As indicated previously, several analysts view the EC’s legal denunciation of the Sugar Protocol (SP) in 2009 as the “final nail in the coffin of Guyana and the rest of Caricom’s sugar industry.” That event has been held mainly, if not solely responsible for today’s crisis in the region’s sugar industry. As the EC’s intention to abandon the SP became more and more apparent, the rest of Caricom strategically opted to terminate sugar production as it had evolved up to then. Contrarily, Guyana decided to continue its industry as is, based on what I believe is opportunistic decision-making.

Regional analysts have, however, generally underestimated the dire straits confronting all Caricom sugar producers then. In the 1960s, sugar was indeed king. The ten West Indian sugar producers together produced about 1.4 million tonnes of raw sugar and as a group were ranked among the world’s top ten producers (ninth). Thereafter, however, several regional producers, for different reasons, abandoned sugar so that when the EC denounced the SP in 2009, there were only six left. These produced one half of the earlier quantities (averaging 775,000 tonnes from the mid-1990s to the mid-2000s).

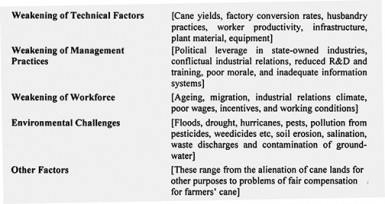

At its peak, Guyana produced about 360,000 tonnes of sugar, which accounted for about one third of its GDP and 40 per cent of export earnings. Presently, sugar accounts for about one tenth of its GDP and one third of export earnings. Its sugar output growth for the period 1961 to 2002 was negative (-0.85 per cent). For the region as a whole that decline was even greater (-1.97 per cent). The steepest declines occurred in Barbados (-3.87 per cent) and Trinidad and Tobago (-3.83 per cent). Only Belize had positive growth (2.92) per cent. The schedule below summarily identifies the factors causing this.

Rest of Caricom responses

Consider some of the subsequent actions taken by the other Caricom states in relation to their sugar industries: 1) St Kitts and Nevis exited the industry even before the EC’s formal denunciation of the SP. 2) The Trinidad and Tobago Government produced a National Sugar Strategy and closed Caroni (1975) Limited. The strategy’s objective was “to diversify and develop the economic base of formerly sugar-dependent areas.” This entailed the re-training of former Caroni employees and the provision of land development schemes for agricultural, industrial, residential and service activities. Pension plans were provided for ex-sugar workers and social and environmental impact assessments are being conducted to guide the adaptation of sugar-dependent areas.

3) Barbados, Belize and Jamaica have all invited external private investors into the industry. The Government of Barbados announced “its withdrawal from the EC sugar market, since it was uneconomical.” It also declared that the industry’s assets will be focused on serving “national and regional markets, based on special refined sugar and molasses (geared to high quality rum).” It further announced that Japanese investors had joined government’s effort to convert the sugar sector into “renewable energy.” Its 2013 plan is aimed at producing: 15,000 tonnes raw sugar; 12,000 tonnes refined sugar; 24,000 tonnes of molasses and, 170,000 megawatt hours of electricity, as well as using sugar assets as tourist attractions!

Similarly, the Jamaican government has joined with a Chinese company (Pan Caribbean Sugar) to expand its sugar industry based on private access to the Cariforum-EC, EPA market, and others, including Caricom and the United States.

The Government of Belize has brought in private US investors (American Sugar Refineries) to exploit the premium brand status of Belize’s fair trade sugar. This is based on the fair trade practices of its mostly independent and cooperatively organized cane sugar producers.

Guyana’s response

While other Caricom sugar producers have sought the strategic option of ending their sugar industries along inherited lines, Guyana has instead opted to continue as is, in the risky expectation that improvements within the traditional GuySuCo framework would suffice. In making this choice the key indicator which Guyana has failed to apply is the relation of the average full cost of producing its sugar (as indeed for all Caricom producers) to the likely long-term world price of sugar. This relation is the only safe guide for determining whether exporting sugar is sustainable.

The SP price has varied in relation to the world market price between 1975 and 2009. It has, however, in later years reached multiples as high as four times the price prevailing in the free world market. This has masked somewhat the stringency of the underlying cost pressures GuySuCo has been facing. And it is those pressures which fundamentally explain why the industry has reached a point of no return. As I shall demonstrate next week, this observation does not ignore the considerable value the SP brought to all the parties to it (EC, ACP, and Guyana).

The Guyanese authorities have misjudged the political economy facing GuySuCo and indeed Guyana at the time. They were bamboozled by the prospect of the industry gaining, if other Caricom producers dropped out of sugar, and Guyana was then allowed to claim for itself their shortfalls in accessing the EC market.

Conclusion

Guyana’s opportunistic response to the denunciation of the SP is not bearing fruit. This conclusion does not, however, mean the more strategic option chosen by other Caricom sugar producers will yield better results. While the verdict on Guyana’s opportunistic decision is clear, the jury is still out for the other Caricom sugar producers.