Dear Editor,

There has been much reporting of carefully thought out cash grants being given impetuously to a substantial number of farmers, apparently without differentiation of the nature, volume or condition of various crops. In other words one hopes the values of the grants would address the individual farmer’s needs, and therefore the extent to which it would help, if not disappoint expectations. For indeed it must be presumed that the concern is about sustainability of the varieties of crops, but more substantively of the returns that would contribute to livelihoods. It would not be impertinent to recall the basis on which the ‘small cane farming’ component of the sugar industry was established. The relevant legislation included the: National Cane Farming Committee Act (1965); as well as a Cane Farmers Special Funds Act.

It is worth mentioning that this initiative was generated by the sugar companies Bookers Sugar Estates Ltd. and Demerara Co. after rather productive talks between Dr. Cheddi Jagan, Premier of British Guiana and Sir Jock Campbell, then Chairman of the Booker Group of Companies. The two enjoyed a very empathetic relationship. Campbell had already arranged for BSE to establish a cane farming community at BelleVue, West Bank Demerara, where some fifty-five employees selected from various estates were each allotted a fifteen acre plot of cane, a house and house lot to accommodate a kitchen garden. There was the further provision of a community centre and playground. Incidentally there were already at the time small cane farmers at Buxton, East Coast Demerara supplying cane to then Enmore Estate, and villagers at Plaisance and Beterverwagting supplying to then LBI Estate.

What, however, was fundamentally critical to this 1965 initiative was the establishment of a supportive funding agency to finance the development and sustenance of small cane farming across the estates – from Skeldon to Uitvlugt, including of Diamond and Leonora. So that the Cane Farming Special Funds Act facilitated the establishment of the Cane Farming Development Corporation – in the expansive sum of the day of G$3.7m. The shareholders were Bookers Sugar Estates, Demerara Coy, Barclays Bank DC+O (now known as GBTI) and Royal Bank of Canada (now known as Republic Bank). Funding was intended both for capital works and for later crop rehabilitation – as advised by Can Farming Officers employed by the industry.

Of course fundamental eligibility for accessing funds lay on the respective farming groups having a legal status accepted by the funding agency – CFDC. This activated the mostly interested village groups to register as Cooperative Societies. Except that in the Skeldon area there were larger independent farmers who could qualify for loans on their own. Unfortunately the latter suffered materially and financially with the collapse of the Skeldon Estate factory to which, like all other locations, farmers sold their canes based on the legislated cane farming contract. In some cases the indebtedness to private banks was substantial.

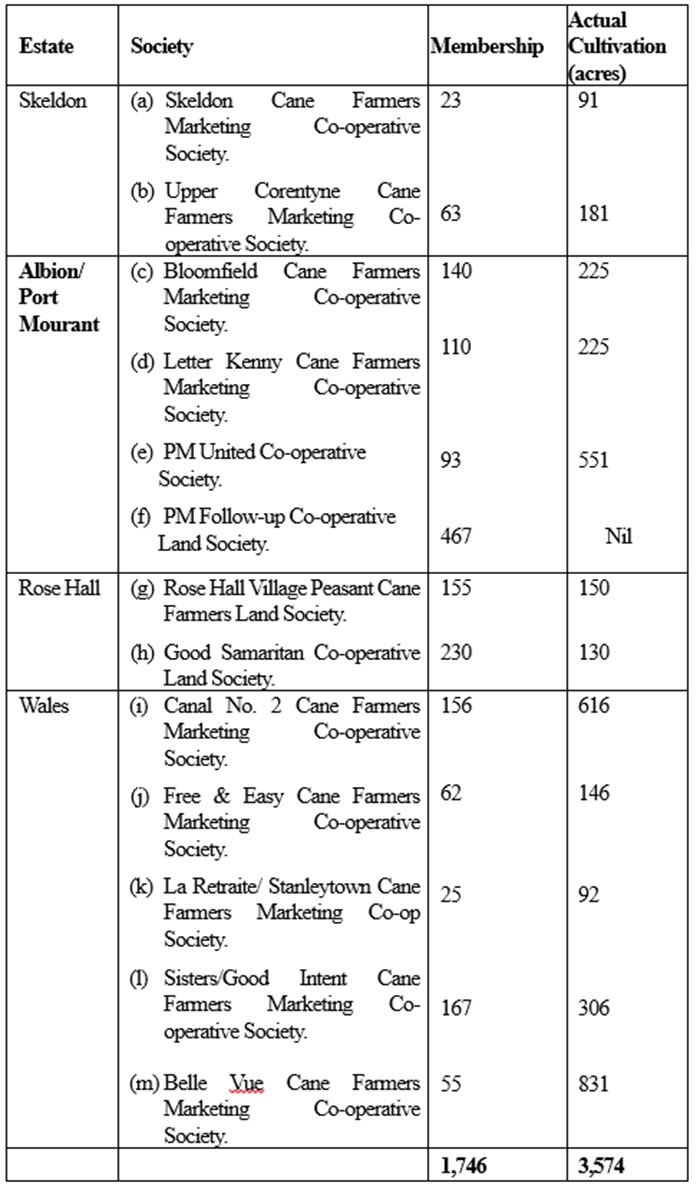

This was an unfortunate experience for those farmers, particularly against the background of the Strategic Plan of 1998 – 2008 which predicted that Skeldon Estate’s agricultural expansion would require 30% of cane being supplied by farmers. For what it is worth, please see following list of some of the cane farming cooperatives referred to:

Some may well ask of the relevance of this recital to ‘Cash Grants’. Hopefully others may see the need for the strategic sustainability of the expectations of farmers and families who may be unduly excited by ‘Cash Grants’. And even though the ‘cooperative’ construct is not necessarily popular with the parties now involved, it is arguable that there is a case for establishing a funding facility on which farmers, amongst others, can rely, and eventually achieve financial stability. Would the IPED example be of interest to the decision-makers concerned? The undersigned was BSE’s representative on the Cane Farming Development Corporation.

In the meantime it is suggested that in the interest of current small cane farmers (cooperatives) the National Cane Farming Committee Act needs to be upgraded. But in the final analysis one must ask whether or not there is a case for the development and management of an Agriculture Strategic Plan which takes serious account of climate change across our ten Regions; not to mention the unpredictabilities also of a ‘pandemic’ future?

How will ‘new farmers’ benefit?

What accountability will there be of returns on investments?

The proposed developmental construct must obviously involve such participants as:

National Agriculture Research and Environmental Institute

Guyana Livestock Development Authority

National Drainage and Irrigation Authority

Sincerely,

E.B. John