This New Year’s column 2017, starts discussion of the last topic left in this continuing 50th Anniversary series on Guyana’s extractive industries. It focuses on policy issues arising from the impending development of the oil and gas sector. These issues are rather complex, but nonetheless remain of fundamental importance, if Guyanese are to play constructive roles in designing, executing, and monitoring the sector’s development.

In the 2016 National Budget, the Ministry of Natural Resources had identified four broad policy areas for the sector, namely,

More recently, (December 2, 2016) the ministry had further announced eight specific policies/ laws/regulations, scheduled to be in place by the end of 2016! These are: 1) a national oil and gas (upstream) policy; 2) a local content policy; 3) petroleum exploration and production legislation and regulations; 4) a petroleum regulatory commission Bill; 5) the regulations and oversight mechanisms for the commission mentioned at 4; 6) petroleum taxation and fiscal legislation; 7) a sovereign wealth fund; and 8) the public commission framework.

In my view, there are three priorities seemingly spearheading government’s actions. These are 1) the establishment of a Guyana sovereign wealth fund and relatedly, designing fiscal rules for utilizing expanded export revenues; 2) securing membership of the Extractive Industries Transparency Initiative (EITI) and related governance issues; and 3) passing legislation to embed local content and linkages into the economic and financial activities of the oil and gas sector. Each of these policies will be assessed in turn, and treated as the first set of policy priorities to be addressed in these columns.

It should be noted here that government is expecting: 1) substantial increases in export revenue inflows and correspondingly in its spending; 2) to use these enhanced means to boost economic growth (GDP) and broader development; 3) its spending to be sustainable, and thereby promote sustainable forms of development; and, finally, 4) to be equitable in relation to present and future generations of Guyanese (inter-generational equity).

Sovereign wealth funds

During its 2016 National Budget presentation, the Ministry of Natural Resources had advocated:

“It is important that the extractive industries that fuel our growth today also provides for the future of our children tomorrow. In an effort to ensure that the benefits accrued from the sector reach every Guyanese for generations to come, the Government of Guyana will finalize a framework for a Sovereign Wealth Fund (SWF), in 2016. The SWF will enable us to protect the economy from the volatile nature of mineral economies, help growth and modernize the sustainable non-extractive sectors of the economy, and further, advance the capacity of our people”.

What is a SWF? There are several definitions, but their common core contains the following elements: 1) a long-term state-owned pool of money (investment fund); 2) invested in a variety of assets (financial and real), including: stocks, bonds, FDI, real estate, precious metals, along with “alternative investments” such as private equity/hedge funds;3) these assets are held globally; and 4) funded by export revenues from both commodity, and non-commodity sources (our main interest however is specific to oil and natural gas exports). Typically, SWF funds are preferred to central bank holdings because they serve very different purposes. In financial circles the quip is: SWFs aim “to maximize long term returns”; while central bank holdings aim “to minimize currency volatility and inflation”. This quip is not strictly accurate!

