Dear Editor,

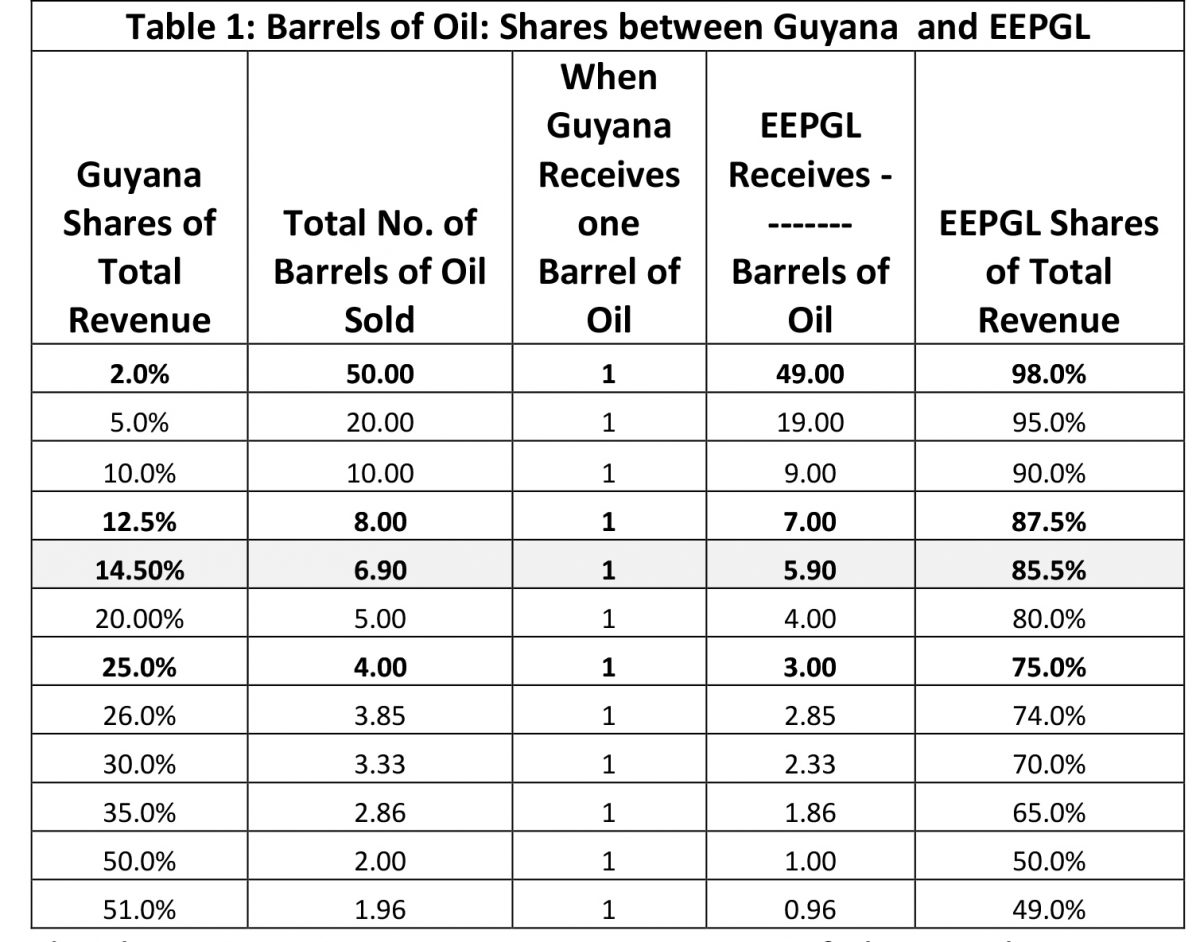

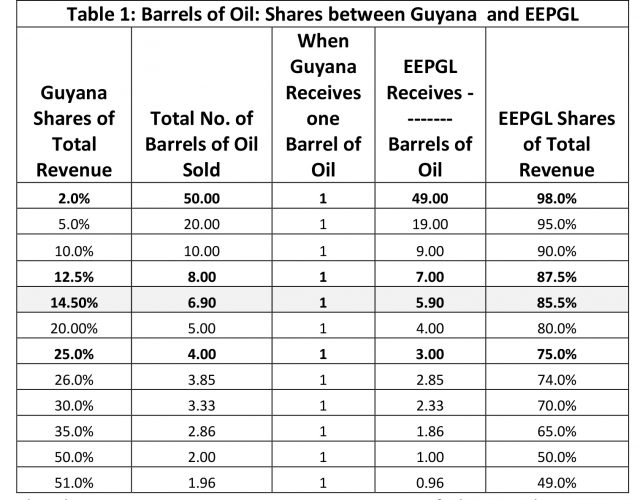

Recently, I read a report prepared by SPHEREX Analytics, an accounting firm that produced the 2020 and 2021 financial statements for Esso Exploration and Production Guyana Limited (EEPGL). In the report, it is claimed that, ‘… Guyana’s share in profit and royalty is greater than the net profit of the oil companies.’ While this statement is correct, it argued here that to only measure profit oil and royalty that Guyana receives is deceptive and misleading. This specification is deceptive and misleading because this measure of profit oil and royalty does not take into account the share of total revenue captured by EEPGL, which is several times larger than the share of total revenue that Guyana receives. In particular, it is stipulated in the contract that EEPGL will receive 75 percent of the total revenue (TR) as cost; Guyana will receive 2 percent of Total Revenue (TR) as royalty, and 12.5 percent of profit oil. What this really means is the following: Profit = TR – Total Cost = PQ – 0.75 (PQ) = (1 – 0.75) PQ = 0.25PQ where P is the price of a barrel of oil; Q is the quantity of barrels of oil sold; PQ is Total Revenue; and Total Profit oil = 0.25 (PQ).

Since Guyana receives 50 percent of Total Profit oil, this yields a Guyana Profit Share = 0.5 (0.25 PQ) = 12.5 percent. Adding 2 percent for royalty times (PQ), plus Guyana Profit Share, yields for Guyana a share of total Revenue (GSTR) = 0.145PQ. Consequently, EEPGL share of total revenue is 85.5 percent of Total Revenue (TR), implying thereby that EEPGL share of Total Revenue (TR) is 5.896 times that of Guyana’s share of Total Revenue (TR). What 5.896 pellucidly indicates is that every time 6.896 barrels of oil is sold, Guyana receives only one barrel of oil, while EEPGL owns and can sell 5.896 barrels of oil. Furthermore, recognizing that the oil is owned by Guyana and it is a non-renewable resource, this is the blatant inequity that Guyana is experiencing; and this must be immediately rectified in order to generate a fair and just return for Guyana’s oil, our non-renewable patrimony.

