Last week I addressed two of the four lines of justification, which I advance in support of my bullish prediction of 13 to 15 billion barrels for Guyana’s oil reserves. These two lines were: the “Atlantic mirror image theory” of Guyana’s petroleum geology and two US geological assessments of the Guyana-Suriname Basin’s petroleum potential. Today, I address the two remaining lines, namely: other bullish expert opinion and Guyana’s “creaming curve.” Section I provides a small recent sample showing the range and authority of global expert opinion, with a similarly bullish outlook. This opinion stands in stark contrast to the manufactured “doom and gloom,” which infests local commentary and its echo chambers. Section 2 addresses the creaming curve.

Section 1: Bullish Expert Opinion

Consider:

1. Drilling Offshore

The December 3rd, 2018 issue of Drilling Offshore cites petroleum expert Luiz Hayum’s claim: “With about 17 projects still to drill [Guyana] will easily become the fourth largest oil producer within the Americas by the end of the next decade, if Venezuela and Mexico’s production decline continues.”

2. Offshore Energy Today

This publication’s February 14th, 2019 edition states: “US oil major Exxon Mobil can’t stop finding oil in Guyana” (my emphasis). This assessment followed the recent (January 2019) discoveries: Tilapia 1 and Haimara 1, which make for 12 successful discoveries in the Stabroek Block.

3. ExxonMobil

ExxonMobil’s Exploration Company notes: “We see a lot of development potential in the Turbot area [in the Stabroek Block] and continue to prioritise high potential prospects … we expect the area to progress to a major development hub providing substantial value to Guyana, our partners and ExxonMobil.”

4. Rystad Energy

Similarly, Rystad Energy has reminded us: “US oil major Exxon was the leader of the pack among the top oil and gas explorers in 2018. ExxonMobil was exceptional both in terms of discovered volumes and value creation for exploration.”

5. Energy Group, Canada

The Energy Group has labelled Guyana’s “reservoir quality exceptional with low development costs and low risk.” Furthermore, “of the top 50 developments [the Group] surveyed, on average, Guyana’s figures are among the lowest.”

6. Wood Mackenzie

In September 2018, Wood Mackenzie depicted Guyana as “a new planet in oil’s solar system” (my emphasis). This same piece projected Guyana would become one of an “elite group” of oil exporters, “exporting more than one million barrels a day, when four years ago it produced none.”

7. The National

Finally, Robin Mills in The National asked the question “who will be world’s largest oil producing country per person in the 2020s? And, responded “Guyana may be the next big beast in global oil” (my emphasis).

These superlatives reinforce the substance behind my bullish outlook. The Road Map, therefore, invites Guyanese to awake and grasp the driving and transformational potential, which may soon be ours.

Section 2: Creaming Curve

Kevin Ramnarine, Minister of Energy, Trinidad and Tobago, at a Guyana Oil and Gas Association Conference (2017) introduced the notion of the creaming curve to public discourse on Guyana’s petroleum sector. He stated: “if we believe in the creaming curve, we know that Guyana will find more and more oil and we begin to find more and more oil closer and closer to the shoreline” (my emphasis). What is a creaming curve?

In energy economics a creaming curve depicts a graph showing the relationship between cumulative aggregated volumes of oil reserves growth (on the linear Y axis) and, on the linear X axis, the number of wells dug over time. The steeper the curve, the more rapid is the revealed rate of discovery. And, the flatter the curve the more gradual is that rate and/or the smaller the size or the drier is the wells.

