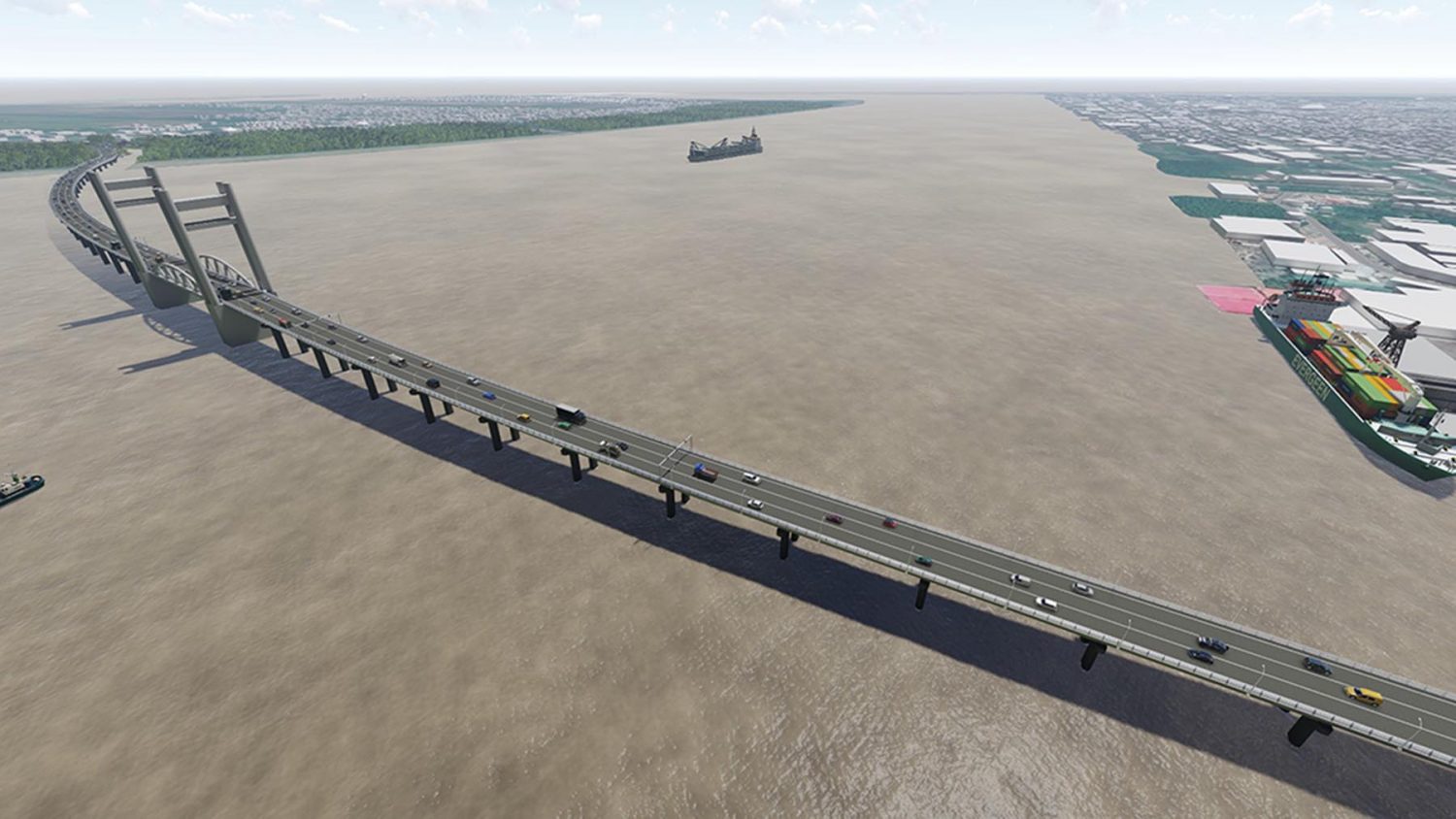

The proposed US$150m three-lane, low bridge from Houston to Versailles will not be financially viable without support from the government, according to the feasibility study done by Dutch company LievenseCSO.

The feasibility study which was submitted to the government on August 17th this year and released yesterday by the Ministry of Public Infrastructure, said that revenues from the proposed toll would make up for operational expenses but would not cover debt servicing.

The study said that the toll rates can be increased but there is a limit to that as too large an increase would make it unaffordable to users.

According to the study, “There seems to be strong appetite and sufficient liquidity in the financial markets of Guyana and the region to fund the Project. Loans or bonds and preferred cumulative shares issues provide for the required funds. This so-called Project Financing Structure requires a government supported Special Purposes Company (SPC)”.

The study does not cite the source of its optimism of funding availability. Several of the issues raised in this study are similar to those that the former PPP/C government had grappled with in relation to the Berbice Bridge.

LievenseCSO said that a private-public partnership such as Build, Own, Operate and Transfer (BOOT) where the concessionaire has to arrange the financing can only be successful “if the government provides support in case contribution and certain guarantees”.

The study added that the government voiced the wish to maximize funding from the non-government sector in order to limit the government’s contribution. The study says this therefore means that a BOOT-type structure is required where commercial banks and institutional investors are involved.

“The overall objective is a sound and sustainable funding of the project whereby the government contribution is minimized and at the same time an affordable toll rate is charged”, the study added.

The investment is budgeted at US$150m of which 20% will be denominated in local currency.

The study said that the traffic numbers for the study were taken from the traffic forecast study. A cap on traffic demand was applied as the road network will become saturated at a certain point in time. The toll rates applied are at the present rate (scenario 1) and scenario 2 and 3 which have been increased by 100% and 200% respectively.

“In all scenarios a general increase of 9% at the end of each consecutive third year has been applied to follow the increase of cost in time”, the study added.

The study said that there is a good case to make for increasing the rates and that “there are voices stating that increasing the rates even further to triple (increase of 200%) would still be acceptable”.

The existing toll categories and tariffs for ships are applied, the study said, raised with a part of the amount that will be saved on demurrage costs as the bridge can open any time except for rush hours. “These rates are increased charging a toll for the ocean going vessels in the amount of USD 1625 (in 2017 USD 250). The marine traffic tariffs also grow by 9% every fourth year.

The funding plan assumes that the project is exempt from paying import and VAT taxes and that a dividend is only paid if the project make a profit.

LievenseCSO advised that toll rates be increased by 250% of the present rates and the toll for river vessels by 700%. Under this model the government would have to contribute US$39m over the first five years after which the project becomes viable.