Furthermore, what contributes in part to this inequity in the production sharing agreement is the relationship between cost and revenue, where cost is proportional to total revenue: Cost = 0.75TR = 0.75(PQ). This cost specification is outrageous, as a cost function does not include the price (P) of the product (a barrel of oil). In other words, this specification indicates that whenever the price of a barrel of oil increases, cost increases, which is palpably false. The recent increases in the price of oil and the statement by President Biden that, ‘Exxon made more money than God this year,’ is relevant to this discussion. Apart from the concern with total revenue in the cost function, Tom Mitro in a KN article June 24, 2022 stated that, ‘…all interest on loans borrowed to fund the development of related oil projects.’ can be included as cost. EEPGL do not have to pay income taxes on their profit share and the government has to provide a receipt that can be used for tax deduction purposes. Undoubtedly, this transaction of issuing a government receipt for money not collected is fraud and corruption; for if a public servant in any government department was to initiate such a transaction, that person can be charged and perhaps be incarcerated for a crime based on an illegal directive. Hopefully, the person tasked to write the receipt and the person who authorized the transaction are aware of the consequences of this fraudulent transaction. Certainly, the Auditor General has work to do, for this kind of fraudulent transaction cannot be swept under the carpet; otherwise, this precedent can become endemic and unstoppable across all government services.

