In this section we consider the measures announced by the Minister, analyse them, evaluate their impact and discuss the extent to which they provide useful economic benefits to stakeholders. These are set out in Part 6 – Budget Measures of the Speech. Amendments are necessary to give effect to the respective tax measures and to the date on which they become effective.

We now look at these measures and offer our comments.

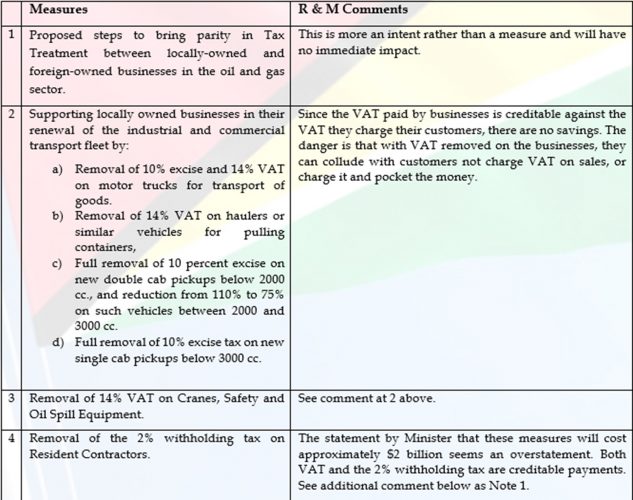

Measures to improve Business Competitiveness, promote Local Content and Job Creation

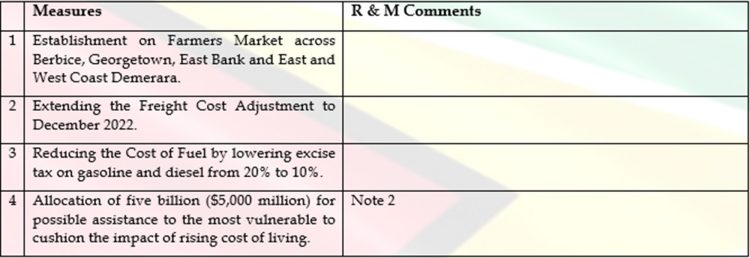

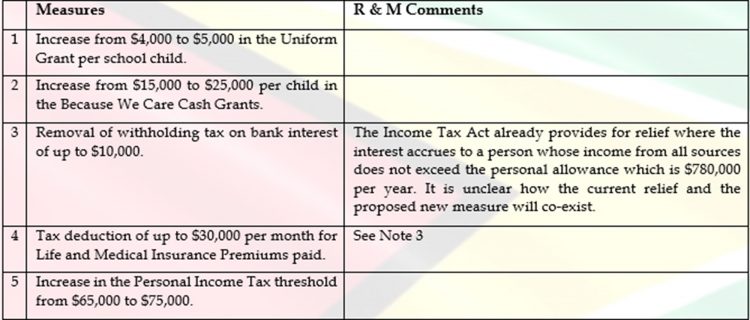

Measures to ease the Cost of Living

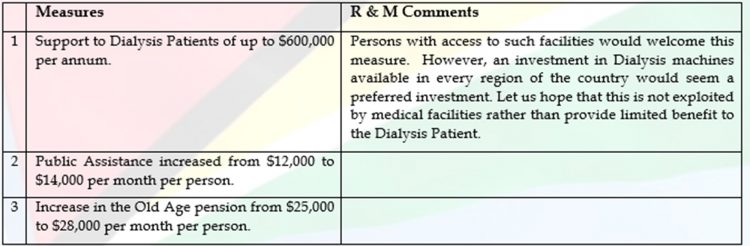

Measures in Supporting the Vulnerable

Measures in Increasing Disposable Income

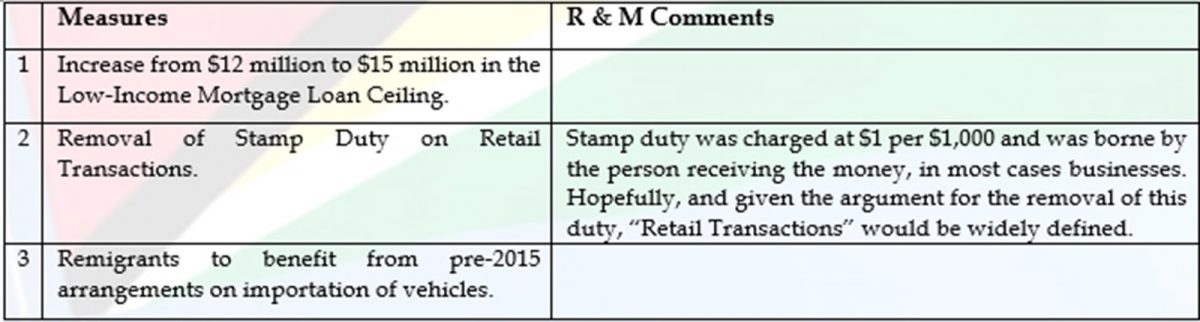

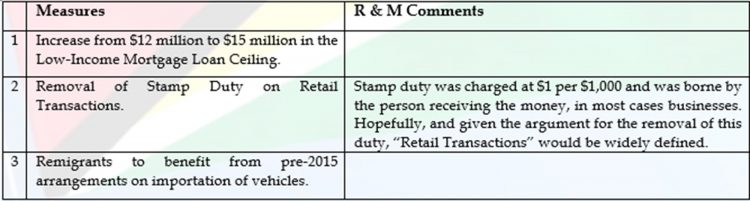

Other Measures

Ram & McRae Comments

Note 1. Ram & McRae considers the removal of the 2% withholding misguided and unfortunate. It was an anti-avoidance measure designed to bring into the tax net those contractors who avoided their direct tax obligations, including non-deduction of PAYE from their employees. It also assisted the GRA in identifying the tax evaders through the monthly remitted by the payer.

Note 2. Cash grants appear to be the medium of choice to assist the needy, but such transactions are notoriously vulnerable to fraud, misappropriation and corruption. To minimise these risks, such payments should give way to more secure transactions and involve the use of official ID’s such as Taxpayer Identification Number, payments by cheques or bank transfers and Special Audits.

There is also a bigger and more fundamental. This allocation is not within the constitutional and statutory framework for unforeseen expenditure. That is why there is a Contingencies Fund. This request by the Government has dangers and certainly violates the spirit if not the letter of the provisions of the Constitution on spending.

Note 3. The tax system is gradually returning to itemised deductions which was abolished and replaced by the higher of the personal allowance or 1/3 of total income. The 1/3 continues in a regressive structure and favours higher income earners.

Note 4. Measures to support the vulnerable are naturally welcome but still inadequate. There can also be increases if such expenditure is targeted to the vulnerable.