ExxonMobil yesterday confirmed a hydrocarbon discovery from the Tanager, its first well in the Kaieteur Block, offshore Guyana, but said it does not appear to be economic on a standalone basis even as it pledged to press on with exploration activities in the area.

“Tanager-1, the first well in the Kaieteur Block offshore Guyana, encountered hydrocarbons but based on initial analysis it does not appear to be economic on a standalone basis. We will evaluate the data we have gained through additional tests and analysis and will continue exploration activities across our acreage offshore Guyana, including in the high risk frontier areas such as the Kaieteur and Canje blocks,” Exxon-Mobil’s Government and Public Relations Advisor Janelle Persaud said yesterday.

Her comments followed Westmount Energy’s announcement yesterday that its partner in the Block, Ratio Petroleum Energy, reported Tanager-1 as an oil discovery albeit non-commercial as a standalone development.

The Tanager-1 was spudded on the 11th August, 2020, using the Stena Carron drillship, and reached a total depth of 7,633 metres in recent days.

Evaluation of wireline logging and sampling data confirm 16 metres of net oil pay in high-quality sandstone reservoirs of Maastrichtian age, West-mount said. It added that preliminary evaluation of the fluid samples from the Maastrichtian reservoir shows heavier oil than is reported from the Liza Phase I producing field crude assays and these samples will be the subject of further detailed analysis over the coming months.

The company said that although high quality reservoirs were also encountered at the deeper geological aged timescales -Santonian and Turonian intervals- interpretation of the reservoir fluids is reported to be equivocal at this stage and requires further evaluation.

It is anticipated that the well will now be plugged and abandoned in the coming days.

While Guyana will not have to foot the costs for the works done, the non-commercial quantity find once again raises the issue of not only the high risks taken by companies drilling but on government safeguarding its potential earnings through ring-fencing.

The average cost to drill a deepwater exploration well has reduced significantly as the cost for crude dropped.

The cost to drill an ultra-deep exploration well ten years ago ranged from around US$300 million to US$600 million, and now averages from around US$100 million to US$200 million. However, it is unclear what was the cost to drill the Tanager-1. It is the deepest well thus far in the Guyana-Suriname Basin but its technical characteristics are much different from the other deepwater wells given its depth.

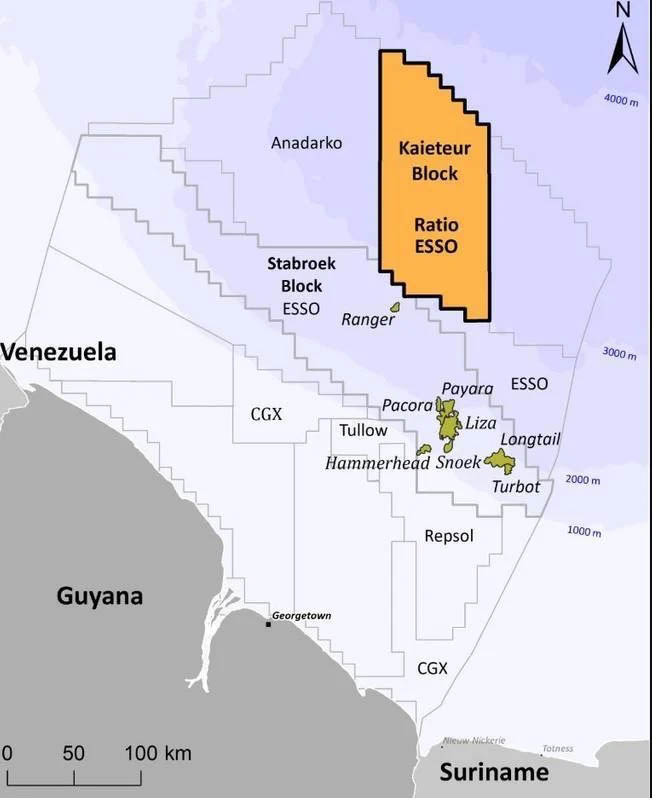

In the 3.3 million acres (13,535 square kilometers) Kaieteur Block, Exxon-Mobil now holds a 35 percent working interest while Ratio Petroleum and Cataleya Energy Corpora-tion each hold a 25% participating interest. ExxonMobil’s Stabroek Block partner, Hess holds the remaining 15%.