Meanwhile, there are other possibilities that can impact cost. Among these are transfer pricing, between the subsidiary, EEPGL, and Exxon Mobil and the other owners, namely, HESS Corp, and China National Offshore Oil Company (CNOOC). Also, there is latitude,’… for costs exceeding the 75% ‘cap’ to be carried forward to successive months until recouped.’ The expectation in this case is that the 75% ‘cap’ on cost will come to an end; and cost will decline to something less in the future, resulting in an increase in the 12.5 percent profit share for Guyana. This is at best a false hope, no less than trying to empty the mighty Essequibo River with a spoon; for EEPGL will be reluctant to relinquish control of its 75% share of Total Revenue. Furthermore, as the life of the project approaches its final production date, EEPGL can terminate operations prior to that date, and claim it is not financially viable to continue production; and that would be too late for Guyana to get additional profit and taxes. In these circumstances, one remembers the old Russian proverb made popular in the West by Ronald Reagan, ’Trust but verify’. This can be accomplished by utilizing comprehensive monitoring, and appropriate controls/penalties/incentives on exploration, investment, employment, production, marketing and ensuring environmental balance. Additionally, employing comprehensive auditing programs with corrective measures; and hiring the best and brightest, regardless of their political affiliations. Not sure if we are ready for this, but failure would lead to adding a few lines to the Russian proverb: ‘Trust but verify’; if not, the statements received will only deceive.

In order to get a better understanding of the distribution of revenue between Guyana and EEPGL for financial years 2020 and 2021, SPHEREX Analytics prepared the information shown in Table (a) below. Total revenue in 2020 and 2021 are G$176.1M and G$545.1M, respectively. It is further reported that in 2020, Guyana’s net-take (profit oil and Royalty) was G$25.532M, distributed as profit G$22.0M and royalty of G$3.532M. In 2021, it is reported that Guyana’s net-take was G$79.0M with royalty of G$10.9M and profit oil of G$68.1M. Given the financial information in Table (a) above, there are a few matters which must be clarified. First, in the year 2020, profit oil (G$44,022M), royalty (G$3,522M) and cost recovery (G$132,066M) sum to G$179,610M, which represents total revenue. However, this amount of G$179,610M is larger by G$3,522M than the stated revenue of G$176,088M in 2020. Interestingly, the amount of G$3,522M is the same as the royalty payment, and this should be explained by SPHEREX Analytics. Likewise, a similar discrepancy is observed in 2021, where the sum of profit oil (G$136,272M), royalty (G$10,902M), and cost recovery (G$408,815M) total G$555,989M. This total (G$555,989M), when compared with the total revenue in 2021 of G$545,086M, is overstated by G$10,903M; and this amount is equal to the royalty payment in 2021. SPHEREX Analytics needs to explain this inconsistency. It is important to recognize that with a royalty of 2 percent, this is equivalent to one barrel of oil, out of 50 barrels of oil, with the remaining 49 barrels to be further distributed between Guyana and EEPGL (Table1).

As previously noted, when Guyana receives 14.5 percent of the total revenue (profit oil and royalty), this yields for Guyana one barrel of oil, while EEPGL receives 5.90 barrels of oil. Furthermore, the data in Table 1 confirm that as Guyana’s share of the total revenue increases, EEPGL’s share of the total revenue and the number of barrels of oil decline. And not surprisingly at 50 percent of the total revenue, both Guyana and EEPGL each would receive one barrel of oil when two barrels of oil are sold. It is therefore contended that a fair equilibrium lies somewhere between 25% and 50% of total revenue for Guyana; and this would imply that for every four barrels of oil sold, EEPGL would receive three barrels of oil and Guyana would receive one barrel of oil. The outcome of this arrangement is that there is no need to worry about royalty, but the focus must only be on a New Production Sharing Agreement (NPSA): 3 barrels for EEPGL and 1 barrel for Guyana. This should be the goal of the renegotiation team. Now applying this NPSA to the sales in 2020 and 2021, respectively, would yield the following:

1. Guyana’s take in 2020 = 0.25 (G$M176, 088) = G$M44, 022, which is the total profit in 2020; while EEPGL’s take in 2020 = 0.75 (G$176,088) = G$132,066, which is the cost recovery.

2. Guyana’s take in 2021 = 0.25(G$M545, 086) = G$M136, 272 which is profit oil, while EEPGL‘s take in 2021 = 0.75 (G$M545, 086) = G$M408, 815), which is cost recovery. In conclusion, it is useful to point out that given Guyana’s history, our patrimony of non-renewable resources, such as gold, bauxite, manganese, silica sand, and other minerals, cannot again be squandered, for extraction without optimal compensation must end. Therefore, get organized Guyana; and be more proactive, so that we can build a nest-egg for our future generations.

Sincerely,

C. Kenrick Hunte, Ph.D.

Professor and former Ambassador