SWFs &Global Capital Circuits

Today’s column revisits my earlier discussion (January 8 to February 5, 2017) of Sovereign Wealth Funds (SWFs). At that time, the Authorities were proposing a SWF as one of three priorities, laying the foundations for Guyana’s national petroleum management framework. My earlier effort (and today’s) offers a Guyana perspective on this matter, in the hope of furthering better design outcomes.

Such an outcome is crucial, given the global drumbeat (strongly echoed in the local media) which asserts that SWFs are “progressive policy proposals.” Indeed, these are advocated as representing only the best interests of small poor petroleum exporters. I do not believe Guyana can afford such “progressive orthodoxy.” I shall advance later that all SWFs recycle surpluses generated from national resources exploitation in Guyana-type economies, into global capital accumulation circuits. These accumulation circuits drive capitalist expansion and growth, yet this feature is never stressed in proposals to establish SWFs! Indeed, it is typically claimed: SWFs only perform essential roles for the benefit of petroleum-rich Guyana-type economies. While this driver is never admitted in the discourse on SWFs, I shall have much to say on it, when I expand later in some detail on my Buxton Proposal.

Essence of SWFs

In essence, SWFs constitute long-term state-owned pools of money (investment funds), which are invested worldwide in real and financial assets. These pools derive largely from export earnings. Investors claim that some Central Banks are similarly structured. However, Central Banks’ goal is currency stability and avoiding inflation, while SWFs goal is to maximise returns.

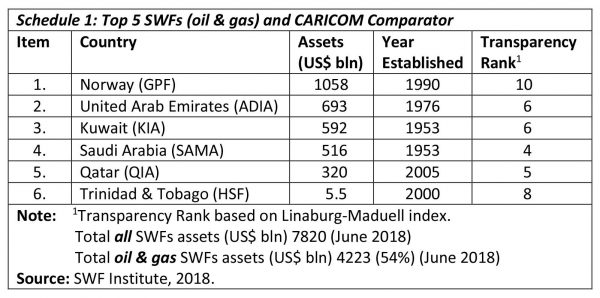

At the end of August 2018, there were worldwide 80+ SWFs, holding assets totaling US$7820 billon. The assets were held against revenues from petroleum, other commodities, and non-commodity items. Fifty-four per cent of the assets were held against petroleum revenues (June 2018). Schedule 1 lists the top 5 petroleum-based SWFs, along with Trinidad and Tobago’s Heritage and Stabilization Fund, for purposes of comparison.

Norway’s Fund (GPF) is the largest (US$1058 billion), followed by the UAE (693), Kuwait (592), Saudi Arabia (516), Qatar (320) and the Comparator (Trinidad and Tobago) at only US$5.5 billion. All these Funds are listed among the top 10 in transparency rankings.

Contrary to popular belief, Norway (1990) is not the country that first established an SWF! Four decades earlier (1953), both Kuwait and Saudi Arabia had established theirs. Some countries also have multiple SWFs. Regional distribution shows Asia and the Middle East account for around 40 percent of the global total, Europe 13 percent, and all of Africa less than three percent.

Lessons Learnt

My earlier analysis focused on drawing lessons from global experiences, to guide Guyana’s efforts. I had posited then that the economic features and design of Guyana’s SWF should be guided by two basic factors; namely 1) promoting the Green State and sustainable development vision and 2) macroeconomic management of the risks/uncertainties that small, poor, open developing economies routinely face.

Guyana’s SWF should therefore, 1) be integrated into the country’s national budgetary processes, 2) utilise global best practices (especially in the area of governance), 3) establish a ‘careful’ balance between rules and discretion in its main areas of operation (both extremes must be avoided), 4) avoid ambiguities in the key areas of regulation, oversight and surveillance, 5) secure a long-lasting commitment from successive governments particularly in such areas as defining Fund objectives; disclosure requirements; employment of specific numerical targets; unambiguous investment rules; and, backed by legislation defining the responsibilities of stakeholders.

Conclusion

In conclusion, five observations are advanced: First, there are no perfect SWFs. Searching for such is futile, illusory, and wasteful. The Authorities should establish Guyana’s SWF in an iterative or evolving process. That is, one in which the Authorities commit to improve, in response to all demonstrated weaknesses. In this sense, Guyana’s forthcoming SWF, cannot be presented as “done and dusted,” after the legislation is passed and the organisation established!

Second, there is no “one-size-fits-all” set of legislation and organisation to be purchased “off-the-shelf.” Each SWF has to be designed/constructed as specific to its economic environment. Guyana’s size, the size of its expected petroleum finds, its openness, human and institutional capabilities, along with its investment needs, growth and poverty reduction requirements, have to be inputted into the design of its SWF.

However, although SWFs should be located in their economic specificities and cannot therefore, be purchased “off-the-shelf,” I had noted (February 5, 2017) that “there are salespersons (consultants) who are ready to provide readymade templates (even though) “in truth both their design rules and analytic economic foundations … are country specific.”

Third, a common thread throughout SWF legislation/ structure/operation is the preservation of a balance between rules-based regulations/decision-making and the discretion afforded to the relevant Authorities. Third World oriented policy recommendations, presume rules-based SWFs “insulate” these countries from the supposedly grave danger of political direction. As I had indicated earlier, this danger is over-stated. And, indeed it is rooted in contempt for Third World governments. I believe though that self-styled experts and unelected spokespersons pose far greater risk of subverting the public will. I had concluded earlier, and it bears repeating here, while I strongly believe history supports this observation; today’s column is not the place to pursue this polemic.

Fourth, all SWFs carry intrinsic risks. One of these intrinsic risks is moral hazard. This particular risk is embedded in all insurance-type arrangements; and arises because insurance spending provides compensation for errors in risk-taking behaviour. However, such spending also competes with expenditure devoted to minimising/preempting risks.

To repeat: “there is no known perfect SWF.” Furthermore, every SWF which I have researched, has been “the subject of serious criticisms.” This will apply to Guyana’s coming SWF. The key lesson is that the Authorities should not “feel threatened by this outcome.” I urged then and repeat today, Guyana should “remain open, receptive, and even positively responsive to constructive criticism.”

Next week, I evaluate the Green Paper on Guyana’s SWF.