Westmount holds approx. 5.4% of the issued share capital of Cataleya Energy Corporation and less than 1% of Ratio Petroleum Energy’s.

Scrutiny

The circumstances of ExxonMobil’s buying into the operations of the controversial Kaieteur and Canje blocks have come in for much scrutiny. This is because months after the signing of its renegotiated Stabroek Block Production Sharing Agreement (PSA) in June 2016, the company bought shares in both the Canje and Kaieteur blocks. The Canje and Kaieteur blocks had been controversially awarded in 2015, just prior to Exxon’s first major oil strike in the Stabroek Block. The small companies that snagged the rights did not have the required capital and expertise to explore the blocks.

Of note, according to Guyana Geology and Mines Commission (GGMC) records, was that ExxonMobil and its then partner in the Stabroek block, Royal Dutch Shell, relinquished the area that subsequently became the Canje block in two separate transactions in June of 2010 and June of 2012. The Canje Block was part of the total acreage awarded to ExxonMobil in the original 1999 PSA. Shell had first given up its share in 2010, indicating to the Government of Guyana that it was changing its investment strategy. ExxonMobil would in 2012 also let the area be returned to the state as part of the relinquishment agreement under the 1999 PSA.

In early 2018, Ratio’s Chief Geologist and Manager Eitan Aizenberg had expressed optimism in the Kaieteur Block and had told a Theatre Guild forum, then hosted by the Ministry of Natural Resources, that his company had drilled some 28 dry holes in his home country Israel’s Leviathan Basin before it made a huge offshore gas field discovery.

He had said that he brings to Guyana that same optimism and would have pressed to see the same investments here.

Of note by Aizenberg was that finding dry or non-commercial holes is always a deterrent to investors and the companies seeking revenue would have to justify continuing.

The absence of ring-fencing obligations here could be used to attract investors, as while all current contracts cover cost recovery only after commercial discoveries, if dry holes are discovered in a block with production, their costs can then be absorbed as cost oil.

It was only last year that the former APNU+AFC government expressed concern to the International Monetary Fund (IMF), after the discovery of 12 operable wells in the offshore Stabroek Block by ExxonMobil and partners, that the absence of a ring-fencing arrangement could negatively affect revenue earned from its explorations.

According to the Concluding Statement of the 2019 IMF Article IV Mission, authorities have indicated their concerns that the absence of a ring-fencing arrangement in the Stabroek PSA (Production Sharing Agreement) could potentially affect the projected flow of government oil revenues.

Liability

The absence of a ring-fencing arrangement in the 2016 PSA has for years been discussed as a possible liability of Guyana’s developing oil sector.

It is unclear who in the government had signaled the concern to the IMF mission, which visited Guyana from June 3-14 2019, though it was likely the Department of Energy (DoE), which took over responsibility for the petroleum sector from the Ministry of Natural Resources.

The admission of the ring-fencing lacuna was a further indictment of former Minister of Natural Resources Raphael Trotman, who presided over the renegotiation of the PSA with ExxonMobil’s subsidiary, EEPGL without addressing a range of key issues.

Analyst Christopher Ram has argued that the Stability Clause contained in the renegotiated 2016 PSA would prevent Guyana from making substantial changes to the agreement.

Trotman had at one time described the new PSA as a tweaking of the earlier one but his handling of the process has come under severe criticism for not addressing matters such as ring-fencing, relinquishment of oil blocks, higher royalties and a bigger signing bonus. His being relieved of responsibility for the sector was seen in some quarters as a response to the various problems with the renegotiated PSA. Critics had said that the renegotiation was done without a single recognized expert on the Guyanese side capable of matching wits with ExxonMobil.

The current PPP/C government has said that it would put on hold any other agreements for oil blocks here as it analyses the old contacts, so as to tighten loopholes, such as the absence of ring-fencing.