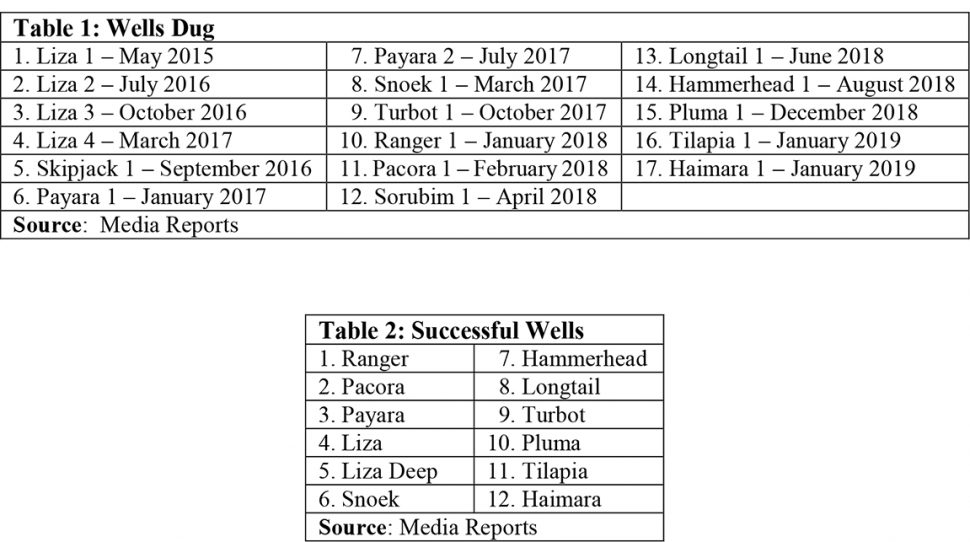

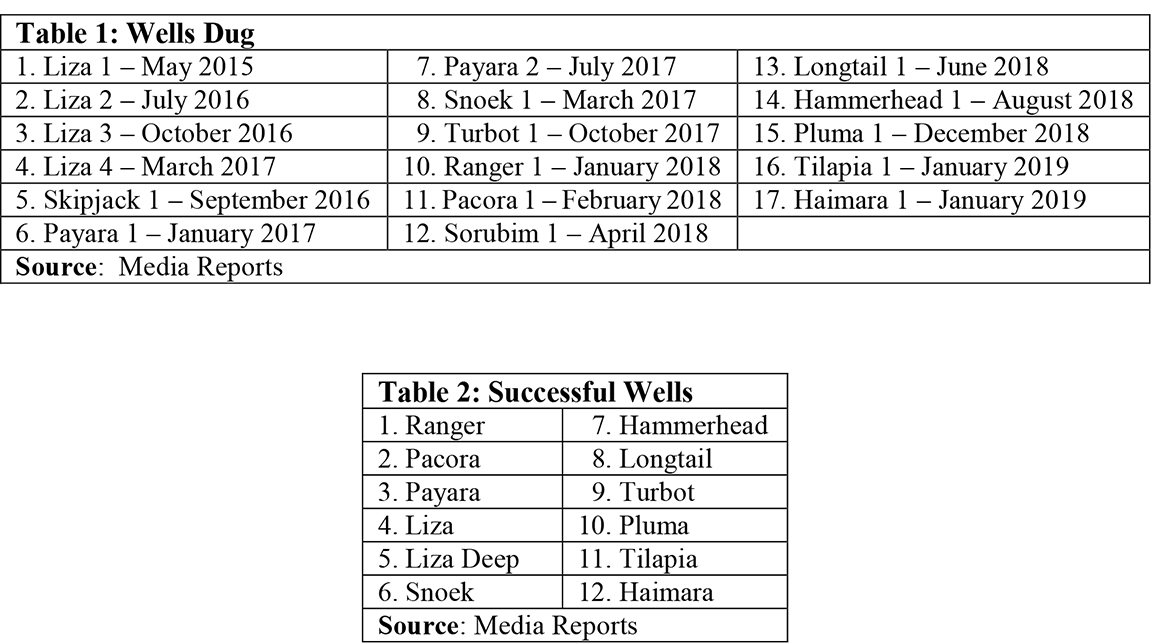

From Exxon Mobil’s public reporting (as shown in Table 1), reveals that 17 wells have been dug to date; 12 are recorded as successful (Table 2). This information is unofficial, so I cannot calculate for sure Guyana’s creaming rate. However, other sources with better Exxon contacts have already done so. Wood Mackenzie, perhaps the petroleum industry’s most iconic research, analysis/ consultancy firm, has announced that Guyana’s success rate for discoveries is 82 percent. That is, more than four times the global average of less than 20 percent! Significantly, the breakeven cost for this oil is reported to be less than US$40 per barrel.

Wood Mackenzie cautions that, forecasting based on a limited number of outstanding discoveries is troublesome. However, it indicates that Guyana’s “yet to find” expectation (YTF) is very high: 8 to 10 billion barrels of oil, as of late 2018. This report further reveals Wood Mackenzie expects Guyana to join the “elite group of million barrels per day exporters,” based on the trend of on-going exploration.

While at present, the focus has been almost exclusively on Exxon Mobil and its partners, Guyana’s contracting opportunities are expanding. Thus Eco Atlantic, is expected to come on-stream shortly, based on its Competent Persons Report for the Orinduk Block. Indeed, it plans for 2022, a first producing well generating positive cash flow!

Exxon’s Liza Phase 1 is scheduled to produce daily 120,000 barrels of oil by early 2020. Phase 2 expects to come on-stream in 2022, and to produce 220,000 barrels. A third development (Payara) is scheduled to come on-stream by 2023 (500,000 barrels). By 2025, the Stabroek Block alone is scheduled to be producing 750,000 plus barrels of oil per day. This requires at least five floating production, storage and offloading installations. This is alongside Eco-Atlantic’s planned output from its estimated 3 billion barrels of crude oil.

Conclusion

This wraps-up discussions of Guidepost 2. Next week, I address Guidepost 3, the price of crude oil.