Cummins, a commenter on SN’s web page, stated that Karl Marx’s ideas are outdated and not relevant to the 21 century. He suggests that “maybe there is a much better system in man’s mind and is yet to be tried.” He says “… capitalism, offers the best hope for people, especially poor people”. My fellow blogger, Mr. Skinner, feels that America is the model for us to follow. I guess it’s because Guyanese have it so much better over there.

We have to accept that capitalism is no longer a country thing but global in nature. This globalization is touted to be the instrument to accelerate global growth and at the same time create more economic opportunities and reduce poverty. Many including this writer have a problem with this conclusion as the evidence does not support this.

Evidence indicates that there was less growth after global liberalization and definitely more inequality.

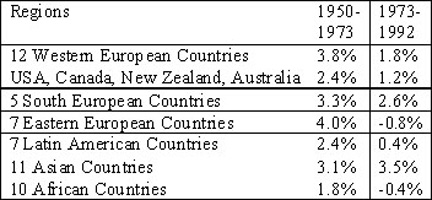

The Table below demonstrates the reduction in growth rates.

What is interesting to note is the growing disparity between the rich and the poor countries engendered by global liberalization.

From 1950 to 1973 the spread between the richest and the poorest of the seven regions increased from 10:1 to 11:1 but from 1973 to 1992 it increased from 11:1 to 16:1. The spread between the richest and poorest of the 56 countries mentioned in the table increased from 35:1 to 40:1 during the first period but for the period 1973 to 1992 it increased from 40:1 to 72:1 (Robin Hahnel).

The reality is that the USA and Britain, especially their control of the International Financial Institutions, are imposing liberalization which obviously benefits the rich nations.

With regards to capital market liberalization, this is being pushed although according to Stiglitz “there is no evidence showing its spurs economic growth”. He further stated that the “European countries banned the free flow of capital until the 70’s. Some might say it’s not fair to insist that developing countries with a barely functioning banking system risk opening their markets. The advanced industrial countries – including the United States and Japan – had built up their economies by wisely and selectively protecting some of their industries until they were strong enough to compete with foreign companies”.

Today the USA through the IMF and World Bank and the IDB is forcing a free for all in the developing countries – total liberalization.

On the question of Russia and globalization Stiglitz stated that it had “not produced the promised result in Russia and most of the other economies making the transmission from communism to the market” Almost all except two had declines ranging from -1.4 to -20% with the Russian Federation at – 9.8 (World Bank, 1997). And there is a need to contrast Russia’s transition as engineered by the international economic institution and that of China designed by itself.

China accommodated foreign capital and private investment but they operate within a dominant socialist political and economic structure.

According to Stiglitz “The western countries have pushed poor countries to eliminate trade barriers but kept up their own barriers, preventing developing countries from exporting their agriculture products and so depriving them of desperately needed export income. The United States was of course one of the prime culprits”

Food for thought: The USA’s contribution to aid the poor is 0.02 percent of its income in real assistance, says a study released by Action Aid International. USA refuses to double its aid to Africa by 2015, and so the British Chancellor is appealing to the “richer oil producing states” of the Middle East to fill the funding gap. “Oil wealth to save Africa” reads the headline in the London Observer.

An article in The Nation captioned “A noose, not a Bracelet” reads “Here is a better idea: Instead of Saudi Arabia’s oil wealth being used to “save Africa” how about if Africa’s oil wealth along with its gas, diamond, platinum, chromium, ferroalloy and coal wealth was used to save Africa.

Stiglitz, Nobel Prize winner in economics stated clearly in his book “Globalisation and its Discontent” page 5, “To many in the developing world Globalization has not brought the promised benefits”. He continued stating that there is a growing divide which “left increasing numbers in the third world in dire poverty living with less than a dollar a day”

With regards the USA, according to Robin Hahnel, “the top 5% of households benefited from increased income 16.6% in 1973 to 21.2% in 1994. The top 20% obtained increased income from 43.6% to 49.1%. At the same time the share of the poorest 20% fell rom 4.2% to 3.5%.

Between 1976 and 1992 the share of the wealth owned by the top 1% doubled. This is explained by the fact that the top 1% received 62% of the gain in wealth between 1983 and 1989, while the bottom 80% obtained only 1% of the increased wealth.

Interestingly while labour productivity increased the average real wage in the USA fell by 11 percent.

It is left to the readers to wonder if indeed this system provides any hope at all. Unfortunately the ideologues of this system have utilized the corporate media to fashion the minds of people to condemn the alternative as being absolutely wrong while during the Cold War we were told that we must take the better of the two systems. So we threw out the baby with the bath water.

I see no evidence to suggest it has improved rather it seems to have deteriorated.

Yours faithfully,

Rajendra Bisessar