be clear to distinguish between the references.

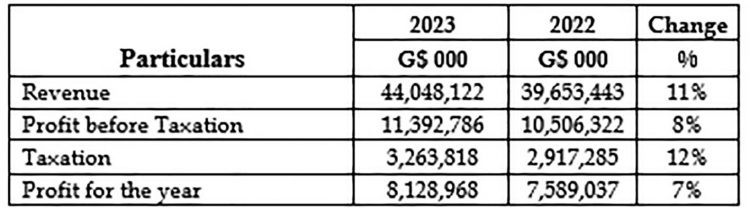

In the year ended September 2023, the Group recorded a Profit before Tax (PBT) of $14.509 billion, an increase of $1.111 billion or 8.29%. The Profit before Tax for the Company was $11.393 billion, which means that the company accounted for approximately 78% of the group’s PBT. The new company reports revenue of $170.9 million and Profit before Tax of $9.2 million. Those figures should be regarded with caution. The spanking new building across Thirst Park is actually owned by Banks DIH and the operational management is also conducted by the parent for a peppercorn charge – distorting the economic performance of the new kid.

Dividends and share price.

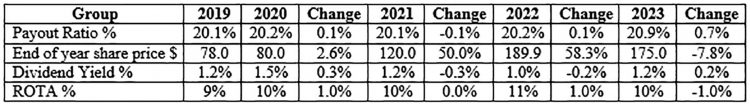

The directors recommended a total dividend for the year of $2.20 per share resulting in an overall cost of $1.870 billion. The CEO and Chairman was keen to highlight that the dividend cost increased by 10 % but steered shareholders’ attention from the fact that the company has one of the lowest (about 20%) payout ratios of companies among Guyanese companies. The Chairman should not therefore be indignant that the company’s share price has slid recently. In a perverse way, a slide in the share price actually helps the dividend yield and makes the shares more attractive. Dividends have been a sore a point among shareholders for several years, both at annual general meetings and, I understand, in direct communication with the company.

Source: Annual Reports of Banks DIH and GASCI website

This stinginess is also reflected in two other numbers computed from the financial statements, which this columnist has found most interesting. Measured by retained earnings in relation to last year’s dividends paid, the company has 29 years of dividends locked in and out of the reach of shareholders. The company has a cash hoard of more than $19 Billion dollars and year after year has a positive cash flow, even with capital expenditure financed from current operations. Public companies are exploiting the lack of opportunities which a small shareholder has at his/her disposal for alternative investments.

The problem Guyana has with public companies is the conflicting relationship which the main institutional investors have with their main boards, a feature of the Banks, DDL and the Beharry groups. There is no way that the main shareholders of the DDL and the Banks Group will go against the wishes of the principal or controlling shareholders or personalities. For the record, the substantial shareholders are the Hand-in-Hand Group, Trust Company, Demerara Life and Banks Holdings of Barbados. In terms of personality, the Chief Executive has an interest in less than one third of one percent of the total shares but seems to enjoy a lifetime appointment, apparently answerable to no one but himself.

Election of directors

Sharing a practice common to many of the local companies, only the non-executive directors are subject to reelection, which in my view is a violation of the Companies Act. In violation of good corporate governance, the majority of the directors of the Banks board are executive directors who are not subject to shareholders’ oversight. And even those who are subject to re-election can hardly be considered independent.

New direction

The board has decided that the model which has worked for decades must be changed and has decided that this company will now become a subsidiary in which individuals and companies will own no shares. This is an absolutely logic-defying move and will have consequences for shareholders. The company with all the retained earnings will become a private company in which existing shareholders will have no interest or voice. It does not appear that this initiative was properly thought out and should be revisited.

Re-routing transactions through Florida

The Company’s and the Group’s purchasing policies have always generated interest, but one particular transaction has put these under microscopic review. It appears that for several years, the Company has unnecessarily re-routed business transactions through a small Florida operation with a share capital of less than US$10,000. The principal of the Florida company it seems has close to 600,000 shares in Banks. Banks Guyana sources alcoholic beverages from a manufacturer in Netherlands and by extrapolation, paid some G$562,123,894 or well over US$2 Mn. in commission to the Florida intermediary.

There is no doubt that Banks DIH is a blue-chip company but with major issues and concerns. Shareholders need to take both note and action.