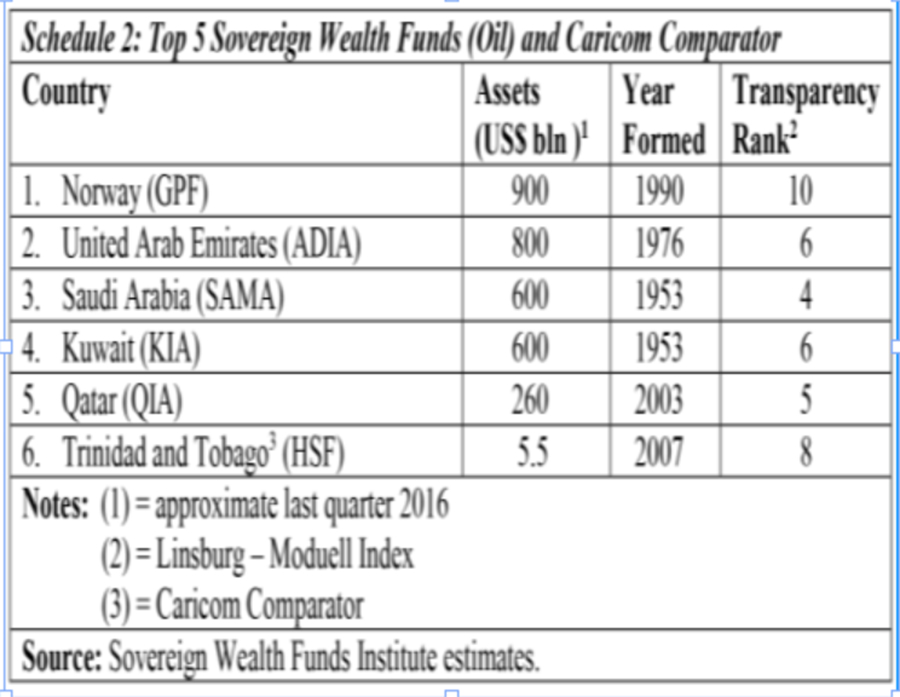

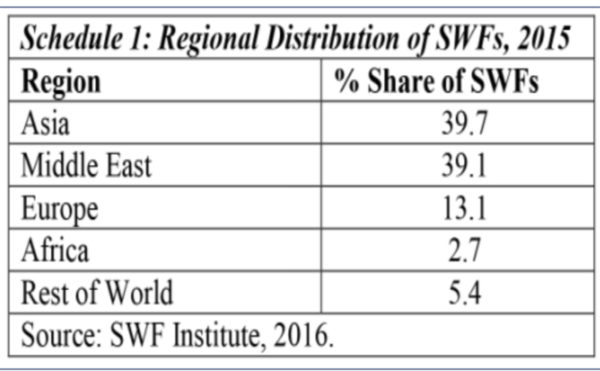

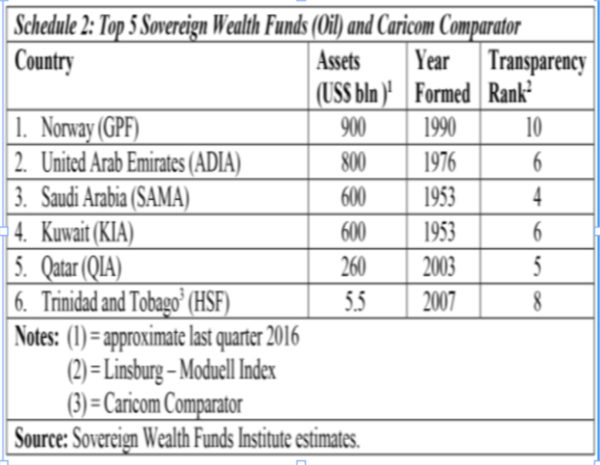

Although popular awareness associates SWFs exclusively with the export of oil and gas, empirically this is not true. Worldwide, we find, out of the 80 odd SWFs (end 2015), just over 57 per cent of their holdings are based on oil and gas revenues, and the remainder are based on other commodities, and non-commodities. The total assets of all SWFs were estimated at US$7.3 trillion (end 2015) and their distribution by region is indicated in Schedule 1.

Further, Schedule 2 shows the world’s top 5 oil-based SWFs, along with Trinidad and Tobago ¾ Caricom’s only SWF at present. The date of their formation is included, as well as their rank in terms of their “transparency and accountability”. This latter feature will be a prominent part of our discussion on this topic as it develops.

Most Guyanese are of the view that Norway is responsible for innovating oil and gas revenues management through its establishment of the first SWF. As the data in the Schedule reveal, this is not the case. Four decades earlier (1953), Kuwait and Saudi Arabia had already established their SWFs. These were followed by the United Arab Emirates (nearly a quarter-of-a century later).

Conclusion

Next week I shall begin the evaluation of an SWF as a policy tool (instrument), and consequently, its applicability to Guyana. I shall evaluate its relevance and what can, at best, be expected of it. As we shall observe, this discussion raises issues of immense importance for formulating policy guidelines in Guyana’s coming time of oil and gas extraction and export.