Local commercial banks are preparing a push back against a proposal by the Bank of Guyana (BoG) that service fees be made uniform.

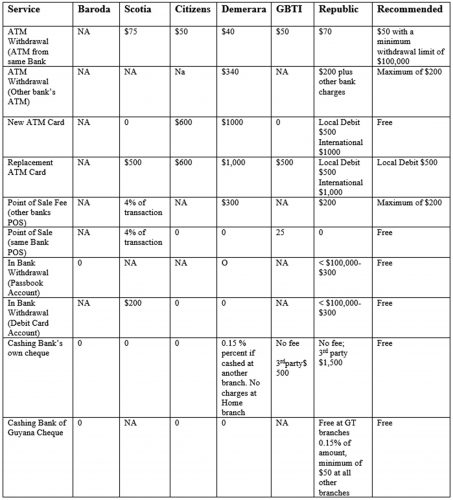

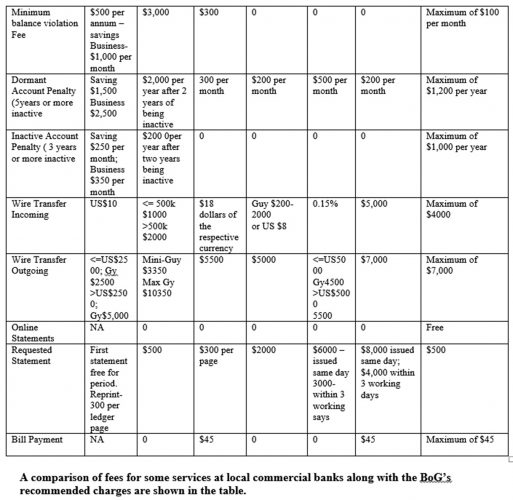

Sunday Stabroek has seen correspondence from the BoG to local commercial banks, sent last week, with a proposal for consultation on structured service fees, including a standard $50 fee for ATM withdrawals of up to $100,000 and a $2,500 cap on late fees for loan repayments.

“It is unfair that banks be asked to have across-the-board service fees. Fees play an important choice in the selection of banking choice for customers and it helps in terms of competition,” an executive of a commercial bank, who did not want to be named, told the this newspaper, while also claiming that the fees here are a fraction of what they are in the region.

“Yes, it was sent by us. However, it is not a requirement; it is recommendation and there will be a consultation,” he explained.

Asked for the reason for the recommendation, Ganga explained that apart from the number of complaints by customers on the amount of service fees being charged by banks, the regulatory body wants to ensure transparency and financial inclusion.

“We are trying to ensure that there is transparency, in terms of fees. We are also looking at financial inclusion…we want to bring people into the financial system who may have reservations about it…if the fees are affordable, they probably would want to move over,” he explained.

Told about the complaints from some banks that see the fees for services as a way competing, the Governor said that customers should be allowed to choose and determine for themselves which bank best suits their needs.

The proposed fee structure recommends that there be no charges for overactive bank accounts and that for ATM withdrawals from customer’s bank the fee should be $50 per transaction with a minimum withdrawal limit of $100,000 per transaction.

With late bank fees for loans ranging from $1,000 per installment to 3% percent of the installment, a recommendation was made to cap the fee at $2,500.

And given that banks charge customers for repaying their loans early, from 3% of the remainder of the loan to three months’ interest at the current loan rate, Central bank proposes a maximum of three months’ interest alone.

Many customers have bemoaned the service fees attached by banks, with complaints increasing amidst the COVID-19 pandemic when they have been encouraged to use their ATM cards or online banking services.

Some banks last year waived the ATM fees but reinstituted them, with some increasing the fee, justifying the decision that in some cases the daily limits were increased.

Only recently, a citizen, T. Gravesande, bemoaned what he believed were exorbitant costs, as he called on the BoG to act.

“The banks restrict customers from using their buildings to conduct transactions, driving them to ATM machines, and then seize the opportunity to maximize their incomes/profits by increasing ATM usage fees. In fact, ATM machines are deployed by banks to reduce its employee costs (it’s part of automation, the more one interacts with a machine, the less one does with a person), but here in Guyana, unlike other countries, the banks are allowed to charge for its use. It’s what one would expect from a monopoly/oligopoly system and why they should be properly regulated,” Gravesande wrote in a letter to the editor of Stabroek News.

“But the abuse by the banks is not limited to ATM machines. Another automation/technology feature subject to such exploitation is the emerging online electronic money transfers. This allows customers, from the safety of their homes and offices, to move funds from one bank account to another. Again, the technology provides a cost saving to the bank but be warned – use it only if you’re willing to pay a minimum of $1,000 per transaction. Yes, a transfer of $1,000 will result in the attachment of a $1,000 bank fee,” the writer added.

Gravesande blamed the country’s banking regulators for the situation, saying it was them “who have allowed the situation to get out of control” and charged that “they need to get their act together”.

“Proper regulation requires that every charge by the bank be cost justified. This cannot be the current case as banks are charging for use of technology which results in cost savings to them. Unless properly regulated, development would just be an unattainable dream,” the writer said.