Time Horizon

An observation was made about the use of the word “yield” in the narrative of the Lucas Stock Index (LSI) and of the importance of not confusing the concept of the yield with the concept of rate of return on investment. The observation pointed out an important difference between the yield and the rate of return, a difference which arose from the time horizon under consideration. The yield, it observed, covers multiple time periods and therefore tends to be forward looking while the return often refers to a single period, whether a week, a month, or a year. That observation is essentially correct and offers us an opportunity to make a few remarks about the LSI and the relevance of those two concepts to it. We will therefore make use of the desire for the index to continue providing useful information and to help increase awareness among Guyanese about financial and investment issues and concepts. In this context, we will first discuss briefly the concern about the way the word yield is used in the LSI and then we will talk about the numbers that appear in the weekly narrative.

Same Concept

It is important to realize that the yield and the return are essentially the same concept. Both of them are based on a rate of interest or rate of gain and both of them require a time period for maturity. These two elements are necessary to facilitate measurement and comparison of the concepts. For comparisons to be meaningful, similar or like items have to be used. This is at the heart of the observation on the use of the two concepts of yield and return. As is often the case, both the rate and time period can be different, thus making it difficult to talk about the two concepts without first doing some additional work. Yet, the return might be the simpler of the two to understand. The return simply measures the amount of gain or loss that an investor obtains as a percentage of the money that was initially spent. For example, a stock purchased for G$10 and sold for G$12 one year later yields a return of G$2 or 20 percent.

The more troublesome of the two concepts is the yield. It is itself a rate of return that usually covers multiple periods of time. The yield therefore involves compounding the return until the security is gotten rid of, whether by sale or redemption. It generally assumes that the interest earned is reinvested as many times as necessary over the life of the security. It should be pointed out that returns that cover one year or less are acceptably referred to as current yield. For example, when the capital gain of G$2 on the stock referred to above plus any dividends received within the year are divided by the initial price of the stock that return is referred to as a current yield. The important point here is that over the short-term, the yield and the return are essentially the same concept. Even when the maturity of a security exceeds one year, the yield becomes a way of providing an upfront indication of the annual rate of return on the investment.

Stable

Securities are of different kinds and carry many maturity periods. They can be stocks, bonds or Treasury Bills (T-Bills). For example, T-Bills issued in Guyana carry maturities of 91 days, 182 days and 364 days. The LSI references the 91-day T-Bill as a way of identifying a basis for comparing other investments, primarily stocks. The index selected the 91-day T-Bill since it is public and almost all the details of the instrument are known. The index could have used the 182-days or 364-days T-Bills, but there is no significant secondary market for T-Bills in Guyana. Moreover, the shorter term treasuries remove the risk of significant interest rate fluctuations because of the short periods of maturity, suggesting that the return on the investment could be regarded as stable. For us, the future value of the T-Bill will be realized. The stock price is not a security with a defined maturity period. However, an investor is free to decide for how long he or she would be willing to hold the stock. It could be for any period less than a year or more than a year. The focus is on stocks as an alternative to treasuries because that is the composition of the index and there are virtually no other investment securities available inside Guyana.

Approximation

The LSI has been using year-to-date (YTD) values of the stock index as approximations of annual rates of return without necessarily converting them to an annualize rate. The returns only takes account of the short-term capital gains of the market. The assumption was that the YTD value would be enough to provide interested persons with a clue to the performance of the stock market vis-à-vis T-Bills or any other investment option in which he or she might be interested. The LSI is not intended as advisory tool, but many understand that it can be of interest to persons who see value in investing in equity and debt securities that are sold in Guyana.

Annualized

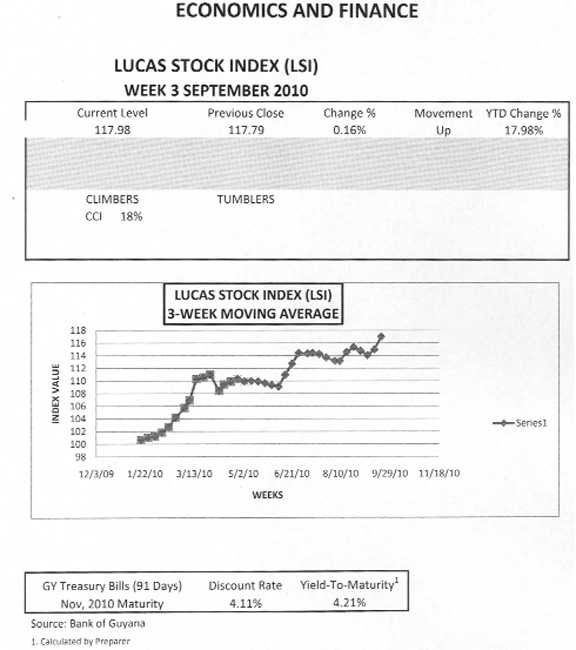

As noted earlier, the yield is a way of making it possible to see what the return on the T-Bills would be if they were held for an entire year. Because the yield is, in essence, an annual rate, it helps to bring the future cash flows of the T-Bills to the present. It is that consideration that encourages the comparison between the current period or YTD returns of stocks and the yield of the short-term treasuries. Given the interest there is in having the index continue serving a useful purpose, the observation is noted. As of 9/20/2010, the YTD return of the LSI was 17.98 percent. When annualized, the return is 19 percent, still over four times greater than the 91-day T-Bills.

LUCAS STOCK INDEX

In week three of September 2010, the Lucas Stock Index (LSI) gained an additional 0.16 percent to bring the index to 117.98. This 18 percent increase helped the index to record a marginal gain for the week. The positive movement in the index pushed the return above four times that of the risk-free Treasuries with maturity in November 2010.