Introduction

Today’s column and the next three provide a wrap-up commentary of aspects of the Buxton Proposal, which I believe have been somewhat misconstrued; whether by design or otherwise, in various public and private exchanges. My intent here is to deal with four of those aspects; namely, 1) how original am I in putting forward a call to use windfall oil revenues to finance cash transfers to citizens as a leading poverty policy intervention vehicle; 2) does the Proposal seek to replace or miniaturize other government social safety provisions; 3) how best to describe the prevailing situation in Guyana’s emerging petroleum industry on the eve of its second anniversary of First Oil; and 4) as a rule how best to estimate state share of oil revenues or Take from the net cashflow, which is generated by Guyana’s ruling Production Sharing Agreement, PSA? These items are discussed below in the order listed, with the fourth running over into next week’s column.

Originality

On the first aspect, after repeatedly stressing that the Buxton Proposal is not founded on new-fangled economic ideas — instead it is based on time-tested empirical assessments of world-wide poverty intervention measures — I find it incredibly uncharitable that any reader would challenge me for claiming originality for the ideas which inform the Proposal. This is particularly bewildering in light of my provision of a list of readings on the topic, several of which go as far back as to publications cited from the 2000s, a decade and more ago before First Oil! Recall, these readings report on the empirical results of poverty policy intervention measures based on variants of similar basic income support schemes.

Replacement

In similar fashion, I note with deep consternation that the Buxton Proposal has raised queries as to whether its design reduces the flow of public resources towards other safety nets that provide poverty alleviation, income protection for the vulnerable, as well as public goods and services like education, health, social insurance and community services. To the contrary. It is precisely to avoid such risks that the Proposal contains the binding constraint, which limits public spending on cash transfers to households at one-tenth, or a tithe, of projected gross windfall oil revenues

Industry performance to date

Approaching the second anniversary of Guyana’s First Oil (December 2021), this section very briefly highlights sector performance to portray prospects for the Buxton Proposal. This is not intended as a comprehensive review. That task will be undertaken in the New Year, shortly after 2021 data are released. Today’s review is selective, brief and presented serially. My overall assessment is that, on a scale of 1 to 10, Guyana’s emerging oil sector has thus far performed at a level of 6-7.

The leading positives are: 1) the lead producer grouping [ExxonMobil and Partners] has held firmly together since 2015 and it continues to enjoy good working relations with the Government; 2) discoveries/finds continue at world class speeds; 3) the original 2025/6 DROP target of 750,000 barrels/day remains on track; 4) currently, ExxonMobil is pursuing public EPA consultations on its fourth Project [Yellowtail] and a DROP of 340000bbls/d is expected next year; 5) by end 2021 the Government would have received a minimum of nine profit lifts of crude, each approximately one million barrels; 6) unaudited details on intersectoral transactions and employment continue to grow. Finally, oil sector GDP growth is estimated at 32.3 and 20.9 per cent for 2021-2022, respectively.

The major drawbacks are: 1) persistent start-up compressor failure; 2) incomplete/ inadequate petroleum sector governance arrangements, particularly in the areas of data dissemination, revenue capture, environmental/health oversight; 3) the absence of a National Oil Company, NOC, to leverage public management/ decision making in the sector; and 4) concentration of strategic control of the industry in the hands of an intrinsically incapable transnational. I’ll expand on this in a coming column.

Government Take

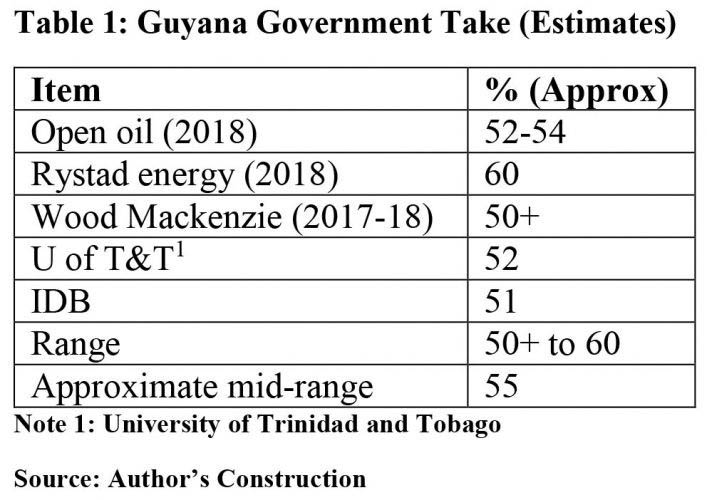

As earlier indicated, I am aware of results for six independent estimates of Guyana Government Take. Three of these measures have been conducted by non-commercial bodies; that is, Open Oil, a global NGO; the Faculty of Engineering, University of Trinidad and Tobago; and, the Inter-American Development Bank, IDB. The IDB study, 2020, is the most recent. The other three commercial studies were conducted by two petroleum intelligence/ business consultancy firms; namely, Rystad Energy (one) and Wood Mackenzie (two). These updated data are shown in Table 1 below.

As previously indicated, although I have had no access to worksheets, I have benefited from extensive access to notes and reports on the models employed in the modeling exercises undertaken by the three non-commercial bodies reported on in Table 1. For the record, access to the commercial bodies’ information is fee-based and I cannot afford to purchase these reports. This is the reason why in earlier columns I was able to report at some length on the estimation of Government Take by the University, Open Oil and the IDB. Indeed, I have reviewed the Open Oil modeling exercise over eight consecutive columns during 2018 and the IDB’s extensively since its publication August 2020.

Table 1 portrays the range in the estimates of government take is from 50+% (Wood Mackenzie) to 60% (Rystad Energy). The mid-range is, therefore, approximately 55%. The 60% value is an outlier as four of the five results cluster in the narrower range of 50+ to 54%, The IDB result of 51% seems consistent with the pattern of results yielded in such exercises thus far. As noted above, the Rystad Energy’s result is the outlier value.

Conclusion

Basically, because of its centrality to the debate on affordability of the Buxton Proposal, next week I shall offer an extended discussion of Government Take in the oil and gas sector. It has been three years since I submitted a close assessment of Government Take. Meantime, the noise and nonsense mis-directions have attempted to fill this information gap