The UK‘s Tullow Oil plc yesterday announced that the Carapa-1 exploration well, drilled on the Repsol-operated Kanuku licence offshore Guyana, has encountered approximately four metres of net oil pay based on preliminary interpretation but that this is below pre-drill estimates.

The below-estimate find caused a steep drop in Tullow’s share price which had also suffered from reports on the type of oil found in the first two wells in the Orinduik Block.

The find is significant in the sense that it is the third offshore block in which oil has been found. The major find has been by Exxon in the Stabroek block.

According to yesterday’s Irish Times newspaper, Tullow Oil’s shares fell yesterday after what it described as the “troubled exploration company” finding less oil than expected.

The newspaper said that the Irish-founded Tullow reported that results from test drilling of its Carapa-1 well off Guyana’s coast showed the oil deposit was smaller than it had hoped. The Irish Times said that analysts said that the find was not commercial.

It said that the news wiped more than £60 million sterling (€70 million) off Tullow’s value. The group’s shares plunged 20 per cent in early trade in London, where it has its main listing, though it clawed back ground to close 6.78 per cent down on the day at 59.66 pence sterling.

Mark MacFarlane, Tullow’s chief operating officer, conceded that the results were below the company’s pre-drill estimates, but he said they showed that an existing lucrative find in Guyanese waters extended to areas encompassed by its licences.

According to the Irish Times, Job Langbroek, analyst at Davy stockbrokers, noted the reservoir thickness was “sub-optimal and not commercial”. It further said that David Round of BMO Capital Market said that the outcome was “some way short” of investors’ expectations ahead of the result.

The report said that the poorer than anticipated finding from Carapa-1 follows news that oil production from Tullow’s key fields off Ghana’s coast in west Africa would fall below forecast levels this year.

Chief executive Paul McDade and exploration director Angus McCoss resigned last month after Tullow cut production forecasts for a third time. Its shares swooned by almost 70 per cent in 2019.

Tullow also warned in November that two other finds in Guyana contained heavy oil, prompting fears that the projects would be difficult to commercialise.

According to the Irish Times, BMO Capital Markets noted that Carapa-1 had been seen as the “big Hail Mary play” to save Tullow after it downgraded its predictions for Ghana.

Tullow said that the Carapa-1 well’s net pay – the thickness of the actual oil deposit – was four metres. The company will plug and abandon the well. It will conduct a detailed laboratory of analysis of the oil found, which it said was of reasonable quality.

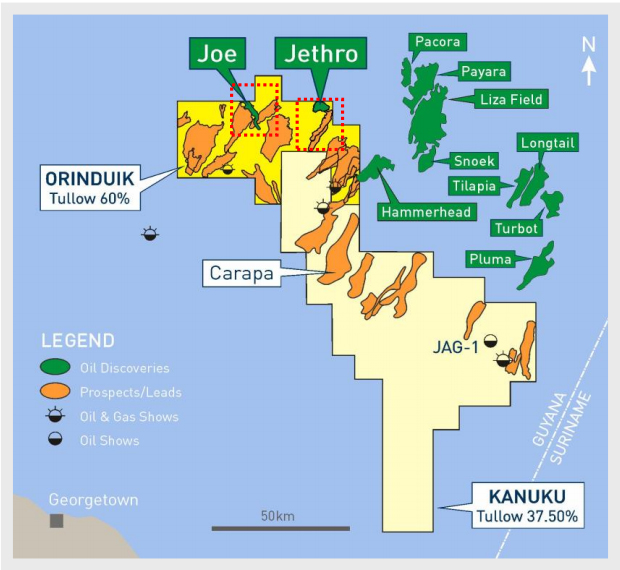

The Carapa-1 well falls within the Kanuku block which is 37.5 per cent owned by Tullow. A further 37.5 per cent stake is held by the operator, Spain’s Repsol, and France’s Total owns the remaining 25 per cent.

Tullow suspended its dividend in December and undertook to take steps to cut its liabilities. Tullow expects total oil production this year to be between 70,000 and 80,000 barrels a day, down from original forecasts of 87,000.

It estimates that production for the next three years would average 70,000 barrels a day from an original prediction of 100,000.

Oil play

Tullow in its statement yesterday on the find said that it has extended the “prolific Cretaceous oil play into the Group’s Guyana acreage”.

It said that the preliminary results of drilling, wireline logging, pressure testing and sampling of reservoir fluid indicate oil in Upper Cretaceous age sandstone reservoirs. Rig site testing has further indicated that the oil is 27 degrees API with a sulphur content of less than 1%.

Tullow said that the Carapa oil discovery suggests the extension of the Cretaceous oil play from the Stabroek licence – held by ExxonMobil and partners – southwards into the Kanuku licence.

“While net pay is lower than pre-drill forecasts, the 27 degree API oil supports the significant potential of the Cretaceous play on both the Kanuku and adjacent Orinduik licences”, the release added.

The Valaris EXL II jack-up rig drilled the Carapa-1 well to a Total Depth of 3,290 metres in 68 metres of water.

Commercial viability

On November 13 last year, Tullow said that the oil found in two offshore wells in Guyana was heavy crude and the company and its partners would have to assess the commercial viability of the project.

Tullow announced two oil discoveries here at the Jethro-1 well and the Joe-1 well in the Tullow-operated Orinduik licence in August and September respectively. The Jethro-1 well found 55 metres of net pay in high-quality sandstone reservoir in the Lower Tertiary and Joe-1 encountered 14 metres of net pay, opening a new play in the Upper Tertiary.

“Following the completion of well operations, oil samples were sent for laboratory analysis and results indicate that the oils recovered from both Jethro-1 and Joe-1 are heavy crudes, with high sulphur content. Tullow and the Joint Venture Partners are assessing the commercial viability of these discoveries considering the quality of the oil, alongside the high-quality reservoir sands and strong overpressure”, Tullow said in a release.

Bloomberg said that the stock fell as much as 23% on the news that crude from two wells was found to be heavy, with a high sulfur content. That’s disappointing to shareholders as the Guyanese discoveries earlier this year had countered concerns over troubled ventures elsewhere, Bloomberg said.

“We expect investors to worry about the projects’ value,” Al Stanton, an analyst at RBC Europe Ltd., said in a note. Heavier oil is harder to produce and requires more energy to extract and transport, Bloomberg added.

ExxonMobil has found lucrative light crude in the Stabroek Block.