Introduction

Today’s column addresses price, in the cost-price relation that Guyana’s oil and gas ‘discovery’ will likely encounter, after it comes on stream 5-7 years from today. Like last week’s treatment of cost in the relation, today’s treatment is also indicative. This underscores the difficulty of determining oil prices so far into the future.

Economists model the market price for any product (including oil) as a function of both the quantity demanded and supplied. Demand largely depends on 1) ability to purchase (in turn dependent on incomes, wealth, and so on); 2) preferences (for example, oil versus other energy products); 3) prices of those substitutes; 4) expectations; and 5) the number of potential consumers. Relatedly, the quantity supplied is primarily dependent on 1) production costs; 2) access to supplies (oil deposits); 3) expectations; and 4) total supply.

Economists expect such demand and supply forces to configure all markets and their prices, including crude oil. However, crude oil is traded in a complex market, indeed, one that is too complex for these basic forces to determine its price solely. What follows below, illustrates three crucial features of the oil market, namely, its structure and organization; the role of economic drivers plus the role of non-economic drivers in its operation. In practice, these three features do not function in isolation as might be wrongly inferred from the portrayal below.

Oil market structure/organization

Oil prices are continually changing minute by minute each day. Indeed, oil is traded on 24-hour exchanges, strung across the globe and located in different time zones. Moreover, different types of oil are traded, based on its physical/chemical composition. Oil sold on the Brent exchange is treated as standard.

Oil is sold through future contracts, which set the forward date and price at which sellers will deliver to buyers on the contract. Because price variation is intrinsically continual, this amplifies price fluctuations occasioned by the factors listed below.

Role of economic factors

Schedule 1 lists ten of the most commonly referenced economic factors. These include, but are not limited to: 1) activity of commodity traders (hedging and speculating); 2) existing supply plus access to future supplies; 3) overall GDP and its sectoral growth (worldwide, regional and national) and competitive energy sources; 4) global and national policies/regulations (for example, emissions control, green development and other such environmental regulations); 5) responsiveness (elasticity) of both supply and demand to price changes. The principle is: the greater the elasticity of demand and supply the easier for oil prices to clear market imbalances.

Sixth, oil inventories (stocks). These are typically held to smooth temporary/transitory imbalances in quantity demanded and available supply, which arise from market errors and/or shocks, which often amplify price swings. Seventh, stabilizing speculation, which plays a similar role to hedgers, in smoothing demand and supply imbalances. On the other hand de-stabilizing speculation, disrupts market operations and price formation. The historical record reveals that destabilizing speculation has been quite frequent in the crude oil market.

Eighth, crude oil prices are quoted in US dollars. Therefore, changes in the US exchange rate relative to other countries affect the income received and the amount that has to be paid in those other currencies. Ninth, economists have empirically established that although their length varies, commodity prices behave in distinct long-term cyclical patterns. Finally, the cost of producing oil (which depends on available reserves, technology, skills, and finance) has an independent impact on its market price through supply.

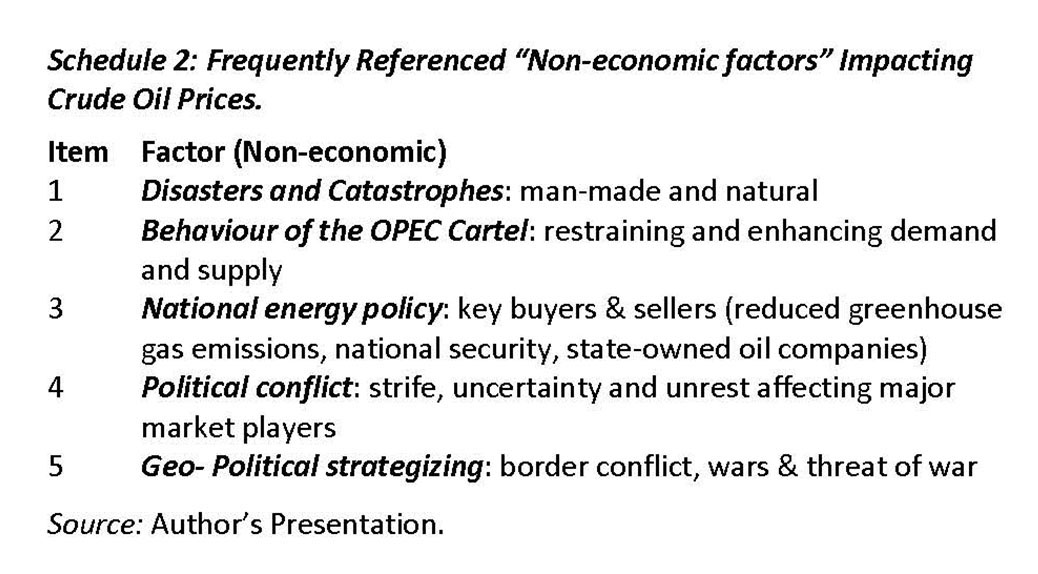

Role of non-economic factors

Oil prices are also heavily impacted by non-economic factors. Schedule 2 highlights five of these: 1) disasters and catastrophes (both man-made and natural). These physically disrupt market supply and demand. 2) Operations of the OPEC cartel (which accounts for one-third of global oil sales). Like all cartels, OPEC seeks to manipulate the market. 3) National energy policies pursued by major players and groupings of these players, as well as the international community (through the UN system). Their policies impact the energy-intensity per unit of output (GDP), and reveal national (government) preference functions for the energy-mix.

Fourth, global political conflicts impact on the oil price because of the central role oil plays in today’s energy-mix, around which standards of living and the quality of life revolve. Finally, at a deeper level, this political factor morphs into geo-political strategizing of the major players in the oil market.

Conclusion

The factors listed above are so important that any one of them can be the subject of an entire column! Space does not permit this. It does make it clear though, that forecasting oil prices, (with a reliable degree of certainty 5 to 7 years into the future) cannot be sensibly accomplished. Indeed, recent projections I have seen for 2021-2025 by different analysts (foolhardy) put these prices in an incredulous range: from less than US$30 to above US$220 per barrel, at 2013 prices!

Next week I suggest indicative prices.